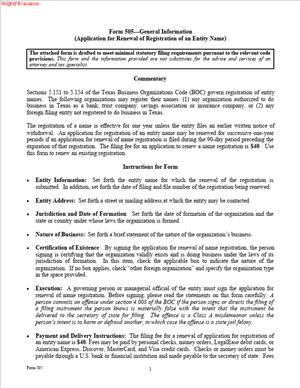

Form 505 – Application for Renewal of Registration of an Entity Name

Fill out nowJurisdiction: Country: The United States | Province or State: Texas

What is a Form 505 – Application for Renewal of Registration of an Entity Name?

Form 505 is the Texas Secretary of State filing you use to renew a registered entity name. It extends your exclusive right to that exact name on the Texas records for another calendar year. It is designed for foreign filing entities that want to keep their name protected in Texas but are not yet registering to transact business in the state.

A “foreign filing entity” includes corporations, limited liability companies, limited partnerships, limited liability partnerships, and similar entities formed outside Texas. If your entity is already registered to transact business in Texas, you do not use this form. In that case, your entity name is protected through your foreign registration. You would manage your name through amendments or assumed name filings, not a name registration renewal.

Think of a name registration as a defensive filing. It blocks others from forming, registering, or changing their name to your exact name while you prepare your Texas plans. The registration is temporary. It runs on a calendar-year cycle. It expires each December 31 unless you renew.

Who typically uses this form?

Out-of-state entities that want to hold their exact legal name in Texas without foreign qualifying. You might be planning a future expansion. You might be completing a merger or rebrand. Or you may be pausing operations while you evaluate market timing. You still want to keep your name secure in Texas during that period. Form 505 lets you maintain that protection year by year.

Why would you need this form?

The benefit is exclusivity at the state filing office. It shields your name in the public record. That reduces the risk that another filer takes the same name before you are ready. It also simplifies a later foreign registration, because you have already preserved the exact name.

Typical usage scenarios

You formed an out-of-state LLC and will launch in Texas next year. You registered the name for this year and now need to renew to cover next year. You completed a corporate rebrand and want to lock the new legal name in Texas while you phase in marketing. You are in due diligence for a national roll-out. You want your exact name preserved in major states, including Texas, while teams sequence filings. Or you held a name this year but had delays. You still want the name preserved for the next year while you finalize licensing or staffing.

A registered entity name does not grant authority to do business in Texas. It also does not grant trademark rights. It is a corporate name protection within the Secretary of State’s records. If you plan to transact business, you must file a foreign registration before you start. If you plan to protect a brand as a trademark, you must pursue those rights through the appropriate channels. Treat each track separately.

When Would You Use a Form 505 – Application for Renewal of Registration of an Entity Name?

You use Form 505 when your existing Texas entity name registration is set to expire at year’s end, and you still want the name protected for the next calendar year. The registration expires on December 31. The renewal applies to the upcoming year. To keep continuity, you file the renewal during the final quarter of the year. Do not wait until the last minute. If you miss the window, the name can become available to others on January 1.

As a practical matter, you use the form when you still are not ready to foreign qualify in Texas. Perhaps your team has not finalized Texas tax registrations. Maybe licensing or regulatory approvals are still in process. Your lease or staffing plan shifted into the next year. You still want your exact name reserved in the Texas records while these items close. Renewing the name registration preserves that position.

Typical users include corporate counsel and paralegals at national companies. They also include startup founders expanding to Texas on a delayed timeline. They include private equity portfolio operations teams managing staggered rollouts. They include franchisors that reserve the parent’s exact legal name while franchise filings take shape. They include professional service firms that will foreign qualify after they secure Texas board approvals, but want their name protected now.

Here are a few clear examples:

- Your Delaware corporation registered its name in Texas for this year. Your Texas launch moved to the second quarter next year. You file Form 505 to renew the name for the upcoming year, so it remains blocked for others.

- Your out-of-state LLC completed a brand refresh mid-year. You registered the new LLC name in Texas. You intend to foreign qualify next summer. You renew now to avoid a gap in protection.

- Your limited partnership paused Texas investment activity for compliance reasons. You still do not plan to transact business in the state next year. You renew your name registration to keep your exact LP name protected while you hold.

- You are in an M&A process and cannot change entity structure until closing. You use the renewal to keep the name secure during the transition.

Use the renewal if you want the same exact name. If you changed your legal name in your home jurisdiction, you must reflect that exact current name on the renewal. If that new name is not available in Texas, you will not be able to renew under that name. Your options would be to choose a different name for Texas in a later foreign registration or adjust your home-jurisdiction name again. The renewal protects the exact legal name on the Texas records, not a variant.

Legal Characteristics of the Form 505 – Application for Renewal of Registration of an Entity Name

This filing is legally binding within the Texas Secretary of State’s corporate records. When accepted, the renewed registration gives your foreign filing entity the exclusive right to its exact legal name on the Texas records for the next calendar year. That legal effect flows from the state’s business organization laws. The office will not file a formation, foreign registration, or name change for another entity using that same exact name during your registration period.

Enforceability rests on several factors. First, the Secretary of State screens names for availability. Your renewal can only be accepted if the name remains available under state rules. The standard is whether the name is distinguishable in the office’s records. If your name conflicts, the renewal will be rejected. Second, you must be eligible. The applicant must be a foreign filing entity. It must not be registered to transact business in Texas under that name. If your entity already foreign qualified in Texas, you cannot maintain a name registration for the same entity name. Third, you must provide evidence that the entity exists and is in good standing in its home jurisdiction. That proof is typically a recent certificate of existence or good standing. The certificate must be current. If it is stale or missing, the renewal is not effective.

A valid renewal has clear scope. It protects the exact entity name on file. It does not provide authorization to transact business. It does not establish trademark rights. It does not override special regulatory naming rules. If your name includes restricted terms, such as banking or professional designations, it must meet Texas naming rules. The state may require proof of authority for regulated terms. The state may also require specific organizational words, like “Corporation,” “Incorporated,” “Company,” “Limited,” “LLC,” or “LP,” depending on your entity type.

The renewal period is time-limited. It covers a specific calendar year. It must be renewed annually to continue protection. If you do not renew, your protection lapses at year-end. After a lapse, someone else could take the name. You could reapply if the name is still available, but you lose priority during any gap.

There are other legal considerations. A name registration does not prevent others from using a similar name in commerce. It controls formations and registrations with the Texas Secretary of State, not marketplace use. It also does not prevent assumed name (DBA) filings by others that are not confusingly similar under the state’s standards. If brand confusion is a concern, you should evaluate trademark protection. If you plan to transact business, you must file a foreign registration. Finally, remember that public records are relied on by lenders, suppliers, and regulators. Keeping your name registration current helps avoid downstream conflicts and rework.

How to Fill Out a Form 505 – Application for Renewal of Registration of an Entity Name

Before you start, confirm two things. Your entity still exists and is in good standing in its home jurisdiction. Your exact legal name remains available in Texas. If either is not true, the renewal will fail. Run a preliminary name check. Then gather your supporting certificate of existence or good standing. The certificate should be recent. If it is not in English, include a translation.

Follow these steps to complete the form accurately:

1) Identify the applicant entity with its exact legal name.

Enter the full legal name of your entity as shown on the home-jurisdiction records. Include the required organizational word. Do not shorten or alter punctuation. The state compares this line to your supporting certificate. Any mismatch can trigger rejection. If you changed your legal name since your last registration, use the new legal name. Note that the new name must be available in Texas. If it is not, you cannot renew under the new name.

2) State the entity type and home jurisdiction.

Select the correct entity type, such as corporation, limited liability company, limited partnership, or limited liability partnership. Then list the jurisdiction where the entity was formed, such as Delaware or New York. Use the current formation jurisdiction, not where the principal office sits. If your entity converted or domesticated, make sure your records are consistent.

3) Provide formation or registration details if requested.

Some versions of the form ask for the date of formation. Others ask for file numbers or home-jurisdiction ID numbers. Provide the details exactly as shown on the certificate of existence. If you do not know your formation date, obtain it from your home-jurisdiction records. Do not guess.

4) Confirm you are renewing the registered name for the next year.

The form renews protection for the upcoming calendar year. You do not select a custom period. The renewal operates on a January 1 through December 31 cycle. If you file late in the year, the renewed protection applies to the next year. If you file too early, the filing may not be accepted. Aim for the final quarter of the current year to keep continuity.

5) Affirm eligibility and compliance.

The form contains statements you must affirm. You are a foreign filing entity. You are not registered to transact business in Texas under this name. The name meets Texas naming standards and is available. Read the statements carefully. If your entity has since foreign qualified, you should not renew a name registration. Manage your name through your existing registration instead.

6) Attach a current certificate of existence or good standing.

Obtain this from your home jurisdiction. It should be recent. The certificate must show that your entity exists and is in good standing. It should also show your exact legal name and formation details. Many rejections happen because the certificate is missing or outdated. Order and attach a fresh certificate. If your certificate includes an alternative name due to a merger or conversion, ensure the current legal name is clear.

7) List the principal office address.

Provide your principal office street address. Do not use a Texas registered agent address unless it is also your principal office. A P.O. box alone is not sufficient if the form requires a street address. Include city, state, and ZIP or postal code. Use a consistent address with your other filings to reduce confusion.

8) Provide a contact for filing questions and document return.

Include a contact name, phone number, and email. This person should be able to answer questions quickly. If the Secretary of State needs corrections, prompt responses help avoid delays. Also provide a return mailing or electronic delivery preference as the form allows.

9) Sign the form with proper authority.

The form must be signed by a person with authority to act for the entity. For a corporation, an officer typically signs. For an LLC, a manager or authorized member signs. For an LP, a general partner signs. For an LLP, a partner signs. Print the signer’s name and title. The signature affirms the truth of the statements. The form does not require notarization. If an attorney-in-fact signs, make sure the power of attorney exists and can be provided if requested.

10) Prepare the filing fee.

A filing fee applies to a renewal of registration of an entity name. Confirm the current fee amount before you file. Include the correct payment method accepted for your chosen filing channel. If you need faster review, ask about expedited processing and related fees. Do not staple checks to the form. Include payment in a way that keeps it with your filing.

11) File the form with the Texas Secretary of State.

You can submit by your preferred method. Ensure all pages and attachments are included. Keep your proof of submission. Track the filing until you receive confirmation. If the office requests corrections, respond quickly and resubmit as instructed. Your renewal is not effective until accepted.

12) Calendar your next renewal and related follow-ups.

Once accepted, the name is renewed for the next calendar year. Set a reminder to renew again during the final quarter of that year. If you plan to foreign qualify in Texas, coordinate timing. After foreign qualification, you will manage your name through that registration and stop renewing the separate name registration. Also update internal systems so your sales, tax, and compliance teams know the current status.

Practical tips to avoid common issues

- Match the name exactly. Include punctuation, spaces, and entity designator. Consistency matters.

- Order a fresh certificate. Stale certificates are a common reason for rejection.

- Monitor name conflicts. If another filer took the name because you missed last year’s renewal, you cannot force renewal. You must choose a different name for Texas or pursue other options.

- Watch restricted terms. If your name includes regulated words, the state may require proof of authority. Do not assume prior acceptance guarantees renewal if your status changed.

- Avoid timing gaps. File during the last quarter to protect continuity for the next year. Plan around holidays and internal approvals.

- Keep your records. Save the accepted filing, date-stamped copy, and receipt. Lenders, vendors, or agencies may request proof that your name is protected.

What happens after filing? If the Secretary of State accepts your renewal, your name protection extends through the next December 31. During that period, no other domestic or foreign entity can file to use that exact name in Texas. If the filing is rejected, you will receive notice with reasons. Correct the issues and resubmit if you remain within the renewal window. If the window closes, you may need to file a new name registration for the next available year, assuming the name is still available.

Finally, confirm that a name registration aligns with your strategic plan. If you will start doing business in Texas soon, it may be more efficient to proceed with a foreign registration rather than renew. A foreign registration gives both name protection and authority to transact. If your operations are still months away and you want to keep your name blocked, a Form 505 renewal is the right tool.

Legal Terms You Might Encounter

- A registered name is your entity’s exact legal name protected in Texas for a set period. You renew that protection with this form so others cannot register a confusingly similar name during the term.

- A foreign entity is a business formed outside Texas. You use this form when your entity is formed in another state or country and you want to keep the name protected in Texas.

- Jurisdiction of formation is the place where your entity was created. You must list that jurisdiction exactly as shown on your organizing documents and any supporting certificate.

- Distinguishable means your name is unique on the state’s records. Minor differences, like punctuation or articles, may not create uniqueness. A renewal generally preserves your existing protection if filed on time.

- An assumed name is a trade name that differs from your legal name. This form does not renew an assumed name. It renews the legal name registration.

- A certificate of existence, sometimes called a certificate of good standing, confirms your entity is active. The form may require a recent certificate from your home jurisdiction as proof.

- An entity identifier is the ending that shows your business type, like Inc., LLC, or LP. Your registered name must include the correct identifier required by your home jurisdiction.

- The effective date is when your renewed protection begins. Your renewal should keep your protection seamless if the filing is accepted before the current term ends.

- The term is the length of protection granted. Registration renewals typically extend the protection for another one-year period.

- An authorized signer is the person who can legally bind the entity. The form requires a valid signature with the signer’s title, like manager or officer.

FAQs

Do you need this form if you only reserved a name?

No. Name reservation and name registration are different. This form renews a registered entity name, not a reservation. If you reserved a name, use the reservation renewal form instead.

Do you gain authority to do business in Texas by renewing?

No. A name registration only protects the name. It does not let you transact business. You must separately register or qualify if you plan to conduct business in Texas.

When should you file the renewal?

File before your current registration expires. That helps preserve your priority and avoids gaps. Don’t wait until the last day. Processing and corrections take time.

Can you change your registered name on this renewal?

No. This form renews the existing registered name. To change the name, file a new registration for the new legal name. You may also consider assumed name filings if appropriate.

What if your legal name changed in your home jurisdiction?

You cannot renew a name that is no longer your legal name. Register the new legal name in Texas. Attach a current certificate of existence that reflects the changed name.

Do you need to attach a certificate of existence?

Often yes. Many renewals require a recent certificate from your home jurisdiction. Obtain one that is dated within a recent period. Check that it shows the correct legal name and status.

Can a domestic Texas entity use this form?

No. This form is for entities formed outside Texas. A domestic entity protects its name through formation, reservation, or other Texas filings, not this renewal.

What happens if you miss the renewal period?

Your name protection lapses. Another party could secure a similar or identical name. You may have to choose a different name or refile if the name becomes unavailable.

Checklist: Before, During, and After the Form 505 – Application for Renewal of Registration of an Entity Name

Before signing:

- Confirm your current registered name and expiration date. Locate your prior registration evidence.

- Verify your legal name in your home jurisdiction. Match punctuation, spacing, and the entity identifier.

- Obtain a recent certificate of existence from your home jurisdiction, if required.

- Confirm your jurisdiction of formation and exact entity type, like corporation or LLC.

- Identify an authorized signer and their title. Ensure they can bind the entity.

- Gather a return email and mailing address for correspondence.

- Confirm the preferred effective date, if the form allows selection.

- Prepare payment information. Verify the acceptable payment methods.

- Calendar your internal deadline to file several weeks before expiration.

During signing:

- Enter your legal name exactly as it appears on your home records.

- Include the correct entity identifier. Avoid abbreviations not used by your home jurisdiction.

- State the jurisdiction of formation accurately. Use the full state or country name.

- Confirm the entity type. Do not confuse LLC, PLLC, LP, or corporation designations.

- Review the certificate of existence. Make sure the date and name match the form.

- Check the effective date, if available. Avoid creating gaps with the current term.

- Confirm the contact person for notices and rejection letters, if any.

- Sign in ink or electronically as required. Include the signer’s printed name and title.

- Review all entries for typos or missing fields. Small errors can trigger rejection.

After signing:

- File the form through an accepted method. Options may include online, mail, or in person.

- Retain proof of filing and a copy of the submitted form.

- Monitor for an acceptance notice or a file-stamped copy.

- If rejected, correct issues promptly. Resubmit with any requested documents.

- Store the approved renewal with your governance records.

- Update your brand, marketing, and domain teams that the name remains protected.

- Calendar the next renewal reminder at least 60 days before the new expiration.

- If you plan to transact business in Texas, address qualification filings separately.

- If your legal name changes later, plan to file a new registration for the new name.

Common Mistakes to Avoid Form 505 – Application for Renewal of Registration of an Entity Name

Using the wrong form

- Don’t confuse a name reservation with a registered name. This form is for renewing a registered name. Using the wrong form delays protection and could cause a lapse.

Letting the registration lapse

- Don’t wait until the last minute. If you miss the deadline, your name protection ends. Another business may claim a similar or identical name.

Attaching an outdated or mismatched certificate

- Don’t submit a certificate of existence that is too old or shows a different name. The filing may be rejected. Use a recent certificate that matches your legal name.

Misstating the legal name or identifier

- Don’t leave off Inc., LLC, or LP if required. The legal name must match your home records exactly. Errors can cause rejection or create ambiguous protection.

Having the wrong person sign

- Don’t use an unauthorized signatory. If the signer lacks authority, the state may reject the filing. Use an officer, manager, or other empowered person.

What to Do After Filling Out the Form Form 505 – Application for Renewal of Registration of an Entity Name

- File the renewal promptly. Choose the filing channel that meets your timing and record-keeping needs. If online filing is available, it may provide faster confirmation. If you file by mail or in person, allow time for processing.

- Track the filing. Save your submission confirmation, proof of delivery, and any receipt. Assign one person to monitor status daily until acceptance.

- Respond to any rejection quickly. Review the reason, fix the error, and refile. Common issues include name mismatches, missing certificates, or incomplete signatures. Aim to cure within a few days to preserve priority.

- Record the approval. Store the approved renewal in your corporate records. Keep both digital and hard copies. Save the file number, approval date, and new expiration date.

- Notify internal stakeholders. Inform legal, finance, marketing, procurement, and IT. Confirm that brand assets and contracts continue to use the registered name. Update style guides if the entity identifier must appear consistently.

- Update external touchpoints. Review signage, websites, invoices, letterhead, and agreements for name accuracy. If you operate under an assumed name, make sure both names are used correctly.

- Calendar the next renewal. Set reminders for 90, 60, and 30 days before the next expiration. Assign responsibility to a person and a backup.

- Plan for business activity, if needed. This renewal does not authorize you to conduct business in Texas. If you plan to transact, prepare the appropriate filings separately. Coordinate timing to avoid brand disruptions.

- Handle amendments and changes. If your legal name changes in your home jurisdiction, stop using the old name for renewals. File a new registration under the updated name. If your formation jurisdiction changes due to conversion or domestication, update your filings accordingly.

- Prepare contingency options. If the name becomes unavailable, identify acceptable alternates. Consider registering a different legal name in Texas. You can also use an assumed name for branding, if needed.

- Maintain ongoing compliance. Check that annual or periodic obligations in your home jurisdiction remain current. Your status there supports your renewal in Texas. Keep registered agent details and internal records updated.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.