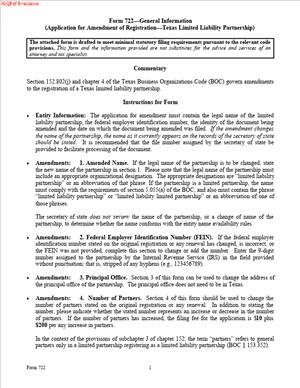

Form 722 – Application for Amendment to Registration of a Limited Liability Partnership

Fill out nowJurisdiction: Country: United States | Province/State: Texas

What is a Form 722 – Application for Amendment to Registration of a Limited Liability Partnership?

Form 722 is the Texas filing you use to update the public record for a registered limited liability partnership (LLP). You file it with the Texas Secretary of State to change information from your original LLP registration. It keeps your registration current and accurate. It also preserves your good standing and liability protection under Texas law.

Think of it as an “update card” for your LLP’s core details. You use it when the facts in your most recent LLP registration filing are no longer correct. You may change your partnership name, your registered agent or registered office, or your principal office address. You may also correct a mistake in a prior filing. In short, if the Texas record for your LLP no longer matches reality, this is the form you file.

Who typically uses this form?

Managing partners and firm administrators use it most. You might also see outside counsel, accountants, or operations managers handle the filing. Professional service firms use it often, including law firms, accounting firms, engineering firms, and medical practices organized as LLPs. Both Texas LLPs and foreign LLPs registered to do business in Texas may need to file it.

You need Form 722 when your LLP goes through a change that the Secretary of State tracks. If you rebrand and adopt a new name, you must update the name on file. If you appoint a new registered agent or move your registered office, you must amend the registration. If your principal office relocates, you must update that address. If a previous filing contained an error, you correct it with this amendment.

Common usage scenarios

Your firm merges with another practice and adopts a new name. Your registered agent resigns, so you appoint a new agent. Your firm moves from Austin to Dallas and needs to update the registered office street address in Texas. Your original application missed a character in the LLP name, and you need to correct it. Or your foreign LLP updated its legal name in its home jurisdiction and must reflect that change on its Texas registration. In each of these cases, Form 722 records the change and updates the official Texas record.

In plain terms, you use Form 722 to keep the state’s file in sync with your partnership’s real facts. If the file is out of sync, you risk missing legal notices and compliance issues. This filing avoids that risk and keeps you in good standing.

When Would You Use a Form 722 – Application for Amendment to Registration of a Limited Liability Partnership?

You file Form 722 any time a key data point in your existing LLP registration changes. The most common trigger is a name change. If your LLP adopts a new firm name, you must update the Texas record. The name must include a proper designator, such as “LLP” or “L.L.P.” If the new name drops that designator, Texas will not accept it. Securing name availability before you file the amendment is a smart move.

Another common reason is a change to the registered agent or registered office. In Texas, you must maintain a registered agent and a registered office with a physical Texas street address. A P.O. box alone is not acceptable. If your agent resigns, or you switch to a commercial agent, you must amend your registration to show the new agent and address. If your agent stays the same but moves to a new Texas street address, you must update the registered office address. This ensures that service of process and official notices reach you.

You also use the form if your principal office changes. The principal office is where you manage the partnership. It can be inside or outside Texas. If that address changes, you should amend the registration. This helps banks, counterparties, and agencies identify your current headquarters.

Sometimes the need is corrective rather than change-driven. If your original filing had a typo, a wrong date, or an incomplete address, use Form 722 to fix it. Corrections matter because inaccuracies can cause delivery failures or create doubts about your status.

Both domestic Texas LLPs and foreign LLPs registered to do business in Texas can need this amendment. A Texas firm that relocates its registered office down the street will use it. A Delaware or New York LLP with Texas operations that rebrands will also use it to align its Texas registration to its current legal name in its home jurisdiction.

Typical users include managing partners, firm administrators, operations managers, and in-house counsel. Outside law firms that maintain entity records often prepare the form on behalf of the partnership. Accounting teams may handle it when address changes affect tax and banking relationships.

In short, you use Form 722 when there is a material registration fact that has changed or needs correction. It is the appropriate choice for updating core registration details. It is not the form to withdraw your LLP registration or convert to another entity. Different filings handle those actions.

Legal Characteristics of the Form 722 – Application for Amendment to Registration of a Limited Liability Partnership

This is a formal state filing. It is legally effective upon acceptance by the Texas Secretary of State, unless you choose a delayed effective date. Once filed, the amendment updates the public record for your LLP. Third parties and courts can rely on that record. That makes the filing legally significant and binding.

What ensures enforceability?

First, Texas law requires accurate and current information on file for registered entities. The Secretary of State maintains that file. When you sign and submit Form 722, an authorized person certifies the truth of the information. False statements can lead to penalties. This duty to be truthful supports the reliability of the record.

Second, the registered agent and office information enable service of process. Courts and claimants rely on those details. If your filing provides accurate agent and address information, you preserve reliable service channels. If the details are wrong, you risk default judgments or missed deadlines. Keeping this data current helps protect your LLP’s legal position.

Third, name changes and other amendments become part of the entity’s official history. Anyone searching the records sees the amended name and the effective date. Your contracts, banking arrangements, and licenses should match this record. Consistency across those documents supports enforceability and reduces confusion.

A few legal considerations matter during filing. The registered office must be a Texas street address where the agent is available during business hours. The registered agent must have consented to serve. If you name a new agent, obtain written consent before filing. Your LLP name must include a required designator and must be distinguishable from other names on file. If you are a foreign LLP, your Texas filing should match your legal name in your home jurisdiction, unless that name cannot be used in Texas. In that case, you may adopt an alternate name for use in Texas.

Finally, effective timing matters. You can choose immediate effectiveness on filing. Or you can select a future date, usually within a short, defined window. This allows you to coordinate the amendment with other steps, like signage or bank updates.

How to Fill Out a Form 722 – Application for Amendment to Registration of a Limited Liability Partnership

Follow these steps to complete and file Form 722 correctly.

1) Confirm you are using the right form.

- Use this form to amend an existing LLP registration record in Texas.

- Do not use it to withdraw your LLP registration. Do not use it to convert to another entity.

- If you need to fix only the registered agent or office, this form still works. A dedicated change filing may also be available. Using Form 722 aligns all changes in one instrument.

2) Collect your core information before you start.

- The exact LLP name on file in Texas, including the “LLP” designator.

- The Texas Secretary of State file number for your LLP.

- The jurisdiction of formation if you are a foreign LLP.

- The original registration filing date, if needed for reference.

- The current registered agent name and registered office address in Texas.

- The new information you are adopting, such as a new name or agent.

- The principal office address, current and new.

- Contact name, phone number, and email for filing questions.

3) Check name issues if you are changing the LLP name.

- Confirm the new name includes “LLP” or “L.L.P.”

- Make sure the new name is available and distinguishable.

- Plan to update your contracts and bank records after filing.

4) Complete the heading information.

- Enter the exact LLP name as it appears on file now.

- Enter the Texas file number. This helps the Secretary of State locate your record quickly.

- If the form asks for the entity type, indicate that you are an LLP.

- If foreign, list your home jurisdiction accurately.

5) Identify the amendment items.

- The form typically offers space or checkboxes for common changes.

- State that you are amending the partnership name if that applies.

- State that you are amending the registered agent or registered office if that applies.

- State that you are amending the principal office if that applies.

- Use the “other amendments” or “supplemental information” area for anything not listed.

6) Provide the amended name, if changing it.

- Enter the new LLP name exactly as you want it to appear on the record.

- Include the “LLP” designator in the new name.

- Avoid punctuation or spacing errors that create mismatches.

7) Provide the new registered agent and registered office, if changing them.

- Name the new registered agent. It can be an individual Texas resident or a Texas organization.

- Provide the Texas street address for the registered office. Include the suite number if any.

- Do not list a P.O. box as the sole address.

- Include the agent’s consent. You can include a statement that the person or organization has consented to serve as an agent. Keep written consent in your records.

8) Update the principal office address, if changing it.

- Provide the complete street address, city, state, and ZIP code.

- This address can be in Texas or another state. It is your management location.

9) Add any other amendments or corrections.

- Use the “other amendments” section to correct prior errors.

- Be clear and specific. Quote the corrected text if needed.

10) Choose the effective date.

- Select “Effective when filed” if you want immediate effect.

- Or select a delayed effective date. Texas allows a short delay window.

- Use a delayed date to align with operational changes, like signage or payroll.

11) Confirm compliance with designations and consents.

- Verify that the new LLP name includes an approved designator.

- Confirm you have written consent from the new registered agent.

- Verify the registered office is a physical Texas street address.

12) Sign the form.

- The form must be signed by an authorized person.

- For an LLP, a partner usually signs. If an entity is the partner, an authorized officer signs for that entity.

- Print the name and title of the signer. Date the signature.

- You can submit electronically with an acceptable electronic signature if filing online.

13) Provide a filing contact and return delivery information.

- List a person the Secretary of State can contact with questions.

- Include a phone number and email. This speeds issue resolution.

- If the form asks where to return the filed document, provide the address or email.

14) Prepare the filing fee.

- Confirm the current fee before submitting.

- You can usually pay by check, money order, or card.

- If paying by card, complete the required payment page if filing by mail or in person.

15) Submit the filing.

- You can file electronically, by mail, or in person.

- Electronic filing is often faster. In-person submission works for urgent needs.

- If you need faster processing, request expedited handling and pay the extra fee.

16) Track processing and keep records.

- Monitor for acceptance or rejection notices.

- If rejected, fix the issues and resubmit. Common issues are name conflicts, missing consent, or address errors.

- Once accepted, save the stamped copy in your records.

- Share the stamped copy with your bank, insurers, and key vendors if the name has changed.

17) Update your downstream records after acceptance.

- If the name changed, update your tax accounts and licenses.

- Update your engagement letters, signage, website, and letterhead.

- Update your registered agent records in internal systems.

18) Avoid common mistakes.

- Do not omit the “LLP” designator from a new name.

- Do not list a P.O. box as the only registered office address.

- Do not name a registered agent without consent.

- Do not forget to sign and date the form.

- Do not miss the file number or mismatch the current name.

19) Know what this form does not do.

- It does not withdraw your LLP’s Texas registration. A different filing handles that.

- It does not convert the LLP to a different entity type. Use a conversion filing for that.

- It does not fix tax registrations. You must update those separately.

20) Keep your compliance calendar current.

- Note the date of the amendment and what changed.

- Set reminders to review registered agent and office details each year.

- Keep written consents and proof of filing with your minute book.

Practical example: Your law firm becomes “Pecan Street Law, LLP” and moves its registered office. You complete Form 722 to change the firm name and the registered office address. You attach a statement that the new registered agent has consented. You select “Effective when filed.” A partner signs and dates the form. You pay the fee and submit electronically. You receive the filed copy. You then update your trust accounts, engagement letters, and malpractice insurance to match the new name.

Another example: Your New York LLP operates in Texas and changes its legal name in New York. You file Form 722 to reflect the new name on your Texas registration. You verify that the name includes “LLP” and is available in Texas. You keep your registered agent and office the same. You choose a delayed effective date two weeks out to align with your marketing launch. You sign and submit. On the effective date, the Texas public record shows the new name.

By following these steps, you will file a clean amendment and keep your Texas registration accurate. You reduce risk, avoid service issues, and support your firm’s daily operations.

Legal Terms You Might Encounter

- Limited Liability Partnership means a partnership that has filed to limit each partner’s personal liability for certain partnership debts. On this form, you confirm that your partnership remains an LLP after you make the changes.

- Registration is the earlier filing that puts your partnership on the public record as an LLP. Form 722 updates that existing registration. It does not create a new partnership.

- Amendment means a change to information already on file. You use this form to amend details such as the LLP’s name, registered agent, or registered office. It does not replace your original registration; it updates it.

- File Number is the unique number assigned to your LLP when it was first registered. You enter it so the filing office can match your amendment to the right record. If you enter the wrong number, your changes may post to another entity.

- Registered Agent is the person or company you appoint to receive legal papers for your LLP. If you change your agent on this form, the new agent must have consented to serve. The agent’s name must match exactly with your records.

- Registered Office is the physical street address in the state where your agent receives deliveries. A P.O. Box alone is not acceptable. If you move offices, you amend that address here so legal notices go to the right place.

- Effective Date is when your amendment becomes active. You can often choose the date the filing office approves it, or a delayed date. You cannot select a date before you file.

- Assumed Name (or “DBA”) is an alternate name your LLP uses. A name change on this form affects the legal name, not any assumed names on file elsewhere. If your legal name changes, you may need to update any assumed name records separately.

- Governing Persons refers to the people in charge of the partnership, typically partners or managers. This form may ask for a signer with proper authority. Make sure the signer is authorized under your partnership agreement.

- Foreign vs. Domestic LLP distinguishes an out-of-state LLP registered to do business in the state (foreign) from one formed under state law (domestic). Use the version of the amendment that fits your status. The file number and required data may differ.

FAQs

Do you need to file an amendment when you change your LLP name?

Yes. If you adopt a new legal name, you must amend your current registration. Confirm the new name meets state naming rules and is distinguishable from other entities. If you only change an assumed name, use the appropriate assumed name process instead. This form updates the legal name on the LLP record.

Do you have to file an amendment if your registered agent or office changes?

Yes. You must keep your agent and office current. If you switch agents, get the new agent’s consent before filing. If you only change the office address, update the address here. A wrong agent or address can cause missed legal notices and default judgments.

Do you need partner approval to submit this form?

Check your partnership agreement. Most agreements require partner consent for name changes, agent changes, and other key details. For general partnerships without a written agreement, common practice is to seek majority or unanimous consent. Keep written evidence of the approval with your records.

Do you pick the effective date, or is it set by the filing office?

You choose. You can accept effectiveness upon approval or set a delayed effective date within allowable limits. A delayed date helps coordinate bank changes, insurance updates, or contract notices. Do not pick a date earlier than the filing date.

Do you need to attach any consents or supporting pages?

If you change the registered agent, ensure you have the agent’s consent. Some versions of the form include a consent statement. If not, retain a separate written consent in your files. If you amend the name, some partnerships also attach a brief statement confirming partner approval. Keep attachments simple and consistent with the form.

Do you have to notify anyone after the amendment is filed?

Yes. Notify banks, insurers, landlords, lenders, major clients, and licensing bodies. Update tax accounts, payroll, and any permits. If you changed your legal name, update invoices, letterhead, website, and contracts. If you changed your agent or office, update your compliance calendar and internal registers.

Do you need a new tax ID after a name change?

Usually no. A legal name change does not require a new tax ID for the same entity. Update your tax account profile with the new name. Confirm with your tax advisor if you have unusual facts, such as a reorganization.

Do you need to renew your LLP registration after filing an amendment?

This form handles changes to the existing registration. Renewal is a separate maintenance action with its own timing and payment. Keep both tasks on your compliance calendar. An amendment does not replace any renewal requirement.

Checklist: Before, During, and After the Form 722 – Application for Amendment to Registration of a Limited Liability Partnership

Before signing

- Confirm your current legal name and the exact file number.

- Decide what you are changing: name, registered agent, registered office, or other details.

- If changing the legal name, verify name availability and compliance with naming rules.

- If changing agents, obtain written consent from the new agent to serve.

- Confirm the street address for the registered office. A P.O. Box alone is not acceptable.

- Identify the effective date you want: upon approval or delayed.

- Gather signer details: name, title, and authority under your partnership agreement.

- Collect partner approvals required by your partnership agreement.

- Prepare payment information for the filing fee.

- If needed, draft any short attachments that clarify the change. Keep them consistent with the form.

During signing

- Check that the LLP file number is correct and matches your entity.

- Review the LLP legal name. Match punctuation, spacing, and capitalization.

- Select only the items you are amending. Do not re-state unchanged data unless the form asks for it.

- If changing the registered agent, confirm the agent’s exact legal name. Do not use nicknames.

- Verify the registered office street address, suite numbers, and ZIP code.

- Confirm the effective date option you selected and ensure it is not retroactive.

- Ensure the signer’s name, title, and signature are consistent and legible.

- Date the form. Undated filings may be delayed.

- If you attach a consent or approval page, label it clearly and reference the LLP name and file number.

After signing

- Submit the form with the required fee using your preferred method (e.g., online, mail, in person, or fax, if available).

- Keep proof of submission and payment.

- Track the filing status and wait for confirmation or a stamped copy.

- Once approved, distribute the amended details internally to accounting, HR, and operations.

- Update your partnership agreement or internal records if the change affects governance or obligations.

- Notify banks, insurers, landlords, lenders, major clients, and licensing or permitting offices.

- Update your tax account profile and payroll systems with the new legal name or address.

- If you changed the legal name, update the assumed name records as needed.

- Store the approved amendment with your registration documents in both digital and hard-copy formats.

Common Mistakes to Avoid

Filing the amendment without agent consent

- Consequence: The filing can be rejected or later challenged. You may miss legal notices if the agent didn’t agree to serve.

- Don’t forget: Get written consent from the new agent before filing.

Using a P.O. Box as the registered office

- Consequence: The filing can be rejected. Legal papers may not be delivered.

- Don’t forget: Provide a physical street address in the state, with a suite number if applicable.

Selecting an invalid effective date

- Consequence: The filing office may reject the form or default to the approval date, causing timing gaps.

- Don’t forget: Choose “upon approval” or a delayed date within allowed limits. Never pick a past date.

Misspelling the LLP name or entering the wrong file number

- Consequence: The amendment may post to the wrong record or create a name mismatch. Corrections can take time.

- Don’t forget: Verify the file number and copy the name exactly as on record.

Making a name change but not updating third parties

- Consequence: Bank signature cards, insurance policies, and contracts can become inconsistent. Payments may be delayed.

- Don’t forget: Plan a communication checklist for all key partners, vendors, and agencies.

What to Do After Filling Out the Form

1) File and track approval

- Submit the signed form and fee using your preferred method. Keep a copy of the submission and the payment receipt. Monitor the status. When you receive approval, save the stamped version.

2) Implement the change internally

- Update accounting, payroll, and cash management systems. Refresh invoice templates, engagement letters, and letterhead. Adjust signature blocks and email footers. If you changed your legal name, coordinate a roll-out date to avoid confusion.

3) Notify essential third parties

- Contact your bank to update signature cards and account titles. Notify your insurer to update policies and certificates. Inform landlords and lenders if required by your agreements. Update major client contracts and vendor accounts.

4) Update public-facing materials

- If your legal name changed, update your website, social profiles, and marketing materials. Align any assumed names if used. Make sure new name and contact details appear on proposals, invoices, and forms.

5) Adjust compliance and tax records

- Update your tax account profile with your new legal name or address. Confirm payroll and withholding registrations reflect the change. If you maintain any permits or licenses, update those records and certificates.

6) Review and store records

- Place the approved amendment with your original registration and later amendments. Keep digital backups. Maintain agent consent and partner approval records with the filing.

7) Calendar renewals and future updates

- Note your LLP registration renewal timelines. Add reminders for annual or periodic maintenance. If anything changes again—name, agent, or office—prepare a new amendment promptly.

8) Order a certified copy if needed

- If a bank, lender, or counterparty requests proof, request a certified copy of the amendment. Store it with your core entity records.

9) Align your partnership agreement

- If your amendment affects governance or obligations, update your internal agreement and resolutions. Ensure partners sign any required acknowledgments.

10) Communicate the effective date

- Share the effective date with staff and partners. Time system changes and announcements to that date to avoid mismatched records.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.