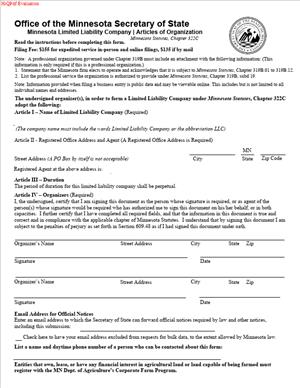

Minnesota Limited Liability Company – Articles of Organization

Fill out nowJurisdiction: Country: United States | Province or State: Minnesota

What is a Minnesota Limited Liability Company – Articles of Organization?

The Minnesota Limited Liability Company – Articles of Organization is the legal form that creates a new Minnesota LLC. You file it with the Office of the Minnesota Secretary of State. Once accepted, your company exists as a separate legal entity. Before acceptance, your LLC does not exist.

This form sets the baseline facts about your new company. It records your LLC name, your Minnesota registered office, and your organizer’s details. It can also set the management structure and the effective date. If you form a professional limited liability company, it includes statements required for regulated professions.

You typically use this form if you want liability protection for a business based in Minnesota. Founders, solo professionals, real estate investors, and small business owners file it. Law firms and accountants also file it for clients. If you operate an out-of-state LLC and want to do business in Minnesota, you use a different filing. That is a foreign registration, not this form.

You need this form to separate your personal assets from business liabilities. It gives your business a legal identity. That identity can own property, hire employees, and sign contracts. It also signals to clients and partners that you operate as an LLC. Many banks will not open a business account without proof of formation. Vendors often require it to set you up as a customer. Landlords may ask for it before signing a lease.

Common uses include launching a consulting practice, opening a retail store, or starting an online business. Real estate investors use an LLC to hold rental properties. Professionals use a PLLC when their work requires a state license. You also use this form to convert an informal partnership into a formal entity. It helps you bring on co-owners in a structured way.

In short, this is the formation document for a Minnesota LLC. File it once. Keep a stamped copy in your records. You will use it often after formation.

When Would You Use a Minnesota Limited Liability Company – Articles of Organization?

Use this form when you decide to start a Minnesota LLC. If you already do business as a sole proprietor, file it when you want liability protection. If you and a colleague plan to co-own a business, file it before you sign major contracts. If you want to create a holding company for assets, file it before moving assets under the company.

You also use it if you plan to hire employees under an LLC. Most payroll providers will ask for proof of formation. Lenders ask for it when you apply for financing. Franchisors often require it before they approve you as a franchisee. If your client contract requires a corporate entity, you file it to meet that condition.

If you are a licensed professional, you may need a professional LLC. That applies to professions regulated by Minnesota boards. Typical examples include lawyers, doctors, dentists, engineers, and accountants. In that case, you file the professional version of the articles. You include the required professional statements and confirm owner licensing.

If you operate an out-of-state company and now have a Minnesota office, do not use this form. Instead, you apply for authority as a foreign LLC. If you formed a company in another state but now want a Minnesota entity, you file Minnesota articles to create a new, separate LLC.

Use this form before you sign a lease, hire staff, or accept client payments in the LLC’s name. A clear timeline helps. Form the LLC, then obtain an EIN, then open a bank account. After that, you can sign contracts in the LLC name. That order protects you from mixing personal and business activity.

Legal Characteristics of the Minnesota Limited Liability Company – Articles of Organization

This form is legally binding because Minnesota statutes authorize it and prescribe its contents. Filing it with the Office of the Minnesota Secretary of State creates your LLC. The filed articles serve as public notice of your company’s existence. They also show who can accept legal papers on your company’s behalf.

Enforceability comes from compliance with state law and acceptance by the filing office. The form must contain the required elements. The organizer must sign it. The registered office address must be a Minnesota street address. The filing fee must be paid. The Secretary of State reviews it for completeness and name availability. If your chosen name meets the naming rules and your form is complete, the state accepts it. Once accepted, your LLC comes into existence as of the effective date on the filing.

An LLC formed under this process gives you limited liability. Your personal assets are generally not reachable for company debts. You must still follow corporate formalities to preserve that shield. Keep separate business records. Do not commingle funds. Sign contracts in the LLC’s name, not your own.

The articles are short by design. They place basic facts on the public record. Use an operating agreement to govern internal matters. The operating agreement sets member rights, profit splits, and decision rules. It is an internal contract, not a filing. Do not pack sensitive ownership terms into the articles. Keep those private in your operating agreement.

Name rules matter for legal validity. Your LLC name must include “Limited Liability Company,” “LLC,” or “L.L.C.” It must be distinguishable from other names on file. Certain words need extra approvals. If you practice a licensed profession, your name may need a professional designator. A name that violates these rules will trigger a rejection.

The registered office enables service of process. You must list a Minnesota street address. A P.O. Box is not enough for the registered office. You may appoint a registered agent, but Minnesota permits the appointment to be optional. If you name one, that person or entity must agree to serve. The state uses this information to deliver legal notices to your company.

Most Minnesota LLCs have perpetual duration. If you want the company to end on a specific date, you can state that in the articles. You can also choose a delayed effective date. Many founders form ahead of a launch date to align tax and contract timelines.

If you form a professional limited liability company, extra rules apply. Owners and certain decision-makers must hold the relevant licenses. Your articles need the required professional statements. If your practice spans multiple licensed professions, confirm that the structure is allowed before filing.

Finally, the articles become part of the public record. Anyone can order a copy. Draft with that in mind. Keep private details out of the filing. Use your internal records for personal addresses where allowed. Use a separate mailing address if you want to limit the exposure of a home address.

How to Fill Out a Minnesota Limited Liability Company – Articles of Organization

Start by confirming you need a new Minnesota domestic LLC. If you have an out-of-state LLC, you need foreign registration, not this form. If you will provide licensed professional services, plan for a professional LLC filing.

Step 1: Gather required information.

You need your desired LLC name. You need a Minnesota-registered office address. You need the organizer’s name and address. If you will appoint a registered agent, get their consent. Decide on the management structure and the effective date. If you form a PLLC, collect your professional details.

Step 2: Enter the LLC name.

Write the full legal name, including “LLC,” “L.L.C.,” or “Limited Liability Company.” Use standard words and avoid restricted terms unless authorized. Example names include “North Star Consulting LLC” or “Red River Holdings L.L.C.” The name on the articles must match the name you will use in business.

Step 3: Provide the Minnesota registered office address.

This must be a physical street address in Minnesota. Do not use a P.O. Box for this field. This is where legal papers can be delivered during business hours. Many small businesses use a commercial office or a professional registered agent address. If you list a separate mailing address, you can use a P.O. Box for mailing.

Step 4: Appoint a registered agent (optional, but common).

Minnesota allows a registered office without naming a specific agent. If you do appoint one, list the agent’s name. The agent can be an individual resident or a business authorized in Minnesota. Make sure the agent consents to the role. The agent must be available at the registered office during normal hours.

Step 5: State the principal office address if requested.

Some forms ask for a principal office or principal executive office. This can be inside or outside Minnesota. Use a street address. You may also provide a mailing address if the form requests it. This address is used for business records and administrative mail.

Step 6: Choose the management structure.

Minnesota LLCs are member-managed by default. If the LLC will be manager-managed, add a statement that the company is manager-managed. Manager-managed status places day-to-day control in one or more managers. Member-managed status gives every member authority by default. Align this choice with your operating agreement.

Step 7: Set the duration and effective date.

Most filers choose perpetual duration. If you want the LLC to end on a specific date, state that date. You can choose a delayed effective date so the LLC starts later. A delayed date can help align tax years or contract start dates. If you leave this blank, the LLC becomes effective upon filing.

Step 8: Add professional LLC statements if applicable.

If you form a PLLC, state the professional services the company will provide. Confirm that all owners who must be licensed hold active Minnesota licenses. Include any required professional confirmations. Many PLLC filers also add a brief compliance statement referencing the professional practice rules.

Step 9: Include an email for official notices (recommended).

Minnesota filings often request an email address for official notices. Provide a monitored inbox. The state may send reminders and status updates there. This is optional, but it helps you avoid missing future renewals.

Step 10: Add any additional provisions if needed.

The articles allow optional clauses. Use them sparingly. You might add a limitation stating the LLC is not authorized to issue shares. You might add a clause confirming indemnification rights to the extent allowed by law. Keep operational and financial terms out of the articles. Place those in your operating agreement.

Step 11: Identify the organizer.

The organizer is the person who submits the filing. This can be you, your lawyer, or another authorized filer. List the organizer’s name and mailing address. The organizer does not have to be an owner. The organizer must be at least 18 and have the authority to file.

Step 12: Sign and date the articles.

The organizer signs under penalty of perjury that the information is true. Handwritten or electronic signatures are accepted based on how you file. Use your legal name. Do not sign on behalf of the LLC using a title that implies the LLC already exists.

Step 13: Attach schedules or addenda if required.

If you need more space for additional provisions, add an attachment titled “Exhibit A – Additional Provisions.” If there are multiple organizers, list them on a schedule titled “Schedule 1 – Organizers.” If forming a PLLC, add any profession-specific exhibits needed by your licensing board.

Step 14: Prepare the filing and fee.

You can file online, by mail, or in person. Online and in-person filings include expedited processing. Mail is slower. Expect a state filing fee. Online and in-person filings cost more than mail filings. Fees can change without notice. Confirm the current amount before paying. Include the correct payment method for your chosen channel.

Step 15: Submit the filing.

If you file online, upload the form and pay the fee. If you mail, send the signed original and the fee. If you file in person, bring identification and payment. The Office of the Minnesota Secretary of State will review your filing for completeness and name rules.

Step 16: Receive confirmation.

After acceptance, you receive a filed-stamped copy and a filing number. Save that in your records. Many banks will ask for this copy when opening an account. Vendors and landlords may request it as well.

Step 17: Organize your internal records.

Adopt an operating agreement. Record initial member contributions. Document who has the authority to sign on behalf of the LLC. Store your filed articles, operating agreement, and organizational consents together. Keep digital backups.

Step 18: Handle post-filing tasks.

Obtain an EIN. Open a business bank account. Update your contracts to reflect the LLC as the party. Apply for any required licenses or permits. If you will collect sales tax or have employees, register for those accounts.

Step 19: Calendar your annual renewal.

Minnesota requires an annual renewal filing to keep your LLC active. It is due each year. There is no fee if you file on time for domestic LLCs. If you miss renewals, the state can administratively dissolve your LLC. Set reminders to avoid lapses.

Practical tips

Use a clean, consistent name everywhere. If your name uses punctuation or special characters, match that exactly. Use a Minnesota street address for the registered office. If you work from home, consider using a registered agent to protect your privacy. If you pick manager-managed, be ready to show who the managers are in your internal records. If you select a delayed effective date, align it with contract start dates to avoid confusion.

Common errors cause rejections or slowdowns.

A P.O. Box as the registered office will trigger a rejection. Forgetting the LLC designator in the name will also trigger a rejection. Leaving the organizer’s signature off the form will stop the filing. Paying the wrong fee amount will delay processing. Mismatched names between your articles and other documents create bank issues.

Keep one goal in mind as you fill each field. You want a clean, compliant public record and a smooth acceptance. Keep the public details brief and accurate. Keep your internal details in your operating agreement. With that approach, you will get approval faster and reduce future headaches.

Finally, remember your articles are one piece of the compliance picture. Your operating agreement governs the business. Your renewal keeps it active. Your registered office keeps you reachable. Treat each step with care. That is how you build a durable Minnesota LLC.

Legal Terms You Might Encounter

- Articles of Organization means the formation document for your LLC. This form creates your company once filed and accepted. When you complete it, you set your legal name and registered office.

- Organizer means the person who prepares and signs this form. The organizer can be you or someone you authorize. The organizer’s name, address, and signature must appear on the form.

- Registered office means the official street address for legal papers. It must be in Minnesota and must be a physical location. The form requires you to list this address.

- Registered agent means the person or business designated to receive legal papers. The form lets you name an agent, if you want one. If you list an agent, use the full legal name.

- Service of process means the delivery of legal documents, such as a lawsuit. This is why the registered office address must be accurate and staffed. The form captures where that delivery will occur.

- Effective date means the date your LLC comes into legal existence. You can ask for a future effective date on the form. If you do not, it takes effect upon filing.

- Operating agreement means the internal contract among the owners. It covers voting, profits, and management. You do not file it with the Articles of Organization.

- Member-managed means the owners run the business. Manager-managed means selected managers run the business. You do not make this choice on the form. You set it in your operating agreement.

- Assumed name means a name you use that is different from your legal LLC name. You do not claim an assumed name in this filing. You would handle that with a separate filing.

- Amendment means a later change to your Articles of Organization. Use an amendment if you change your name or registered office. You do not amend by editing the old form.

- Good standing means your LLC is active and compliant with state rules. Keeping a current registered office helps you stay in good standing. Filing required renewals also keeps you current.

- Foreign LLC means an LLC formed in another state. That company registers to do business in Minnesota. This Articles of Organization form is for a new Minnesota LLC, not a foreign one.

- Professional LLC means an LLC that offers licensed professional services. That structure often needs special language and proof of licensure. Do not use this standard form if you need a professional filing.

- Certified copy means a state-stamped copy that proves authenticity. You may order one after your Articles are filed. Keep it for banks or other institutions that request proof.

FAQs

Do you need to list members or managers on this form?

No. The standard Articles of Organization do not ask for member or manager names. You list the organizer and the registered office. You manage ownership and roles in your operating agreement.

Do you need a registered agent to file?

The form requires a Minnesota registered office address. The form also lets you name a registered agent. If you choose to name an agent, get their consent. Either way, the registered office must be a Minnesota street address that accepts legal papers.

Can you use a P.O. Box for the registered office?

No. The registered office must be a physical street address in Minnesota. A P.O. Box alone will trigger a rejection. If you have a suite number, include it.

Do you need a business purpose for the Articles?

A general business purpose is typically enough. The standard form does not require a detailed purpose. If you provide licensed services, you may need a professional filing. Check your licensing rules before you submit.

Can you delay the effective date of your LLC?

Yes. You can ask for a future effective date on the form. Use a clear date in the space provided. If you leave it blank, your filing becomes effective when accepted by the state.

Do you need an EIN before filing Articles of Organization?

No. You do not need an EIN to complete this form. You usually get an EIN after your Articles are filed and accepted. Many banks will ask for the filed Articles and your EIN to open accounts.

What if your filing gets rejected?

You will receive a return notice that explains the issues. Fix the specific items and resubmit with the required fee. Common fixes include correcting the name, address, or signature. Double-check the registered office address before you resubmit.

How long does filing take?

Processing times vary by filing method and volume. Online or in-person filings often move faster than mail. If your filing is time-sensitive, use the fastest method available to you.

Checklist: Before, During, and After the Minnesota Limited Liability Company – Articles of Organization

Before signing

- Confirm your LLC name is distinguishable and includes “LLC” or “L.L.C.”

- Prepare the Minnesota registered office street address.

- Decide whether you will name a registered agent.

- Get the agent’s exact legal name and consent if you list one.

- Select your effective date or default to the filing date.

- Gather the organizer’s name, street address, and contact details.

- Prepare an email address for official notices and reminders.

- Decide if you need any additional provisions to attach.

- Confirm whether you need a professional filing for licensed services.

- Choose your filing method and payment method.

- Align on your internal operating agreement approach.

During signing

- Enter the LLC name exactly as you intend to use it.

- Include the required “LLC” or “L.L.C.” designator.

- Provide a Minnesota street address for the registered office.

- Do not use a P.O. Box for the registered office.

- If naming an agent, spell the full legal name correctly.

- Check all addresses, including suite numbers and ZIP codes.

- Use a clear future effective date, if requested.

- Review any added provisions for consistency and clarity.

- Print the organizer’s name and sign where required.

- Date the form.

- Provide a return address for correspondence or the filed copy.

- Confirm that all required fields are complete.

After signing

- File the Articles with the state filing office promptly.

- Pay the required filing fee using your chosen method.

- Save the filing confirmation and a copy of the submitted form.

- Record your state-issued file number for future use.

- Store the filed Articles in your corporate records.

- Calendar annual renewal deadlines to keep good standing.

- Share the field articles with the bank and key stakeholders.

- Draft and approve your operating agreement.

- Apply for an EIN if you do not have one.

- Open a business bank account to separate funds.

- Obtain any needed local or state licenses or permits.

- If needed, order a certified copy for third parties.

- Set reminders to update the registered office if it changes.

Common Mistakes to Avoid

- Don’t forget the designator in your name. Missing “LLC” or “L.L.C.” causes rejection. You must include it in the name field on the form.

- Don’t list a P.O. Box as your registered office. The registered office must be a Minnesota street address. Using a P.O. Box will delay or block filing.

- Don’t use an out-of-state registered office. The registered office must be in Minnesota. An address outside Minnesota will not be accepted.

- Don’t leave the organizer’s signature off. Unsigned Articles cannot be filed. Print the organizer’s name and sign with the correct date.

- Don’t mix inconsistent names across attachments. If you attach extra provisions, the name must match exactly. Mismatches cause confusion and delays.

- Don’t pick a past effective date. The state cannot honor a past date. Your filing will default to the acceptance date or be rejected.

What to Do After Filling Out the Form

- Submit your filing. Choose your method: online, mail, or in person. Include the completed Articles and the required fee.

- Track acceptance. Watch for confirmation from the filing office. If you get a correction notice, fix the issues and resubmit.

- Save your formation proof. Store the filed Articles and receipts in your records. Keep a digital and a paper copy.

- Get a certified copy if needed. Some banks and agencies ask for it. Order one and store it securely.

- Approve your operating agreement. Document ownership, management, and profit splits. Have all members sign and keep it with your records.

- Obtain an EIN. Use the filed Articles to request your EIN. Share it only with trusted parties.

- Open a business bank account. Bring your filed Articles and EIN. Separate business and personal funds from day one.

- Set compliance reminders. Calendar annual renewals well before the deadline. Add reminders for license renewals, tax filings, and address changes.

- Update your registered office if it changes. File a change promptly. Keep the address accurate to receive legal papers.

- Amend if details change. Use an amendment filing to change your name or Articles. Do not mark up old Articles.

- Share documents internally. Give members and key staff the filed Articles and operating agreement. Align on roles, authority, and signature rules.

- Keep a formation file. Include the filed Articles, certified copies, amendments, EIN, and operating agreement. Maintain it for audits and banking.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.