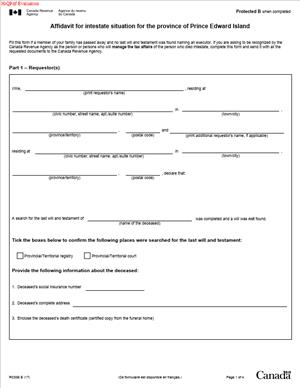

Affidavit for intestate situation

Fill out nowJurisdiction: Country: Canada | Province or State: Prince Edward Island

What is an Affidavit for intestate situation?

An Affidavit for intestate situation is a sworn statement. You use it when a person dies without a will. It tells the tax authority who you are and why you can act. It confirms there is no will and no court-appointed executor. It asks the authority to accept you as the proper person to deal with the deceased’s tax matters. It lets them release certain information or funds to you. It also records key facts about the estate and heirs.

This affidavit is a formal legal document. You sign it under oath or affirmation. A commissioner for oaths, notary public, or lawyer must witness it. The document carries penalties for false statements. It is not a will or a probate application. It supports tax administration for a deceased person who left no will.

Who typically uses this form?

Surviving spouses or common-law partners often use it. Adult children also use it. Sometimes siblings or parents need it. A person with custody of a minor heir may use it. Small businesses also use it when a sole proprietor dies intestate. In each case, the user is a next of kin or heir with a direct interest.

Why would you need this form?

If there is no will, there is no executor. Without an executor, the tax authority will not speak to you. They also will not issue refunds to you. This affidavit bridges that gap. It gives the authority a sworn record of your status. It confirms your right to receive tax information or funds of the deceased. It may also let you request the reissue of a refund cheque. It can help you get a final billing statement or a slip needed to file taxes.

Typical usage scenarios

You are the surviving spouse in Prince Edward Island. Your partner died without a will. A tax refund was issued in their name. You need it reissued to you. You file this affidavit with the death certificate. Or you are an adult child. Your parent died intestate in Charlottetown. You need their last T-slips and account balance. You file this affidavit to get those released. Or you are the owner of a small family farm. Your spouse ran the business in their name. They died without a will. The business needs cash. There is a refund on file. You use this affidavit to claim a refund while you plan the estate.

In Prince Edward Island, intestacy means the estate passes under default rules. Spouses and children are first in line. If none, then parents, then siblings. This order matters. The affidavit asks you to declare your relationship. It asks you to name other heirs. The authority uses this to decide if you can act. It helps them avoid paying the wrong person.

This document is practical. It reduces delay when no probate exists. It does not replace probate for complex estates. It is best suited where the estate is small. It is also useful where funds on file are limited. It helps speed up tax tasks while you decide next steps.

When Would You Use an Affidavit for intestate situation?

You use this form when a PEI resident died without a will. No executor has authority. You need to deal with the deceased’s tax account. You do not have a court grant appointing an administrator yet. The tax authority asks for proof of your status. The affidavit is that proof.

You would use it to request a reissued tax refund. For example, a cheque made out to the deceased remains uncashed. The bank will not accept it. The tax authority will not reissue it without proof. You complete the affidavit and attach a death certificate. You also show ID and proof of relationship. The authority then can reissue funds to you or to the estate.

You would use it to access account details. You may need last year’s assessment. You may need slips to complete a final return. Without an executor, access is blocked. The affidavit lets the authority speak with you. It lets them send you certain documents. It can be limited to what you request.

You would use it if you are the surviving spouse or partner in PEI. You lived with the deceased at death. There was no will and no probate. You need to manage household taxes and credits. The affidavit lets you request adjustments or correspondence. It helps you handle benefits that stop at death.

You would use it as an adult child or next of kin. Your parent died intestate, and there is no administrator. You need to file their final return. You need to confirm balances and credits. The affidavit allows the release of that information.

You would use it when the amount at issue is modest. This often includes a single refund or credit. It may include benefit amounts that accrued before death. It is common that estate assets are simple. Typical cases include a pensioner with modest savings. Or a sole proprietor with a single bank account.

You would also use it to avoid delay while a grant is pending. Probate or administration takes time. You may need documents now to meet tax deadlines. The affidavit can get you what you need to file. It can also prevent interest from accruing on amounts owed.

If multiple heirs exist, one person often completes the affidavit. That person is usually the spouse or eldest adult child. If there are disputes, the authority may ask for more proof. They may ask for consents from other heirs. They may also refuse to act until a court appoints an administrator. The affidavit does not resolve family disputes. It only informs the authority of your claimed status.

Legal Characteristics of the Affidavit for Intestate Situation

This affidavit is a sworn legal document. It becomes legally binding once commissioned. You must sign it before a commissioner for oaths, notary public, lawyer, or other authorized official. In Prince Edward Island, many lawyers and notaries can commission oaths. Some government offices also have commissioners. You must appear in person. You must show valid identification. Remote commissioning may be allowed where permitted. Check current rules before you plan.

Why is it binding?

You swear that its contents are true. False statements can lead to penalties. That can include prosecution for perjury. It can also include civil liability to harmed parties. The authority relies on your affidavit. They release money or confidential information based on it. If you mislead them, you bear the risk.

What ensures enforceability?

First, proper commissioning. The affidavit must show the date, place, and name of the commissioner. The commissioner must sign and stamp or seal. Your signature must match your ID. Second, complete and accurate facts. Names, dates, and addresses must be correct. The deceased’s details must match the death record. Your relationship must be clear. Third, supporting documents. A certified copy of the death certificate is standard. Proof of relationship may include a marriage certificate or birth certificate. If you are a common-law partner, provide proof of cohabitation. Bank statements, a lease, or utility bills can help. If you are acting for a minor heir, provide proof of custody or guardianship.

General legal considerations apply. This affidavit does not grant you full estate authority. You do not become the estate administrator by default. You only gain limited rights with the tax authority. If the estate is complex, you will likely need a court grant of administration. If the authority suspects conflict among heirs, it may decline your request. If the amount is large, they may insist on a grant. They may also require indemnity and a bond in some cases. You should keep this in mind when planning.

Privacy rules restrict disclosure. The authority will not release more than needed. The affidavit must state the purpose clearly. Ask only for what you need. You can file another affidavit later if needed. That avoids delays.

Finally, the laws of intestacy in PEI govern who inherits. The order of heirs matters. Your status in that order affects your standing. A spouse or partner often has priority. Children come next. Extended family follows. The authority will rely on your sworn list of heirs. If you omit someone, you may face claims later. Take care to list all known heirs.

How to Fill Out an Affidavit for intestate situation

Follow these steps to complete the form accurately. Prepare your documents before you start. Work in clear print. Use the legal names that appear on IDs.

Step 1: Confirm the situation is intestacy.

Write that the deceased died without a will. State that no one has been appointed by the court. If an application for administration is underway, say so. If an executor was named later, stop and seek the proper form. This affidavit is for intestate cases only.

Step 2: Identify the deceased person.

Enter the deceased’s full legal name as on the death certificate. Include all middle names. Add their Social Insurance Number. Add date of birth and date of death. Add the last address in Prince Edward Island. Add the tax year or years at issue if known. Accuracy here is critical. It helps match the correct account.

Step 3: Confirm the jurisdiction.

State that the deceased was a resident of Prince Edward Island at death. If not, this form may not apply. If the death occurred in another province, note where. This matters for succession rules and internal processes.

Step 4: State your identity and relationship.

Enter your full legal name and contact information. Include your mailing address, phone, and email. Describe your relationship to the deceased. Examples include spouse, common-law partner, child, sibling, or parent. If you are a common-law partner, provide the start date of cohabitation. If you act for a minor heir, state your authority as guardian or custodian.

Step 5: List all known heirs under intestacy.

Name the spouse or partner, if any. Name each child, including adult children. If no spouse or children, name parents. If none, name siblings. Provide current contact information if known. State if any heir is a minor. State if any heir has died. Include that heir’s date of death and any descendants. This list helps the authority assess your standing.

Step 6: Describe the estate status.

State whether a probate or administration application exists. If none, say none has been started. If you plan to apply later, say so. Estimate the estate’s approximate value if asked. You can state “unknown” if you lack data, but give context. For example, “Bank account and tax refund only, no real property.” This helps explain why you seek a limited release.

Step 7: Explain what you are asking for.

Be specific. Do you want a reissued refund? Name the tax year and amount if known. Do you want access to account balances or slips? List the exact items you need. Examples: Notice of Assessment, T-slips, statement of account, or confirmation of credits. If you want correspondence sent to you, ask for that. State whether payment should be made to you as heir or to “Estate of [Name].” Many banks prefer cheques payable to the estate. If an estate account exists, use that.

Step 8: Provide supporting facts to justify standing.

Explain why you are the proper person to receive funds. If you are the spouse or partner, say so. If you are the only adult child, say so. If there are multiple heirs, explain why you are acting. You may attach written consents from other heirs. Consents reduce delays. If minors are involved, confirm you will hold funds in trust. State that you will distribute funds according to intestacy rules.

Step 9: Attach required documents.

Attach a certified copy of the death certificate. Attach proof of your identity. Attach proof of relationship. For a spouse, a marriage certificate works. For a child, a birth certificate works. For a common-law partner, attach proof of cohabitation. For a guardian, attach custody or guardianship documents. If you seek a reissued cheque, attach the original cheque if you have it. If it was lost, explain what happened. If the cheque is stale-dated, say so.

Step 10: Complete declarations and acknowledgements.

Read every declaration in the form. Confirm that no will exists to your knowledge. Confirm that you will notify the authority if a will is found. Confirm that you will return funds if paid in error. Confirm that you understand penalties for false statements. Do not change or strike out any standard text. If the form allows notes, use the designated area.

Step 11: Sign in front of a commissioner.

Do not sign in advance. Appear with your valid ID. The commissioner will ask you to swear or affirm. Choose an oath or an affirmation based on your preference. Sign your full legal name. The commissioner will complete their section. They will add their name, title, location, and date. They will stamp or seal the affidavit.

Step 12: Review for completeness and consistency.

Check names, dates, and numbers. Check that attachments match the names used. Ensure your contact details are current. Confirm that any cheque payable instruction is clear. Ensure you keep copies of everything. Make a full set for your records.

Step 13: Submit the affidavit and attachments.

Follow the submission instructions on the form. You may need to mail the original. Some offices accept in-person delivery. Keep a tracking number for the mail. If a fax or secure upload is allowed, use it as directed. Do not send original ID. Send copies unless originals are requested.

Step 14: Respond to follow-up requests.

The authority may ask for more proof. Common requests include consents from other heirs. They may ask for bank confirmation of an estate account. They may ask for additional identity proof. Reply quickly. Delays can push payment dates. If nothing arrives after a reasonable time, follow up politely.

Step 15: Handle the funds properly.

If you receive a cheque, deposit it into the estate account. If no estate account exists, ask your bank for options. Keep records of deposits and distributions. Pay any tax balances before distributing funds to heirs. Keep receipts. You may need them for the final estate accounting.

Practical examples help:

- Spouse with refund cheque reissue:

You are the surviving spouse. A refund cheque for last year arrived after death. There is no will and no probate. You complete the affidavit. You attach the death certificate and the marriage certificate. You ask for a reissued cheque. You request it payable to the estate. You deposit it into the estate account and later distribute funds.

- Adult child needs slips to file:

You are the eldest child. Your parent died intestate. The accountant needs the last assessment and slips. You complete the affidavit. You attach the death certificate and your birth certificate. You ask for copies of the assessment and a statement of account. You use them to file the final return.

- Partner in a common-law relationship:

You lived with the deceased for many years. There is no will. You need to confirm tax balances and a small credit. You complete the affidavit. You attach the death certificate. You attach proof of cohabitation. You ask for the reissue of the credit. You deposit it and hold funds in trust for distribution.

Avoid common mistakes. Do not sign before meeting the commissioner. Do not leave blanks. Do not list nicknames. Do not assume your status is obvious. Always attach proof. Do not request more information than you need. Keep your purpose narrow. You can always submit a new affidavit later.

Finally, know the limits. This affidavit helps with tax matters. It may not help with banks or land titles. Those often require a grant of administration. If the estate grows more complex, plan to apply for that. Use the affidavit to keep taxes moving while you do.

Legal Terms You Might Encounter

- Affidavit means a written statement you swear or affirm is true. In this Affidavit for intestate situation, you confirm facts about the death, family relationships, and the absence of a will. You sign it in front of an authorized official.

- Intestate means the person died without a valid will. The rules for who inherits follow intestacy laws. In the affidavit, you state there is no will and list the people entitled under those rules.

- Deponent is you, the person who swears the affidavit. You confirm your identity, your relationship to the deceased, and that the information you provide is accurate.

- Estate means everything the deceased owned and owed at death. This affidavit usually focuses on confirming who can act for the estate in tax matters, not on distributing assets.

- Legal representative means the person authorized to act for the estate. If there is no court appointment yet, the affidavit may help you show you have authority for certain tax steps.

- Administrator is the court-appointed person who manages an intestate estate. If you do not yet have that appointment, the affidavit helps bridge the gap for limited tax dealings.

- Letters of administration are the court documents that appoint an administrator. If you later obtain these, you may need to update the agency and provide a copy.

- Next of kin, or heir-at-law, means the relatives who inherit under intestacy rules. In the affidavit, you list each heir and explain how each is related to the deceased.

- Jurat is the section where the authorized official confirms that you swore or affirmed the affidavit. It shows the place, date, and the official’s name and capacity. The jurat must be complete.

- Commissioner for oaths or a notary public is the official who witnesses your signature. You must sign the affidavit in front of one. The official then completes and signs the jurat.

- Proof of death is a document, such as a death certificate or a funeral home statement. You usually attach a copy to the affidavit to verify the date of death.

- Beneficiary means someone who inherits from the estate. In an intestate situation, beneficiaries are the next of kin. The affidavit helps identify the correct beneficiaries for tax purposes.

- Statutory declaration is a sworn statement like an affidavit, but with different formal wording. This form is an affidavit. Use the affidavit format and witnessing requirements it specifies.

FAQs

Do you need a court appointment to use this affidavit?

Not always. This affidavit helps when there is no will and no appointment yet. It allows you to address limited tax matters while the estate is being organized. If you later receive a court appointment, update the agency.

Do you need to be the closest relative to complete it?

You should be a person with a direct interest, usually the next of kin or the person seeking to manage the estate. If there are several relatives at the same level, one may complete it. You may still need to list all heirs and provide their details.

Do you attach the death certificate, and must it be original?

Attach a clear copy unless the form specifies an original. Ensure the name and date of death match the affidavit. If the certificate is not in English or French, include a certified translation.

Do all heirs need to sign the affidavit?

Usually, only the deponent signs before the official. However, the form can require information or acknowledgements from all heirs. Read the instructions closely. If consents are needed, collect them before you swear the affidavit.

Do you need to list debts or assets?

This affidavit focuses on intestacy and your authority for tax matters. It typically does not require a full inventory. If the form asks for values or a summary of the estate, provide accurate, current figures and explain how you determined them.

Can you submit scanned copies and keep the original?

Yes, if the agency accepts copies or electronic submissions. Follow the form’s submission rules. Keep the original affidavit and all supporting documents in your estate file.

What happens if a will is found later?

Stop using the affidavit. Notify the agency that a will exists. If an executor is named, they will become the legal representative for tax matters. Provide updated documents as requested.

Can you correct the affidavit after signing?

You cannot change a sworn affidavit after signing. If you made a mistake, prepare a new affidavit with the correct information and swear it again. If the error is minor, ask the agency how they want it handled.

How long is this affidavit valid?

It remains valid while the facts stay true. If the situation changes, such as a court appointment or a newly discovered will, the affidavit is no longer current. Provide updated documents when circumstances change.

Do you need to reside in Prince Edward Island to complete it?

You do not need to live in Prince Edward Island. You must still meet the form’s identity and witnessing requirements. Use an authorized official where you sign.

Checklist: Before, During, and After the Affidavit for intestate situation

Before signing

- Confirm there is no will. Ask family and check the deceased’s papers.

- Record the deceased’s full legal name, previous names, and date of birth.

- Confirm the date of death and obtain proof of death.

- Gather the deceased’s last address and any tax identifiers used.

- Identify all heirs under the intestacy rules for Prince Edward Island.

- Note each heir’s full legal name, relationship, address, and contact details.

- Identify whether any heir is a minor or lacks capacity. Note guardian details.

- Collect documents proving relationships. Use birth, marriage, or adoption records.

- Prepare a simple family tree showing relationships to the deceased.

- List any existing estate documents, such as applications for court appointment.

- Confirm who will act as the deponent. Ensure they have a valid photo ID.

- Review the form’s instructions and any special requirements.

- Prepare translations for documents not in English or French.

- Plan where you will sign. Book an appointment with an authorized official.

- If multiple people will act, agree on roles, and avoid conflicting affidavits.

During signing

- Verify the spelling of the deceased’s name matches the proof of death.

- Check dates for consistency: birth, death, and any marriage dates.

- Confirm your own name and contact details match your ID.

- Make sure every required field is complete. Do not leave blanks.

- List all heirs, not just the person who will manage the estate.

- Use full legal names. Avoid nicknames or initials unless also listed.

- Disclose minors and guardians where applicable. Do not omit them.

- Attach required documents. Label each attachment clearly.

- Number pages and attachments. Ensure the set is complete.

- Review declarations about no will and your authority claim.

- Cross out any inapplicable sections as instructed. Initial any changes.

- Sign only in front of the authorized official. Do not pre-sign.

- Confirm the jurat is complete with the place, date, and the official’s details.

- Obtain the official’s stamp or seal if required.

- Make a copy set for your records before you leave.

After signing

- File the affidavit using the submission method the agency accepts.

- Include all attachments listed on your cover sheet or checklist.

- Keep proof of delivery. Save tracking and a copy of your package.

- Store the original affidavit in a safe place. Keep it accessible.

- Notify heirs that you filed the affidavit and what it covers.

- Watch for requests for more information. Respond promptly and clearly.

- If you obtain a court appointment later, send a copy to update the file.

- If a will is discovered, stop and advise the agency immediately.

- Keep a log of all communications, dates, and decisions.

- Retain records for the full retention period you use for estate papers.

Common Mistakes to Avoid Affidavit for intestate situation

- Don’t forget to list every heir at the same degree. Leaving out a sibling or child can cause rejection. It may also delay any refund or tax release.

- Don’t assume a common-law partner inherits in the same way as a spouse. Rules differ. If you list an ineligible heir, your affidavit can be challenged, and processing can stall.

- Don’t use nicknames or short forms. Inconsistent names trigger identity questions. Mismatches can lead to requests for proof or a returned filing.

- Don’t sign before meeting the authorized official. Signing early makes the affidavit invalid. You may need to redo the entire process.

- Don’t ignore minors or guardians. Missing guardian details raise capacity concerns. This can stop processing until you fix the record.

- Don’t leave blanks or cross out text without initials. Incomplete forms look unreliable. The agency may refuse them and ask for a new affidavit.

- Don’t skip the attachments. Missing proof of death or relationship documents causes immediate delays. Include clear, legible copies.

- Don’t mix estate and personal bank details. If a refund is issued, it should go to the estate. Using a personal account can create accounting problems later.

What to Do After Filling Out the Form Affidavit for intestate situation

- Submit the affidavit and all attachments as directed on the form. Use the mailing or electronic option that the agency accepts. Keep copies of everything you send.

- Wait for acknowledgement. Processing times vary. If you do not receive confirmation within a reasonable period, follow up with your file details handy.

- Respond quickly to any information requests. Provide clear answers and supporting documents. If you need more time, advise them and give an estimated date.

- If you receive a tax refund or credit, deposit it into an estate account. Do not use a personal account. Keep a ledger of receipts and future distributions.

- If you need to provide final tax filings, organize the records. Gather slips, bank statements, and expense records. Coordinate with the person handling the estate’s accounting.

- If you later obtain a court appointment, send a copy of the appointment. Ask the agency to update the legal representative on file. This avoids conflicting instructions.

- If a will is found, pause estate actions. Notify the agency that the intestate affidavit no longer applies. The named executor becomes responsible for tax matters.

- If you discover an error in your affidavit, prepare a corrected version. Swear the new affidavit and submit it with an explanation. Keep both versions in your records.

- When distribution time comes, follow the intestacy rules for Prince Edward Island. Communicate with all heirs. Provide an accounting that ties to tax receipts and refunds.

- When the estate work is complete, archive the file. Keep the affidavit, correspondence, and tax records for your chosen retention period. Securely store or dispose of copies you no longer need.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.