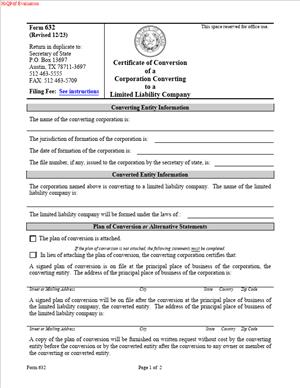

Form 632 – Certificate of Conversion of a Corporation Converting to a Limited Liability Company

Fill out nowJurisdiction: Country: United States | Province or State: Texas

Form 632 – Certificate of Conversion of a Corporation Converting to a Limited Liability Company is a formal filing used to change a business entity’s structure. It documents the conversion of an existing corporation into a limited liability company.

This document matters because it records the change in entity type with the state. It helps align the public record with how the business will operate going forward.

If you are about to complete this form, you are likely coordinating a structural change. Understanding what the form covers can make the process clearer and more manageable.

What is a Form 632 – Certificate of Conversion of a Corporation Converting to a Limited Liability Company?

Clear definition

Form 632 – Certificate of Conversion of a Corporation Converting to a Limited Liability Company is a state filing that reports the conversion of a corporation into a limited liability company. It captures core details about the original corporation and the resulting LLC.

The form serves as an official record of the conversion event. It ties the old entity structure to the new one through a documented process.

This document does not operate as an internal agreement. It is a public-facing filing that reflects a change already approved through the entity’s internal decision-making process.

Who typically uses this form/document?

This form is commonly used by business owners and managers overseeing an entity conversion. It may also be completed by officers or authorized representatives of the corporation.

People filling out the form are often coordinating with accountants, advisors, or internal stakeholders. Even so, the form itself is usually completed by someone directly involved with the business.

Self-represented business owners often encounter this document when handling the conversion without outside filing services.

Why you might need this form/document

You may need this form when a corporation transitions to operating as a limited liability company. The filing helps reflect that change in the state’s records.

This can matter for contracts, banking relationships, and general public transparency. Many third parties rely on the state record to confirm an entity’s status.

Without this filing, there may be a mismatch between how the business operates and how it appears in official records.

Typical real-life scenarios

A small corporation may decide that an LLC structure better fits its management style. The owners may want fewer formalities and more flexibility.

Another common situation involves a closely held corporation restructuring for operational simplicity. The business continues, but under a different legal form.

In some cases, a corporation plans for future growth or investment and chooses an LLC structure as part of that strategy. The form documents that transition point.

When would you use a Form 632 – Certificate of Conversion of a Corporation Converting to a Limited Liability Company?

You would use Form 632 at the point when a corporation has decided to change its legal structure and is ready to formalize that decision with the state. The form is used after the corporation has completed its internal approval process and before it begins operating publicly as a limited liability company.

This filing is most appropriate when the business intends to continue its existence without interruption, but under a different entity type. It is not used for dissolving a corporation or creating a brand-new business from scratch, but for carrying the existing business forward in a new legal form.

The timing often aligns with other transition steps, such as updating governance documents and planning operational changes. Filing too early, before approval, or too late, after acting as an LLC, can create inconsistencies in the public record.

Once submitted and accepted, the form establishes a clear conversion date. That date becomes important for determining how the entity is identified in future transactions and official interactions.

Legal characteristics of the Form 632 – Certificate of Conversion of a Corporation Converting to a Limited Liability Company

- Form 632 – Certificate of Conversion of a Corporation Converting to a Limited Liability Company is generally treated as a binding state filing once accepted. It becomes part of the public record.

- The accuracy of the information affects its reliability. Incomplete or inconsistent details can delay processing or create confusion later.

- Validity typically depends on proper authorization and correct completion. The form reflects actions taken elsewhere, rather than creating those actions by itself.

- While the form records the conversion, it does not replace internal agreements or governance documents. It also does not, by itself, transfer assets or resolve tax matters. Those effects commonly arise from separate processes tied to the conversion.

- Editor note: This form belongs to the Secretary of State of Texas.

How to fill out a Form 632 – Certificate of Conversion of a Corporation Converting to a Limited Liability Company

Step 1 – Identify the converting corporation

You begin by providing the legal name of the corporation that is converting. This should match the name as it appears in state records. Consistency here helps link the old entity to the conversion filing.

Step 2 – State the name of the resulting limited liability company

The form asks for the name of the LLC that will exist after the conversion. This is the name that will appear in future public records. Make sure it reflects the intended final name.

Step 3 – Confirm the type of conversion

You will indicate that the conversion is from a corporation to a limited liability company. This clarifies the direction of the change. It helps distinguish this filing from other types of conversions.

Step 4 – Include jurisdictional details

The form typically requests information about where the original corporation was formed. This connects the conversion to the correct governing framework. Accurate details support proper recordkeeping.

Step 5 – Reference approval of the conversion

You may be asked to state that the conversion was approved in accordance with governing rules. This statement reflects that internal authorization has occurred. The form itself does not document the approval process.

Step 6 – Provide the effective date

The effective date shows when the conversion takes place. This can be the filing date or a later specified date. The timing can affect how the conversion is viewed by third parties.

Step 7 – Add signature and authorization details

An authorized person signs the form on behalf of the converting entity. The signature confirms that the information is accurate to the signer’s knowledge. This step finalizes the submission.

Legal terms you might encounter In Form 632 – Certificate of Conversion of a Corporation Converting to a Limited Liability Company

Conversion

Conversion refers to the statutory process by which a corporation changes its legal form into a limited liability company. The business continues without a break, but its governing structure and classification are altered.

Converting Entity

The converting entity is the original corporation that is changing its legal status. This term is used to distinguish the pre-conversion corporation from the resulting LLC.

Resulting Entity

The resulting entity is the limited liability company that exists after the conversion takes effect. It assumes the ongoing business operations previously conducted by the corporation.

Effective Date

The effective date is the moment when the conversion legally takes place. It determines when the entity is treated as an LLC for official and transactional purposes.

uthorization

Authorization refers to the internal approval required to proceed with the conversion. This approval typically follows the corporation’s governing rules and is confirmed within the filing.

Governing Documents

Governing documents include the corporation’s internal rules and the LLC’s operating framework. While not filed with the conversion form, they support the statements made in it.

Public Record

The public record consists of filings maintained by the state that reflect an entity’s legal status. Once accepted, the conversion form becomes part of this record.

Authorized Signer

An authorized signer is the individual permitted to execute the form on behalf of the corporation. Their signature affirms the accuracy and approval of the conversion details.

Jurisdiction

Jurisdiction identifies the state under whose laws the conversion is carried out. This determines which statutory rules apply to the filing and its effect.

FAQs – Form 632 – Certificate of Conversion of a Corporation Converting to a Limited Liability Company

Does filing Form 632 automatically create the LLC?

Filing the form records the conversion and results in the existence of the LLC as a matter of public record. It does not replace the need for internal LLC governance arrangements that guide how the business operates.

Can the corporation continue using the same name after conversion?

The resulting LLC may use the same name if it complies with state naming requirements. The name listed on the form becomes the official name going forward.

Who is allowed to sign the form?

The form must be signed by someone authorized to act for the converting corporation. This is typically an officer or other person granted authority through internal approval.

Is the conversion effective immediately upon filing?

The conversion is effective on the date specified in the form. This may be the filing date or a later date chosen by the entity.

Does the form handle asset transfers?

The form itself records the change in entity type but does not document individual asset transfers. Those matters are usually addressed through separate internal actions.

Can errors be corrected after filing?

If an error is discovered, corrective action may be required to update the public record. Prompt attention helps reduce confusion and administrative issues.

Is this form used more than once for the same conversion?

The form is generally filed only once per conversion event. Refilling is not typical unless a correction or amendment is necessary.

Checklist: before, during, and after the Form 632 – Certificate of Conversion of a Corporation Converting to a Limited Liability Company

Before

- Confirm internal approval of the conversion under corporate rules

- Verify the exact legal name of the existing corporation

- Decide on the final name of the resulting LLC

- Determine the desired effective date of conversion

- Review the consistency of entity information across records

- Identify the authorized signer for the filing

During

- Enter the corporation’s name exactly as on record

- State the name of the resulting limited liability company

- Confirm the direction of the conversion accurately

- Include correct jurisdictional details

- Specify the effective date clearly

- Sign the form using the authorized authority

After

- Retain a copy of the filed form for records

- Update internal governance documents to match the LLC structure

- Notify relevant parties of the entity change

- Align contracts and agreements with the new entity type

- Confirm public records reflect the conversion

- Organize documentation related to the transition

Common mistakes to avoid (Form 632 – Certificate of Conversion of a Corporation Converting to a Limited Liability Company)

- A frequent mistake is assuming the conversion filing fixes underlying inconsistencies in corporate records. If the corporation’s name, jurisdictional details, or status are not current before conversion, those problems can carry over and complicate the acceptance or later use of the filing.

- Another error involves treating the conversion as purely administrative. Failing to coordinate the filing with internal operational changes can leave employees, managers, or partners uncertain about authority and decision-making during the transition period.

- Some filers also underestimate the impact of timing. Choosing an effective date without aligning it with accounting periods, contractual obligations, or internal approvals can create unnecessary confusion. Careful planning helps ensure the conversion is reflected consistently across business activities.

- One common mistake arises when filers overlook the importance of aligning the conversion filing with other state-level requirements. While Form 632 records the conversion itself, related filings may still be required, such as certificates associated with the LLC’s formation details or periodic reports that come due shortly after the effective date. Assuming that the conversion form automatically updates all state records can lead to missed deadlines or incomplete compliance. Businesses sometimes discover this only after receiving notices or penalties, which can be avoided through a coordinated review of post-conversion obligations.

- Another frequent issue involves signatures and authority. In some cases, the individual signing the form assumes they are authorized based on their role, but the corporation’s governing documents may require a specific officer designation or formal approval before execution. If the signer’s authority is unclear or later challenged, it can create questions about the validity of the filing. Even when the state accepts the form, disputes among owners or stakeholders can arise if internal authorization was not handled carefully and documented properly.

- Mistakes also occur when filers fail to consider how the conversion affects existing licenses, permits, and registrations. Many operational approvals are issued in the name of the corporation, not the resulting LLC. Assuming these permissions automatically carry over can interrupt business operations, especially in regulated industries. Addressing this proactively helps ensure continuity and avoids the need for emergency updates after the conversion has already taken effect.

- There is also a tendency to reuse old templates or prior filings without carefully reviewing them for accuracy. Copying information from earlier documents can introduce outdated addresses, incorrect officer names, or references to corporate structures that no longer apply. Because the conversion filing becomes part of the permanent public record, these errors can persist and create confusion long after the conversion is complete. Taking the time to review each entry as if it were being completed for the first time can significantly reduce this risk.

- Some businesses underestimate how the conversion affects relationships with lenders, insurers, and vendors. While the legal entity continues in a different form, third parties may require updated documentation, acknowledgments, or amendments to reflect the LLC status. Failing to anticipate these requests can delay transactions or trigger technical defaults in agreements that reference the corporate form explicitly. Treating the conversion as a trigger for broader administrative review helps prevent these downstream issues.

- Another mistake is assuming that the conversion simplifies everything immediately. While LLCs often offer more flexible management structures, that flexibility must be implemented deliberately. If internal processes are not updated to reflect the LLC’s operating agreement or management style, confusion can arise about who has the authority to bind the company or make key decisions. This can be particularly problematic in the early weeks following conversion, when habits from the corporate structure may still dominate daily operations.

- Finally, some filers fail to keep adequate records of the conversion process itself. Relying solely on the filed form without retaining supporting approvals, correspondence, and internal resolutions can make it difficult to answer questions later. These questions may come from auditors, investors, or even future owners who want clarity about how and when the entity changed form. Maintaining a well-organized conversion file helps preserve institutional knowledge and reduces uncertainty over time.

What to do after filling out the Form 632 – Certificate of Conversion of a Corporation Converting to a Limited Liability Company

- Once the form has been accepted, it is important to treat the conversion as an operational milestone, not just a completed filing. Business communications, internal procedures, and management practices should reflect that the entity now operates as a limited liability company.

- You should review existing agreements and ongoing obligations to ensure they are being performed in the name of the LLC. This helps maintain continuity while reducing the risk of misunderstandings about which entity is responsible for future actions.

- It is also wise to monitor future state correspondence and filings for accuracy. Making sure the LLC designation is used consistently reinforces the legal change and supports clear, reliable records going forward.

- After the conversion filing is accepted, one of the first practical steps is to update how the business identifies itself in everyday transactions. This includes letterhead, invoices, email signatures, and websites, all of which should reflect the LLC name and designation. Although these changes may seem minor, they reinforce the legal reality of the conversion and reduce confusion among customers, vendors, and partners who interact with the business regularly.

- Internal documentation deserves similar attention. Employment agreements, policy manuals, and internal forms often reference the corporation by name and structure. Reviewing and updating these materials helps ensure consistency and avoids ambiguity about the employer or contracting party. This process can also serve as an opportunity to align internal practices with the more flexible governance typically associated with an LLC.

- Financial accounts and accounting systems should also be reviewed promptly. Banks may require updated resolutions, signature cards, or confirmation of the conversion before continuing services under the LLC name. Accounting software and tax records should reflect the effective date of the conversion to maintain clear financial reporting. Addressing these updates early helps prevent discrepancies that can complicate reconciliations or future audits.

- Another important step is communicating the conversion to key stakeholders. Owners, managers, and employees should understand how the change affects their roles, rights, and expectations. Clear communication reduces uncertainty and helps maintain confidence during the transition. Even when day-to-day operations remain largely the same, acknowledging the conversion as a formal change reinforces its significance and legitimacy.

- Contracts in progress or under negotiation also deserve careful review. While many agreements continue uninterrupted after a statutory conversion, some counterparties may request confirmation or documentation acknowledging the LLC as the continuing entity. Providing copies of the filed conversion certificate or explanatory letters can help smooth these interactions. Being proactive in these communications often preserves goodwill and minimizes delays.

- Ongoing compliance obligations should be recalibrated to reflect the LLC structure. Annual reports, franchise tax filings, and other periodic requirements may differ from those that applied to the corporation. Understanding these differences early helps establish a new compliance rhythm that fits the LLC’s obligations. Missing early deadlines after conversion is a common source of avoidable stress and expense.

- It is also wise to consider how the conversion affects long-term planning. The LLC structure may offer new options for ownership changes, profit allocations, or management arrangements. Reviewing these possibilities with advisors can help ensure the business fully benefits from the new entity form rather than simply carrying forward old assumptions from the corporate structure.

- Finally, maintaining vigilance over public records remains important even after the immediate post-conversion period. Periodically checking state databases to confirm that the LLC information remains accurate can catch errors or inconsistencies before they become larger problems. Treating the conversion as the beginning of an ongoing compliance phase, rather than the end of a task, supports stability and clarity as the business moves forward under its new legal identity.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.