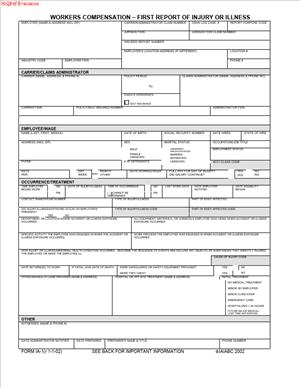

Form 1A-1 – Workers Compensation – First Report of Injury or Illness

Fill out nowJurisdiction: United States | Arkansas

What is a Form 1A-1 – Workers Compensation – First Report of Injury or Illness?

Form 1A-1 is Arkansas’s official first notice that a workplace injury or occupational illness has occurred. You use it to report essential facts about the event, the employee, and the employer. It triggers the workers compensation claim process and puts the state and insurer on notice. It is not a settlement, a release, or an admission of liability. It is a regulatory report that starts the formal claim file.

You will see this form whenever an employee suffers a work-related injury or illness that requires medical care beyond basic first aid or causes lost time from work. It captures who, what, when, where, and how the incident occurred. It also records the nature of the injury, affected body parts, and the initial medical response. Employers or their insurance carriers typically complete and file it. Employees do not usually file this form themselves, but their prompt reporting to the employer makes the filing possible.

The Arkansas Department of Labor and Licensing oversees the workers compensation system in which this form sits. When you file Form 1A-1, you create a formal record. That record helps determine benefits, allows claim assignment and tracking, and opens communication between all parties. If you are an employer, accurate and timely filing is a legal duty. If you are an insurer or third-party administrator, the form feeds your claim intake workflow and compliance timeline.

Why would you need this form?

Because Arkansas law requires quick, accurate reporting of work injuries and illnesses, the form ensures the injured worker’s access to medical care and wage replacement, if due. It protects you against penalties for late reporting. It also documents facts while memories are fresh, which reduces disputes later. For employees, the form is the anchor that supports benefit decisions. For employers, it is the first step in managing risk, tracking lost time, and coordinating return-to-work.

Typical usage scenarios include an employee who slips and fractures a wrist, a mechanic who develops a chemical burn from a solvent, a nurse who strains a shoulder lifting a patient, a warehouse associate with cumulative trauma from repetitive lifting, or a driver who is injured in a motor vehicle accident while on duty. It also includes occupational diseases like hearing loss or respiratory illness linked to workplace exposures. If the event is work-related and more than first aid is needed, you should expect to complete a Form 1A-1.

When Would You Use a Form 1A-1 – Workers Compensation – First Report of Injury or Illness?

You use Form 1A-1 as soon as you learn that an employee was hurt or became ill because of work. Do not wait for a final diagnosis, medical bills, or approval from internal leadership. The standard is prompt reporting. In practice, that means you file shortly after you receive notice of an injury that requires medical treatment beyond first aid or causes lost time from the job. If the injury results in death, you file immediately and coordinate with your insurer without delay.

Consider a few real-world examples. An office worker trips over a box and sprains an ankle. They visit an urgent care clinic and receive an ankle brace and a prescription. This needs a Form 1A-1. A carpenter cuts a finger on a saw and requires sutures. That is more than first aid and must be reported. A line worker notices tingling in both hands after months of repetitive motion and gets a carpal tunnel diagnosis. That is an occupational illness and needs reporting. A delivery driver is rear-ended during a delivery route and needs ER evaluation. File the form. A cook has minor redness from a hot pan but no treatment beyond a bandage. That might be first aid only, and a Form 1A-1 may not be required, but when in doubt, file.

Who usually completes the form?

In small businesses, the owner or office manager often fills it out. In mid-size or large companies, it is often HR, a safety officer, or a designated supervisor. In insured cases, your carrier or third-party administrator may prepare and file the form based on your report, but you must give them the facts promptly. If you are self-insured, your internal claims team files it. Healthcare providers do not file this form for you. Employees do not complete it unless your internal process asks them to help with certain details, such as a description of how the injury occurred.

Timing matters. Arkansas requires quick reporting to the state. Prompt filing also helps the insurer meet its own duties, such as initiating benefits or issuing a decision on the claim. It also protects the employee’s access to care under the employer’s workers compensation coverage. If your organization uses a designated clinic for initial treatment, you still must file. The use of an internal incident report does not replace the Form 1A-1. The internal report may help you gather facts, but it is not a valid substitute for the required state form.

Legal Characteristics of the Form 1A-1 – Workers Compensation – First Report of Injury or Illness

Form 1A-1 is a regulatory filing. Completing and filing it is legally required when a reportable work injury or illness occurs. It is not a contract. It does not waive rights or release claims. It does not, by itself, guarantee benefits or prove fault. Instead, it documents the occurrence, preserves facts, and triggers the claim process under the Arkansas workers compensation law.

Is it legally binding?

The obligation to file is binding on employers and their insurers. The information you provide is submitted to a government authority and used to administer benefits. False, incomplete, or late reports can expose you to penalties, increased scrutiny, or litigation risk. The form’s enforceability comes from statute and regulation. The state can assess fines for noncompliance. Carriers can seek missing details from employers, and the claim can be delayed until accurate facts are received. The information on the form is also evidence. It can support or contradict later statements. Accuracy matters.

Several legal considerations apply. First, timeliness. Arkansas rules expect fast reporting, typically within days of your knowledge of a reportable injury or illness. Second, scope. The form covers accidental injuries, occupational diseases, and cumulative trauma conditions, if they arise out of and in the course of employment. Third, privacy. You may be asked for sensitive identifiers and health details. Handle those carefully and keep copies secured. Fourth, medical control. Arkansas rules on authorized providers and directed care can be relevant, but the Form 1A-1 should be filed whether or not you have yet confirmed the authorized physician. Fifth, downstream filings. After the First Report is filed, the insurer will either pay benefits or dispute the claim. That decision triggers separate filings and notices, but none of that can start until the First Report is in the system.

Employers should not treat the First Report as an admission of liability. You can and should report even if the facts are still developing. Use neutral, factual descriptions. Avoid speculation about fault. If you later discover corrections, submit them through your insurer or claims administrator so the record is accurate. The goal is a clear, timely, and true account of what is known at the time of filing.

How to Fill Out a Form 1A-1 – Workers Compensation – First Report of Injury or Illness

Before you start

- Act quickly. Begin the form as soon as you learn of the injury or illness.

- Gather facts. Speak with the employee and any witnesses. Review incident reports, time records, and supervisor notes.

- Collect documents. Have the employee’s hire date, job title, wage details, and contact information ready. Pull your workers compensation policy number and insurer contact.

Step 1: Identify the parties

- Employer information. Enter the full legal name of the employer, not just a trade name. Add the physical address where the worker is employed. Include the mailing address if different. Provide the employer’s federal employer identification number (FEIN) if requested. List a contact person who can answer questions, with phone and email.

- Employee information. Enter the employee’s full name exactly as it appears on payroll. Add home address, phone, and email if available. Include date of birth, sex, and marital status if the form requests these fields. Provide the employee ID or Social Security number as required. If the form allows a partial SSN, follow the instructions on the face of the form.

- Insurer or claim administrator. List the workers compensation insurance carrier or third-party administrator. Include the policy number and the claim contact if known. If you are self-insured, indicate that and list your claims office.

Step 2: Describe the employment details

- Job information. Enter the employee’s occupation or job title. Note the date of hire and the department or location. If the worker is a temporary employee or leased employee, identify both the client company and the actual employer of record.

- Wage information. Provide the wage rate at the time of injury. Indicate whether the worker is paid hourly, by salary, or by piece rate. Include average weekly wage if known. If there are regular overtime or tips, note them if the form requests it. You may need to supply a wage statement later; for now, give the best available snapshot.

Step 3: Record the incident details

- Date and time. Enter the exact date of injury or the date the employee first became aware of the illness. For occupational diseases or cumulative trauma, use the date of diagnosis or the date the employee first knew the condition was work-related.

- Last day worked and return date. Note the last day worked before disability began. If the employee has already returned to work, include the return date and whether they returned with restrictions.

- Location. Specify where the injury occurred. If it occurred offsite, list the address or describe the location (customer site, road location, or delivery route).

- Narrative of how it happened. Describe the event in plain language. Example: “Employee lifted a 50-pound box, felt a pop in the lower back, and experienced immediate pain.” Avoid blame or guesses. Stick to observable facts.

Step 4: Classify the injury or illness

- Nature of injury. Select or enter the type (e.g., sprain, fracture, laceration, burn, respiratory condition, hearing loss). Use the standardized term list on the form if provided.

- Body part(s). Identify specific body areas affected (e.g., right wrist, lower back, left knee, lungs, hearing in right ear).

- Cause/source. Indicate the cause or exposure source (e.g., overexertion, caught in equipment, struck by an object, repetitive motion, chemical exposure).

- Fatalities. If the injury resulted in death, mark that clearly and provide the date of death.

Step 5: Document medical treatment

- Initial treatment. Record where the employee first received care (clinic, ER, urgent care, onsite). Note the provider’s name if available.

- Ongoing care. If a follow-up provider has been assigned, list the name. If you use a designated occupational clinic, record that referral.

- Work status. Include any known restrictions or off-work orders. If unknown at filing, state that the medical status is pending.

Step 6: Note witnesses and equipment

- Witnesses. List names and contact information for any witnesses. If there were no witnesses, state “no witnesses reported.”

- Equipment or materials. Identify any tools, machines, or substances involved (e.g., ladder, pallet jack, cleaning solvent, forklift). If a product malfunctioned, note the brand and model if known.

Step 7: Capture lost time and compensation

- Days away or restricted duty. Indicate whether the employee missed time or worked with restrictions. Estimate days lost if known. If the employee continued working full duty, state that.

- Compensation. Do not calculate benefit amounts on this form. The insurer does that. Provide accurate wage info to support any benefit calculation later.

Step 8: Include employer safety and OSHA context (if asked)

- Safety devices. If the form asks whether protective equipment was used, answer based on facts. Do not speculate.

- OSHA recordability. Some forms ask if the incident is OSHA recordable. Answer if required. This does not replace your OSHA log duty.

Step 9: Review for accuracy and completeness

- Check identifiers. Confirm names, dates, FEIN, policy number, and contact details.

- Verify narrative. Ensure the description is clear, consistent, and concise. Avoid jargon and acronyms not commonly understood.

- Align facts. Make sure the date of injury aligns with the last day worked and treatment dates.

Step 10: Sign and date

- Signature. The employer or authorized representative should sign and date. Some insurers file on your behalf. If so, they will sign as the filing party. The employee usually does not sign this form.

- Title. Print the signatory’s title and contact details. The state or insurer may call with questions.

Step 11: Submit and distribute

- Submission. File the completed form with the Arkansas Department of Labor and Licensing’s workers compensation authority through the accepted channel. If you work through an insurer or TPA, send it to them immediately so they can file on time.

- Copies. Keep a copy in your records. Provide a copy to your insurer or claim administrator. You may provide a copy to the employee for their records.

- Follow-up. Track confirmation of filing. If you do not receive a claim number or acknowledgment, follow up with your insurer or TPA.

Step 12: Attach schedules or supplemental documents when appropriate

- Wage schedule. If requested, attach recent pay stubs or a wage statement to help calculate the average weekly wage. This may be a separate form, but flag that you can provide it.

- Medical documentation. Do not delay filing for lack of medical records. Submit the First Report now, and send medical updates as they arrive.

- Incident reports or photos. Internal reports and photos can be helpful, but are not required for the First Report. Keep them available for your insurer.

Practical tips to avoid common errors

- Do not wait for a supervisor’s investigation to finish. File the First Report with the facts you know and update it later if needed.

- Avoid vague phrases like “hurt back.” State the action and mechanism: “Twisted while lowering a 60-pound box.”

- Record all affected body parts noted at the time. Adding them later can create disputes.

- If the employee is unsure about dates, confirm with timecards or schedules.

- If you suspect the injury is not work-related, still file. The carrier will evaluate and make a decision. The First Report is not an admission.

Special situations

- Occupational disease or cumulative trauma. Use the date the employee first knew the condition was related to work, or the diagnosis date. Provide a clear exposure history in the narrative.

- Delayed reporting by the employee. Record the date the employee notified you and explain the reason for the delay if known.

- Out-of-state injuries for Arkansas employees. If the employee is hired in Arkansas or primarily works here but was injured elsewhere, still file. Your insurer will address jurisdiction and coverage.

- Temporary or leased employees. Identify the actual employer of record and the worksite employer. Coordinate with the staffing agency on who files, but ensure that a Form 1A-1 is filed.

After filing, what happens next?

- The insurer assigns a claim number and begins an investigation. They will request any missing details.

- If benefits are due, the insurer typically initiates payments and authorizes care. If controverted, you will receive a notice explaining the reasons.

- Keep communication open with the employee. Coordinate light-duty or return-to-work as medically allowed.

- Update facts with your insurer as medical information evolves or the employee’s status changes.

Recordkeeping and retention

- Keep a copy of the Form 1A-1 and all related correspondence in a secure file. Limit access to those who need it.

- Maintain records for the period required by law and your insurer. Good records support compliance and defense.

Bottom line: When a work injury or illness occurs in Arkansas, you file a Form 1A-1 promptly, accurately, and completely. That filing starts the workers compensation claim process, protects the employee’s access to benefits, and helps you meet your legal duties. Gather facts, stick to what you know, and submit without delay.

Legal Terms You Might Encounter

- You will see “First Report of Injury” or “FROI.” This is the initial report that starts the workers compensation claim process. Form 1A-1 is the FROI for this jurisdiction. Completing it puts the insurer and administrators on notice so they can assign a claim number and begin handling benefits.

- “Employee” means the injured worker. The form asks for the employee’s full legal name, date of birth, contact details, job title, and an identifier. Give the exact information as it appears in your payroll and HR systems to avoid mismatches.

- “Employer” is the business that employed the worker when the injury happened. The form asks for your legal business name, address, and industry classification. It also asks for your federal employer identification and policy details. Use the legal name on your policy, not a trade name.

- “Insurer” or “Carrier” is the company that provides your workers compensation coverage. The form has fields for the carrier name and policy number. Accurate carrier and policy information ensures the report reaches the right adjuster fast.

- “Claims administrator” or “TPA” is the company that manages the claim on the insurer’s behalf, if used. The form may ask for this contact. If you use a TPA, list it and give the correct claim intake address or email so nothing gets lost.

- “Date of injury” is the exact calendar date when the event occurred. For illnesses or cumulative injuries, it may be the date of diagnosis or when the employee first knew the condition was work-related. The form requires this date and the time of day. Get both right to avoid disputes about timelines.

- “Occupational disease or illness” is a condition caused by workplace exposure over time. You use the same form for injuries and illnesses. When you report an illness, describe the exposure, the timeframe, and the diagnosis if known.

- “Compensable injury” is an injury that arises out of and in the course of employment. You do not decide compensability on this form. Your job is to report facts. The insurer will evaluate those facts against the law.

- “Average weekly wage” is the worker’s earnings used to calculate income benefits. The form may ask for wage details and the pay schedule. Provide accurate pay rate and schedule so the insurer can set the compensation rate correctly.

- “Temporary total disability (TTD)” means the worker cannot work at all for a period while recovering. If the employee misses work beyond the waiting period under the law, note the first full day missed and any return-to-work date on the form.

- “Maximum medical improvement (MMI)” is the point at which the worker’s condition is stable. You will not know this at filing. Later, the insurer may request updates or additional forms when the worker reaches MMI.

- “Authorized treating provider” is the healthcare professional directing care under the claim. The form asks for the first treating provider and facility. List the provider who first treated the injury and any referral, if known.

- “Lost-time claim” is a claim where the worker misses work beyond a short waiting period. A “medical-only claim” involves treatment but no wage loss. The form asks whether there is lost time. Check the right box so the insurer triages the claim properly.

FAQs

Do you have to file Form 1A-1 for minor injuries?

Yes, file the form for any injury or illness that requires more than simple first aid, diagnostic testing, or results in lost time. If you are unsure, file it. Reporting starts the claim and protects you from late-report penalties and disputes.

Do you complete the form or does the employee?

You complete the form as the employer, often with help from your insurer or claims administrator. You should interview the employee to capture accurate facts. Share a copy with the employee once you file, so they know what was reported.

Do you need to attach medical records when you file?

Not at first. The form captures basic facts. List the treating provider and facility. Keep any medical notes you receive in your internal file. The adjuster will request medical records directly from providers or ask you for specific documents if needed.

Do you still file if you question the claim?

Yes. Report the facts promptly, even if you have concerns. Use the narrative section to document objective details, witnesses, video, or policy issues. Do not include opinions or accusations. The insurer will investigate and decide compensability.

Do you use one form for multiple injuries from the same incident?

Use one form for one incident, even if it involves multiple body parts. If the employee later reports a new condition from the same event, send an amended report noting the added body part and the claim number.

Do you file this form for occupational disease or cumulative trauma?

Yes. Treat it like any other work-related condition. Describe the exposure, the nature of the job duties, and the timeline. For the date of injury, use the date of diagnosis or the date the employee first became aware the condition was work-related. If in doubt, note both dates in the narrative.

Do you need the employee’s Social Security number?

Many versions of this form request it to verify identity and match the claim to wage records. If you do not have it at the time of filing, use an internal identifier and update the claim with the correct number as soon as possible. Safeguard this data.

Do you have a strict deadline to file?

You should file as soon as possible, ideally the same or next business day after you learn of the injury. Delays can slow benefits, complicate the investigation, and may expose you to penalties. If there is any doubt, file and supplement later.

Do you submit the form electronically or by paper?

Follow your insurer’s intake instructions. Many accept electronic submissions through a portal or secure email. Some still accept fax or mail. Use the method your insurer or administrator specifies so the report reaches the correct adjusting unit quickly.

Do you need to give a copy to the employee?

Yes. Provide a copy to the employee for their records. It helps them verify details, contact the adjuster, and understand next steps. Keep a copy in your internal file as well.

Do you need to record witnesses?

Yes. List witness names and contact information on the form. Witness statements help the adjuster confirm what happened. If you have written statements, retain them and provide them if the adjuster requests them.

Do you need to describe safety measures or training?

Use the narrative to note relevant safety facts, such as PPE in use, machine guards, or recent training. Stay factual. Do not speculate about fault. Your insurer will assess any safety issues during the investigation.

Checklist: Before, During, and After the Form 1A-1

Before signing: information and documents you need

- Employee details: full legal name, address, date of birth, phone, job title, and identifying number.

- Employment data: hire date, shift, department, supervisor name, and work location.

- Wage information: pay rate, pay schedule, typical hours per week, and any overtime or bonuses if requested.

- Employer details: legal name, FEIN, business address, industry classification, and location code if you use one.

- Insurance information: carrier name, policy number, policy effective dates, and claims administrator contact.

- Incident basics: date, exact time, and location of the event; whether it occurred on your premises or off-site.

- Injury description: what the employee was doing, how the injury happened, equipment or substances involved, and specific body parts affected.

- Illness exposure details: substance, duration, and context of exposure; when symptoms first appeared; when diagnosed.

- Witnesses: names, job titles, and contact information.

- Medical provider: first treating provider and facility; transport method if emergency services were used.

- Lost time: last day worked, first full day missed, and any modified or light-duty assignments.

- Supporting documents: incident reports, photos, video references, and any initial medical notes.

During signing: sections to verify carefully

- Names and identifiers: employee and employer names spelled correctly and consistent with policy records.

- Dates and times: date of injury, time of injury, last day worked, and return-to-work dates.

- Policy details: carrier name, policy number, and policy period that covers the date of injury.

- Injury narrative: clear, factual description of what happened, including body part and nature of injury.

- Location and department: confirm the exact site and unit where the incident occurred.

- Wage and schedule: verify pay rate and hours; note if the employee has variable earnings.

- Witness and provider details: complete names and contacts; no placeholders.

- Checkboxes: lost-time vs. medical-only, whether the injury occurred on premises, and whether safety equipment was used.

- Signatures and titles: the preparer’s name, title, contact information, and date signed.

After signing: filing, notifying, and storing instructions

- Submit the form using your insurer or administrator’s preferred method. Confirm the correct intake address or portal.

- Provide a copy to the employee and the supervisor. Keep one in your internal claim file.

- Confirm receipt with the insurer. Ask for the claim number and adjuster contact.

- Calendar follow-up dates: expected benefit start, medical appointments, and return-to-work check-ins.

- Update the claim promptly if facts change, the diagnosis evolves, or lost time begins.

- Preserve related documents: incident reports, witness statements, photos, and medical notes. Store them securely.

- Coordinate with payroll to track lost time, light duty, and any wage supplement policies you use.

- If you use internal safety reviews, complete them separately from the claim file, but keep cross-references.

Common Mistakes to Avoid

- Don’t forget the exact time of injury. Missing or vague times create disputes about when the event happened and who was on duty. That can delay claim acceptance.

- Don’t use vague descriptions. Writing “hurt back lifting” is not enough. State what was lifted, its weight, the posture, and the body motion. Clear facts help the adjuster authorize treatment faster.

- Don’t omit wage details. Without a pay rate and schedule, the insurer cannot set the compensation rate. That slows income benefits and may trigger avoidable back-and-forth.

- Don’t guess on policy or claim contacts. A wrong policy number or administrator address sends the form into a void. That can cause late reporting penalties and frustrate the employee.

- Don’t edit the employee’s account to fit assumptions. Changing factual statements can undermine credibility and escalate disputes. Capture the employee’s words and add your separate factual observations.

What to Do After Filling Out the Form

- File the form with your insurer or claims administrator right away. Use the intake method they specify. Ask for confirmation of receipt, the assigned claim number, and the adjuster’s name and phone number.

- Give the employee a copy and explain the next steps. Tell them who the adjuster is and how to schedule care with the authorized provider. Share how to report new symptoms or changes.

- Start your internal workflow. Notify HR, safety, and payroll. Log the incident in your tracking system. Set reminders for medical appointments and return-to-work check-ins. If you run a light-duty program, identify tasks that fit any restrictions.

- Secure and organize documents. Keep the filed form, incident report, witness statements, and any medical notes in a secure claim file. Limit access to those who need it. Note where videos or photos are stored.

- Coordinate medical care. Confirm the treating provider has the claim number and insurer billing information. If the employee needs referrals or diagnostics, ask the adjuster about authorization to avoid delays.

- Manage lost time. Track the first full day missed and any partial days. Note when the employee returns to light duty or full duty. Share changes with the adjuster the same day they occur.

- Update the report if facts change. If a new body part is affected, the diagnosis changes, or the return-to-work date shifts, submit an amended report. Reference the claim number and state what changed.

- Follow through on communications. Respond quickly to the adjuster’s requests for payroll history, job descriptions, or safety information. Document all calls and emails. Quick responses keep treatment and benefits on track.

- Review the claim setup. Confirm that the injury description, body parts, and wage data in the insurer’s system match your records. Correct discrepancies early to prevent benefit errors.

- Close the loop with safety. Separately from the claim file, review root causes, training needs, and engineering controls. Implement corrective actions and document completion.

- When the claim resolves, finalize your file. Store it per your retention policy. Record lessons learned, update your procedures, and refresh training if needed.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.