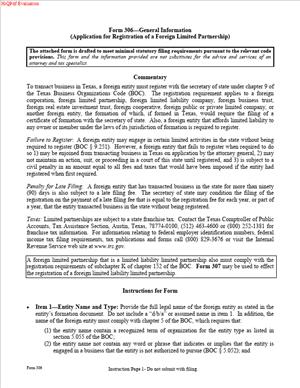

Form 306 – Application for Registration of a Foreign Limited Partnership

Fill out nowJurisdiction: Country: The United States | Province/State: Texas

What is a Form 306 – Application for Registration of a Foreign Limited Partnership?

Form 306 is the Texas Secretary of State’s application to register a foreign limited partnership to do business in Texas. “Foreign” means your limited partnership was formed outside Texas, whether in another state or another country. Registration tells Texas who you are, where to reach you, and who is responsible for managing the partnership. It also gives you legal authority to transact business within Texas.

You use this form when your out-of-state limited partnership plans ongoing operations in Texas. Registration sets up your legal presence. Banks, landlords, and major customers often request evidence of registration. Without registration, your partnership may face penalties and limited legal rights in Texas courts.

Who typically uses this form?

General partners, business owners, in-house counsel, and paralegals. You might be the first employee hired in Texas, a finance lead, or a legal operations manager. If you handle entity management, contracts, real estate, or compliance, this form likely lands on your desk.

You need this form to lawfully operate and protect your rights. Registration allows you to sign leases, open accounts, hire staff, and enter into contracts in Texas under your partnership’s name. It also establishes your registered agent for service of process. This ensures you receive legal notices at a designated Texas address. If your partnership is a limited liability limited partnership (LLLP) in its home jurisdiction, this form also records that status in Texas.

Typical usage scenarios include expansion into Texas markets, opening a Texas office, or hiring Texas-based employees. You might acquire a Texas company and keep operating its facility. You might lease a warehouse or own an income-producing property in Texas. You might begin recurring projects for Texas customers. If you will have an ongoing footprint, you usually need to register.

In short, Form 306 is the mechanism to lawfully extend your limited partnership into Texas. It is a formal filing with the Secretary of State. Once approved, you receive confirmation of registration and can move forward with operations.

When Would You Use a Form 306 – Application for Registration of a Foreign Limited Partnership?

You use this form when your non-Texas limited partnership will transact business in Texas on a continuing basis. This includes opening a physical office, hiring Texas employees, or maintaining a warehouse or facility. It includes managers or sales teams working from Texas. It also includes regular projects or contracts performed within Texas over time.

Consider a real estate limited partnership purchasing an apartment building in Dallas. You will collect rent and oversee ongoing management. You need to register. Consider a construction partnership running an eight-month project in Houston with on-site crews. Registration is expected. Consider a healthcare services partnership opening a clinic in Austin. Registration is required before you sign the lease and hire clinicians.

E-commerce partnerships also need to assess their footprint. If you store inventory in Texas or employ Texas staff, you likely need to register. If you drop-ship from out of state and have no Texas presence, registration might not be required. The same applies to isolated transactions that are short and unusual. But recurring work, local personnel, and in-state facilities point toward registration.

Professional and investment partnerships should also review their plans. If your fund hires local staff, operates a Texas office, or actively manages Texas assets, registration is expected. If you only hold passive interests without a Texas office or employees, registration may not be needed. The details matter. When in doubt, assess the frequency and scale of Texas activities.

Typical users include general partners, CFOs, general counsel, and paralegals. Third-party managers and outside advisors often assist. If you will sign a Texas lease or service agreement in the partnership’s name, you will usually be asked for proof of registration. Many counterparties require this before closing.

Register early. Banks may not open a Texas account without evidence of authority. Landlords may not countersign your lease. Vendors may hold onboarding until they see your Texas registration. Form 306 gives you that proof. It streamlines your entry into the Texas market and reduces business friction.

Legal Characteristics of the Form 306 – Application for Registration of a Foreign Limited Partnership

Form 306 is a statutory filing that creates legal authority for your foreign limited partnership to transact business in Texas. It is legally binding because Texas law requires registration for foreign filing entities with a Texas business presence. Filing establishes your legal capacity to act in Texas under your partnership’s name.

Enforceability rests on proper acceptance by the Secretary of State. The form must be complete, accurate, and signed by an authorized person. The partnership must be in existence in its home jurisdiction. Texas also requires you to appoint a registered agent and registered office in Texas. This ensures a reliable point for service of process. Once accepted, the state issues evidence of registration.

Name compliance affects enforceability. Your legal name must be available in Texas and meet Texas naming rules. If your name is not available or does not meet Texas requirements, you must register under a compliant assumed name. Your records and contracts should reflect the registered name used in Texas.

Accuracy matters. The form includes statements made under penalty of law. False or misleading statements can lead to rejection, penalties, or revocation. Keep your information current. If your registered agent or office changes, you must file an amendment. If your name changes in your home state, update Texas records. If your general partners change, update those records as well.

If you are a limited liability limited partnership in your home state, Texas recognizes that status. You should disclose that status in the application. Texas will rely on your home jurisdiction’s recognition. This helps preserve the liability shield for your general partners while doing business in Texas.

Failure to register has consequences. You may not maintain a lawsuit in Texas courts until you register and cure issues. You may incur monetary penalties. You may create tax exposure or compliance risks. You can still defend a lawsuit, but you limit your offensive legal options. Registration avoids these risks and signals compliance.

After registration, ongoing obligations apply. You must maintain your registered agent and office. You must keep your home jurisdiction in good standing. You will likely have tax and reporting responsibilities in Texas. If you stop doing business in Texas, you should terminate your registration to end ongoing obligations.

Put simply, Form 306 is part permission, part accountability. It grants the right to operate and sets rules for keeping that right. Follow the filing requirements, and keep your records current. Your operations will be smoother, and your rights clearer.

How to Fill Out a Form 306 – Application for Registration of a Foreign Limited Partnership

Use these steps to complete and file Form 306 correctly the first time.

1) Confirm that you are a foreign limited partnership.

- Verify your entity type in your home state. You should be a limited partnership, not an LLC or corporation.

- If you are an LLLP, note that status now. You will disclose it on the form.

2) Check your entity name for Texas use.

- Confirm your legal name is distinguishable in Texas records.

- Ensure your name includes a required LP indicator. Acceptable indicators include “Limited Partnership,” “Limited,” “Ltd.,” “LP,” or “L.P.”

- If your home-state name is unavailable or noncompliant in Texas, adopt an assumed name for Texas. You will list that assumed name on the application. Use the assumed name in Texas contracts and signage.

3) Gather core formation details.

- Identify your jurisdiction of formation and the date you formed the partnership.

- Confirm your partnership’s duration. If it is perpetual, you will state that. If it has a term, you will provide the term.

- Provide the street address of your principal office. This cannot be a P.O. Box. Include city, state, or country, and postal code.

4) Appoint a Texas-registered agent and registered office.

- Choose an individual Texas resident or a Texas organization authorized to serve as an agent.

- The registered office must be a Texas street address. It cannot be a mailbox service.

- Confirm the agent’s written consent before filing. By signing the form, you confirm you obtained that consent.

5) List all general partners and addresses.

- Provide the legal name and business or residence address for each general partner.

- Use complete addresses, including city, state or country, and postal code.

- If you have more general partners than the form allows, add a separate schedule. Title it “Schedule of General Partners.” Match the form’s format.

6) Disclose limited liability limited partnership status if applicable.

- If your home jurisdiction recognizes your partnership as an LLLP, state it in the application.

- Ensure your name reflects LLLP indicators if required by your home jurisdiction. If not, your disclosure in the form covers Texas recognition.

7) Prepare your proof of existence from your home jurisdiction.

- Obtain a recent certificate of existence or similar record from your formation jurisdiction.

- Ensure it is current. Many recipients expect a document issued within the last 90 days.

- Attach this certificate to your application. It confirms that your partnership still exists.

8) Choose your effective date.

- Select “upon filing” for immediate effectiveness.

- Or choose a delayed effective date. Texas allows a future date within a limited window.

- You may also choose effectiveness upon a certain future event. If you do, describe the event clearly.

9) Review internal authority to sign.

- For a limited partnership, a general partner normally signs the application.

- Confirm that the signer’s title and authority are correct under your partnership agreement.

- If someone else will sign, verify they hold proper delegated authority.

10) Complete the execution block.

- Enter the date of signing.

- Print the name and title of the signer. Example: “Jane Smith, General Partner.”

- Sign in ink if filing a paper form. If filing online, follow the electronic signature process.

11) Add required schedules and addenda.

- Attach the Schedule of General Partners if you ran out of space.

- Attach the certificate of existence from your home jurisdiction.

- If using an assumed name in Texas, include any required assumed name addendum. Keep your Texas name usage consistent.

12) Final quality check.

- Confirm your registered office is a Texas street address.

- Check that each general partner’s address is complete and accurate.

- Confirm the jurisdiction and formation date match your home-state records.

- Ensure the effective date selection is clear and valid.

13) Pay the state filing fee.

- Prepare payment for the filing fee. The fee depends on entity type and filing method.

- If filing by mail or in person, include a check or an authorized payment form. If filing online, follow the payment prompts.

14) File the application with the Texas Secretary of State.

- You can file online, by mail, or in person.

- If filing by mail, include the signed application, attachments, and payment.

- Keep a copy set for your records. Request a certified copy if a bank or landlord requires one.

15) Track confirmation and set your compliance calendar.

- Watch for confirmation of registration from the Secretary of State.

- Once registered, the calendar includes the annual tax and reporting deadlines.

- Calendar registered agent renewals and any assumed name renewals.

- Create a trigger to file amendments for any future changes to name, agent, or general partners.

16) Handle common special cases.

- Name not available in Texas: Use an assumed name on the application. Keep this name on Texas contracts and filings.

- Address changes after filing: File an amendment to update your records promptly.

- General partner changes: Amend your registration to reflect current governing persons.

- Ceasing business in Texas: File a termination of registration when you exit the state.

Practical tips

Confirm the registered agent address is staffed during business hours. Service of process must reach a live person. Align your effective date with your lease start or closing date. That avoids gaps between commitments and legal authority. If you face a tight timeline, file online to speed approval. Keep digital copies of all submissions and approvals in your entity management system.

Before signing, cross-check your partnership agreement. Ensure the signer is a current general partner and that their title matches the agreement. Confirm that your home-state records show the same general partners listed in Texas. Aligning records avoids questions during review.

Finally, use the same name on all Texas documents. Contracts, leases, bank accounts, and insurance should match your Texas-registered name or assumed name. Consistency reduces confusion and supports enforceability. Registration through Form 306 sets the foundation. Your consistent use of the registered name builds on it.

With these steps, you can complete Form 306 with confidence. You will establish your legal presence in Texas and clear the way for operations.

Legal Terms You Might Encounter

- Foreign limited partnership means your limited partnership was formed under another state’s laws. You use Form 306 to register that existing entity so it can legally do business in Texas.

- Jurisdiction of formation is the state where your limited partnership was originally formed. On Form 306, you must name that state exactly as shown on your formation record.

- Entity name is the exact legal name of your limited partnership in its home state. Form 306 asks for that name exactly. If that name is not available in Texas, you can adopt an assumed name for use in Texas.

- Assumed name (or alternate name) is a different name you use in Texas when your legal name is unavailable or does not meet state naming rules. If you use one, you will disclose it on Form 306 and complete any required assumed name filings.

- Registered agent is the person or company you appoint to receive legal papers on your behalf in Texas. The agent must agree to serve. Form 306 asks for the agent’s name and a Texas street address for the registered office.

- Registered office is the physical street address in Texas where your registered agent accepts service of process. A P.O. box is not acceptable as the registered office. You list the registered office on Form 306.

- General partner is an owner who manages the partnership and has the authority to bind it. Form 306 requires the name and address of each general partner. You do not list limited partners on this form.

- Limited partner is an owner who typically does not manage the business. Limited partners are not listed on Form 306, but your partnership agreement will govern their rights and obligations.

- Principal office is your main business office, wherever located. Form 306 asks for your current principal office address. This can be outside Texas.

- Certificate of existence (or good standing) is an official document from your home state confirming your limited partnership is active. You generally attach a recent certificate to Form 306 to prove your entity exists and is compliant at home.

- Service of process is the official delivery of legal papers, such as lawsuits. Your registered agent and registered office information on Form 306 ensures proper delivery in Texas.

- Effective date is when your Texas registration becomes effective. On Form 306, you can choose effectiveness upon filing or on a later date set by you.

- Execution means the act of signing Form 306. A general partner must sign. By signing, you declare that the form is accurate and that the registered agent has consented.

FAQs

Do you need to register before doing business in Texas?

Yes. If your limited partnership is transacting business in Texas, you should register. Registration lets you maintain lawsuits in Texas courts and reduces penalties for unregistered activity. If you are unsure whether your activities count as doing business, consider seeking guidance.

Do you need a certificate of existence from your home state?

Yes. You should attach a recently dated certificate from your formation state. The filing office uses it to confirm your entity exists and is in good standing. If the certificate is outdated or missing, your filing may be rejected. Order it before you complete Form 306 so it is ready.

Do you have to list limited partners on Form 306?

No. You list only the names and addresses of each general partner. Keep your limited partner roster in your partnership records. If a general partner changes after registration, file an update with the filing office.

Can you use a P.O. box for the registered office?

No. The registered office must be a physical street address in Texas where the registered agent is available during normal business hours. You may include a suite number. You can use a mailing address elsewhere for other business purposes, but not for the registered office.

Who can serve as your registered agent?

You can appoint an individual Texas resident or a business authorized to do business in Texas. The agent must consent to the appointment. You must list the agent’s name and a Texas street address. Do not list your foreign principal office as the registered office.

Who can sign Form 306?

A general partner must sign. If more than one general partner exists, one can sign on behalf of the partnership. Make sure the signer’s name appears in the general partner section and matches your home-state records. Unsigned or improperly signed forms get rejected.

Can you delay the effective date of registration?

Yes. You can choose effectiveness when filed or specify a later date. A delayed date lets you align registration with your opening or contract start. If you pick a delayed date, you cannot transact business in Texas until that date.

How do you correct a mistake after filing?

You can file a correction or an amendment with the filing office. Use a correction if the error was accidental and the original filing was accepted. Use an amendment if information has changed, such as a new registered agent or a new general partner. Keep proof of all corrected filings with your records.

Checklist: Before, During, and After the Form 306 – Application for Registration of a Foreign Limited Partnership

Before signing

- Confirm your legal name and jurisdiction exactly as shown in your home-state records.

- Check that your limited partnership is active and in good standing in your home state.

- Order a recent certificate of existence (or good standing) from your home state.

- Decide whether you need an assumed name for use in Texas.

- Select a registered agent and get written consent to serve.

- Confirm the registered office is a Texas street address (no P.O. box).

- Gather the principal office address and any alternate mailing address you plan to use.

- List each general partner’s full legal name and business or residential address.

- Verify who has the authority to sign (a general partner).

- Decide on the effective date (upon filing or a later date).

- Prepare payment in an accepted form.

- Review any internal approvals required by your partnership agreement.

During signing

- Enter the entity’s legal name exactly as it appears on home-state records.

- If using an assumed name in Texas, complete that section in full.

- Fill in your jurisdiction of formation and date of formation accurately.

- Provide the principal office address, including city, state, and postal code.

- List the registered agent’s full name and a Texas street address for the registered office.

- Confirm you have the agent’s consent; do not guess or assume.

- List each general partner’s name and address. Do not omit any current general partner.

- Attach the certificate of existence from your home state.

- Choose the effective date option you want and check the correct box.

- Review for consistency: names, addresses, and spellings should match the attached documents.

- Sign and date the form as a general partner. Print the signer’s name and title clearly.

After signing

- Make a clean copy of the signed form and attachments for your records.

- File the form with the state filing office with the correct fee.

- If offered, choose expedited processing if timing is critical to your launch.

- Wait for confirmation and a stamped certificate of registration.

- Store the approved filing with your partnership agreement and minute book.

- Notify your registered agent and confirm they received the approval notice.

- Update banks, landlords, insurers, and key vendors with your Texas registration details.

- If you used an assumed name, complete any companion assumed name filings and renewals.

- Calendar compliance tasks: registered agent renewals, assumed name renewals, and any required reports.

- Track changes. File amendments promptly for name changes, agent changes, or new general partners.

Common Mistakes to Avoid Form 306 – Application for Registration of a Foreign Limited Partnership

Using a P.O. box for the registered office

- Consequence: The filing office will reject your application.

- Don’t forget: Provide a Texas street address where the agent is available during business hours.

Forgetting the registered agent’s consent

- Consequence: Your filing may be rejected, or the agent may resign immediately.

- Don’t forget: Obtain the agent’s consent before you sign and file.

Attaching an outdated or missing certificate of existence

- Consequence: The filing office will place your filing on hold or reject it.

- Don’t forget: Order a recent certificate from your home state and include it.

Listing the wrong or incomplete legal name

- Consequence: Mismatch with home-state records delays approval.

- Don’t forget: Match the exact name, punctuation, and spacing from your formation record.

Having the wrong person sign

- Consequence: The filing office will reject the form as improperly executed.

- Don’t forget: A general partner must sign. Make sure the signer is listed on the form.

Omitting a current general partner

- Consequence: The filing office may reject the form, or your record will be inaccurate.

- Don’t forget: List every current general partner with full name and address.

Choosing a delayed effective date by mistake

- Consequence: You cannot legally transact business in Texas until the stated date.

- Don’t forget: If you need immediate authority, choose effectiveness upon filing.

What to Do After Filling Out the Form 306 – Application for Registration of a Foreign Limited Partnership

File the completed form with the required fee. Include the recent certificate of existence and any assumed name documentation. Keep a copy of everything you submit.

Wait for approval. Do not hold closings or sign Texas-specific contracts until your registration is effective. If you selected a delayed effective date, plan your start accordingly.

On approval, save the stamped certificate of registration. Store it with your partnership agreement, certificates from your home state, and your compliance calendar.

Notify your registered agent that the filing is complete. Confirm the agent’s contact details are correct and that they can receive service during business hours.

Update your records:

- Add Texas as a registered jurisdiction in your internal entity ledger.

- Record the registered agent and registered office address.

- Record the principal office address on file with the state.

Communicate with stakeholders:

- Provide your Texas registration details to banks, insurers, landlords, key vendors, and major customers.

- Update contract templates to include your Texas registration name (or assumed name).

Set up compliance routines:

- Calendar renewal or reporting obligations that apply to foreign entities.

- Track assumed name expiration dates and renew before they lapse.

- Monitor your registered agent engagement and invoice dates.

Handle post-filing changes promptly:

- If your name changes in your home state, update Texas records.

- If you change your registered agent or registered office, file the update and secure the agent consent.

- If a general partner is added or removed, file an amendment to keep records current.

Maintain home-state good standing:

- Keep your home-state registration active. Texas may require you to remain in good standing there.

- If your home-state status lapses, resolve it quickly to avoid Texas issues.

Plan for corrections:

- If you discover an error in the approved filing, submit a correction filing as soon as possible.

- Keep both the original and corrected documents in your records with a clear audit trail.

Prepare for growth:

- Consider whether additional assumed names are needed for branding or franchise locations.

- If you open new Texas locations, confirm they align with your registered agent coverage and hours.

If you cease doing business in Texas, file a withdrawal to end your registration. Closing your Texas operations without filing a withdrawal can lead to continued obligations and fees.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.