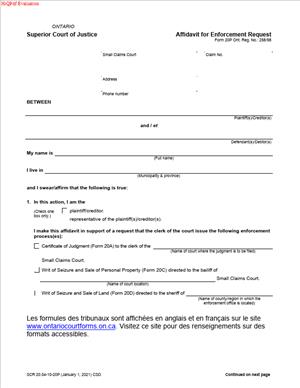

Form 20P – Affidavit for Enforcement Request

Fill out nowJurisdiction: Country: Canada | Province or State: Ontario

What is a Form 20P – Affidavit for Enforcement Request?

Form 20P is a sworn statement you file to start enforcement in Small Claims Court. You use it to confirm what is still unpaid under a court order or a filed settlement. The court clerk relies on it to issue the enforcement you request. It records the debtor’s identity, the amount owing, credits, interest, and costs. It also confirms that the order is still valid and has not expired.

You complete Form 20P after you obtain an order for money. That order could be a judgment after a trial. It could be a default judgment. It could be a settlement filed with the court. If the debtor misses payments, the amount in default becomes enforceable. Form 20P bridges your order to the enforcement office.

Who typically uses this form?

Judgment creditors do. That includes self-represented litigants. It includes lawyers, licensed paralegals, and litigation clerks. It includes small businesses, contractors, landlords, and consumers. If you have a money order from Small Claims Court and want to collect, you likely need this form.

Why would you need it?

Because the court needs verified figures before enforcement. Enforcement turns a paper order into real collection. That can be wage garnishment, bank garnishment, or a writ with the Sheriff. The clerk will not issue those without reliable numbers and sworn proof. Form 20P supplies that proof.

Typical usage scenarios

You won a default judgment and the debtor has not paid. You settled for monthly payments and the debtor stopped paying. You won at trial and the appeal period passed, with no payment. You have costs and interest to add to the award. You want to garnishee wages, a bank account, or file a writ. You complete Form 20P to confirm the balance and conduct the next step.

In short, Form 20P is the enforcement gateway. It states the exact amount due and supports the court’s issuance of enforcement documents. It is sworn evidence, not argument. Be accurate and complete.

When Would You Use a Form 20P – Affidavit for Enforcement Request?

Use Form 20P when you are ready to collect an unpaid money order. It applies in many practical situations. You may be a contractor owed for completed work. You have a Small Claims judgment and the debtor has not paid. You plan to garnishee the debtor’s employer. You file Form 20P with your garnishment materials to confirm the outstanding balance.

You may be a landlord with a judgment for arrears. The tenant moved out and did not pay. You want to garnish a bank account you located. You file Form 20P to set the pay-out figure for the bank.

You may be a consumer who won against a business. You want the Sheriff to seize and sell assets. You file Form 20P with your writ request and pay the fees. The Sheriff needs a sworn amount to know how much to collect.

You may be a supplier who settled with a customer for monthly payments. The settlement was filed with the court. The debtor missed two installments, creating a default. You can enforce the defaulted amount. You complete Form 20P, set out amounts paid and missed, and proceed to enforcement.

You may be an employer who advanced funds and won repayment in court. No funds came in. You believe the debtor owns property. You request a writ of seizure and sale. You file Form 20P to support costs, interest, and the current balance.

You may be a litigation clerk for a firm. The client’s order awarded costs and post-judgment interest. There were partial payments. You must account for all credits and compute interest. You use Form 20P to declare the net sum owed as of a specific date.

In each case, the common trigger is debtor non-payment. Form 20P is the sworn calculation that turns your order into concrete enforcement. It is used both for garnishments and writs. It is also used when re-issuing enforcement or adding further enforcement costs. If payments come in during enforcement, you can update your numbers and file a new Form 20P if needed.

Legal Characteristics of the Form 20P – Affidavit for Enforcement Request

Form 20P is a sworn affidavit. It is legally significant because it is evidence. You confirm facts under oath or affirmation. You confirm the judgment details, the amount due, and the absence of a stay. The court relies on this evidence to issue enforcement documents. Lying in an affidavit is a serious offence. It can result in penalties and costs.

Is it legally binding?

The affidavit is binding as to your evidence. It does not create a new order. The existing order creates the obligation. The affidavit allows the court to implement enforcement based on that order. Its binding effect is in its evidentiary role. It supports the administrative issuance of writs and garnishments.

What ensures enforceability?

Several things do. First, there must be a valid court order for money. Second, the order must not be stayed or suspended. Third, the amounts in your affidavit must match the order and the law. That includes the correct interest rate and costs. Fourth, the affidavit must be sworn before a commissioner or other authorized person. Fifth, you must file the affidavit with the court and pay fees as required. If the clerk or Sheriff sees gaps or errors, enforcement can be refused or delayed.

General legal considerations also matter. If the order provides for payment by installments, you can enforce only the amounts in default. You cannot accelerate future installments unless the order permits that. If there is an appeal with a stay, you cannot enforce until the stay lifts. If a motion to set aside a default judgment is pending, enforcement may continue unless a stay is ordered, but be prudent. If you know of a bankruptcy, stop and get advice. Bankruptcy can affect enforcement.

Accuracy is critical. You must include all credits since the order date. You must use the court-ordered interest rate. If no rate is specified, use the applicable default post-judgment rate. Calculate interest up to a specific date. Use a clear per diem for ongoing accrual. Your math should be easy to follow. You can attach an interest schedule as an exhibit. List each payment and how you applied it.

Names must be precise. Use the debtor’s legal name as it appears on the order. Add any known aliases or operating names if permitted. For corporations, include the full corporate name. If you know a corporation number, include it for clarity. For individuals, include any known middle names. Provide the last known address. If you have a date of birth for wage garnishment matching, include it where appropriate.

Finally, attach the right documents. A certified copy of the order or the filed settlement is typical. If costs were assessed later, attach that endorsement or order. If payments were made, attach proof such as receipts or bank records. Mark each attachment as an exhibit and have the commissioner sign the exhibit stamp. This makes your affidavit complete and credible.

How to Fill Out a Form 20P – Affidavit for Enforcement Request

Follow these steps. Work carefully and keep sentences short in your affidavit. Keep your numbers clean and your exhibits organized.

1) Confirm you are ready to enforce

- Check that you have a Small Claims Court money order or a filed settlement.

- Confirm the debtor has not paid as required.

- Confirm there is no stay of enforcement. Check for any appeal or bankruptcy.

- Decide which enforcement you will use first. Common options include garnishment or a writ.

2) Gather the information and documents

- Court file number and court location.

- Exact names of the parties as they appear on the order.

- A copy of the order or filed settlement.

- The date of the order and any later cost or interest endorsements.

- Details of payments made since the order, with dates and amounts.

- The agreed or default interest rate for postjudgment interest.

- The enforcement office details if you plan to file a writ.

- Debtor identifiers needed for garnishment. That may include employer name, bank branch, and address.

3) Complete the heading of the form

- Enter the court file number exactly as on the order.

- Enter the court location. Use the same court address used for your case.

- Insert your name as creditor. If a representative acts, include their name and contact details.

- Insert the debtor’s legal name. Add the last known address and contact details if requested by the form.

4) Identify the order you are enforcing

- State the date of the order or settlement.

- State who granted the order. For example, “Deputy Judge [Name]”.

- State the amount ordered. Separate principal and costs if applicable.

- If the order has payment terms, describe them briefly. For example, “$2,400 payable at $200 per month starting [date].”

- Confirm the debtor is in default and specify the defaulted amounts.

5) Set out the calculation of the amount now owing

- Start with the judgment principal still unpaid.

- Add postjudgment interest to the calculation date. Use the stated rate.

- Add costs awarded in the order and any later cost orders.

- Add reasonable enforcement costs you have incurred. Examples include filing fees and search fees.

- Subtract any payments received since the order date.

- State the net balance owing as of a specific date.

- Show the daily interest (per diem) for ongoing accrual.

Example layout:

- Judgment principal outstanding: $10,000.00

- Costs awarded: $500.00

- Subtotal: $10,500.00

- Less payments: $1,200.00

- Subtotal: $9,300.00

- Postjudgment interest to [date] at [rate]%: $X.XX

- Enforcement costs to date: $Y.YY

- Total owing as of [date]: $Z.ZZ

- Per diem interest at [rate]%: $A.AA

Keep the math simple and legible, round to two decimals. Use clear labels.

6) Attach supporting documents as exhibits

- Exhibit A: a copy of the order or filed settlement.

- Exhibit B: your interest calculation or schedule.

- Exhibit C: proof of any payments, such as receipts or bank records.

- Exhibit D: any later cost endorsement.

- If you have debtor details for garnishment, you can attach those too. Keep personal data limited to what is needed.

Mark each exhibit with a letter. Write a short exhibit label on the first page of each exhibit. The commissioner will sign or stamp each exhibit.

7) Address debtor identity and enforcement details

- If you know the debtor’s employer, name it for wage garnishment.

- If you know the bank and branch, note it for bank garnishment.

- If you plan a writ, identify the enforcement office. Use the Sheriff office for the region where assets may be found.

- If the debtor uses an operating name, include it after the legal name if permitted. Use “also known as” or “carrying on business as” where appropriate.

- Include any known date of birth for matching on garnishment. Only include if relevant and accurate.

8) Include any set-offs, assignments, or partial satisfaction

- If the debt was assigned, explain the assignment and attach proof.

- If you agreed to a set-off, reflect it in your balance and explain briefly.

- If the debtor returned goods or provided other value, account for it. Show how you valued the credit.

9) Swear or affirm the affidavit

- Do not sign the affidavit until you are with a commissioner.

- Bring valid ID and all exhibits to the appointment.

- The commissioner will ask you to swear or affirm that the contents are true.

- Sign the affidavit in the commissioner’s presence.

- The commissioner completes the jurat. They will stamp and sign the exhibits.

- You can swear at the court office, a lawyer’s office, a licensed paralegal, or a notary. Fees may apply.

10) File the affidavit with the court and proceed with enforcement

- File Form 20P with the Small Claims Court clerk where your file is located.

- File it together with your enforcement form and pay the fee.

- If you are filing a writ, follow the clerk’s instructions for the Sheriff. You may need to pay Sheriff fees and deliver copies.

- If you are filing a garnishment, follow the service steps after issuance. You must serve the debtor and the garnishee within the required time.

- Keep stamped copies for your records.

11) After filing, manage the enforcement steps

- Track payments that come in through garnishment or the Sheriff.

- If the debtor pays in full, notify the court or Sheriff as required. You must stop enforcement once paid.

- If partial payments come in, update your balance. Consider filing an updated affidavit if needed.

- Renewal timelines can apply to writs or garnishments. Diarize any expiry dates and renew in time if needed.

12) Avoid common mistakes

- Do not use the wrong interest rate. Check the order for the rate first.

- Do not forget credits or partial payments. List and subtract them.

- Do not use a nickname or short form for the debtor’s name. Match the order.

- Do not sign before a commissioner. Swear or affirm properly.

- Do not overstate enforcement costs. Include only actual and reasonable costs.

- Do not proceed if there is a stay. Confirm status before filing.

13) Practical tips for calculations

- Use a fixed calculation date. Then state a per diem for interest after that date.

- If interest is simple interest, compute it as principal x rate x days / 365.

- Apply payments first to costs, then interest, then principal, unless your order states otherwise. Use a consistent approach and explain it.

- Consider preparing a one-page interest table. Show dates, balances, and interest for each period. Attach it as an exhibit.

14) Privacy and data handling

- Include only necessary personal details. Do not add sensitive data without purpose.

- Redact account numbers except where needed for garnishment identification.

- Store your copies securely. Enforcement documents contain private information.

15) If the debtor raises issues after filing

- If the debtor disputes your numbers, review your math. Correct any errors fast.

- If the debtor pays a lump sum, inform the clerk or Sheriff as required.

- If a motion to set aside or a stay order is filed, pause and review. Attend the hearing if served. Bring your affidavit and exhibits.

By following these steps, you will complete Form 20P correctly. You give the court and the enforcement office what they need. You show the exact amount owing and support the tool you want issued. You reduce delays and avoid refusals at the counter.

Remember your role here. Your affidavit is sworn evidence. Keep it accurate, concise, and complete. That clarity speeds up enforcement and helps you collect on your order.

Legal Terms You Might Encounter (Form 20P – Affidavit for Enforcement Request)

- Affidavit. This is your sworn statement of facts. In Form 20P, you confirm the judgment amount owing, the debtor’s details, any payments received, and the enforcement method you want to use. You sign it under oath or affirmation, so accuracy matters.

- Deponent. You are the deponent if you sign Form 20P. You must have direct knowledge of the debt, the balance, and the debtor’s information. If you are an employee or agent, you can swear the affidavit if you know the records and have authority.

- Judgment creditor. This is the person or business who won the judgment and is owed money. Form 20P is how you, as the judgment creditor, ask to enforce the judgment.

- Judgment debtor. This is the person or business who owes the money under the judgment. You identify the debtor clearly in Form 20P, including names used, addresses, and any known employer or bank details that support your request.

- Enforcement. Enforcement means using legal tools to collect the judgment. Form 20P supports your request to start, continue, or vary an enforcement step. It confirms the amount owing and why enforcement is justified.

- Garnishment. Garnishment is an enforcement method that redirects money owed to the debtor, such as wages or bank funds, to pay your judgment. When using Form 20P for garnishment, you include accurate payor details, amounts, and how you calculated the balance.

- Writ of seizure and sale. This is an enforcement tool that allows the sheriff to seize and sell the debtor’s property or land to satisfy the judgment. Your Form 20P identifies the balance due and supports issuing or filing a writ.

- Sheriff. The sheriff is the enforcement officer who acts on certain writs. In Form 20P, you provide the details the sheriff needs to act, like the debtor’s address, business locations, or known assets.

- Post‑judgment interest. This is interest that accrues after the judgment date. In Form 20P, you confirm the rate, the start date, and your calculation. You should attach a simple calculation to show how you reached the total.

- Commissioner for taking affidavits. This is the official who administers your oath or affirmation. You must sign Form 20P in front of a commissioner or notary. They complete their section to validate the affidavit.

FAQs (Form 20P – Affidavit for Enforcement Request)

Do you need to file Form 20P for every enforcement step?

Yes, plan to use Form 20P with most enforcement steps. It confirms the balance owing and your good‑faith basis to enforce. Some enforcement tools also require their own forms. Form 20P is the affidavit that anchors your request.

Do you have to serve the debtor with Form 20P?

You usually don’t serve the affidavit itself when you file it. But the enforcement step may require you to serve the debtor with related documents. For example, garnishment notices and certain writ‑related documents may require service. Check the service rules for your chosen method.

Can you include interest and costs in Form 20P?

Yes. You should include post‑judgment interest and reasonable enforcement costs that are allowed. State the interest rate, the period, and your math. Itemize any payments received. Attach your interest calculation and receipt copies for costs, if available.

What if the debtor made a partial payment after judgment?

Update your balance. Credit all payments and show the new amount owing. List the payment dates and amounts. If payment fully satisfies the judgment, do not pursue enforcement. If the debtor pays later, update the court or enforcement office right away.

Can you swear the affidavit remotely or electronically?

You must swear or affirm in front of a commissioner or notary. Some commissioners can witness remotely. Follow any identification and signing steps they require. Make sure the commissioner completes their section on Form 20P.

Do you need the debtor’s employer or bank information before filing?

It depends on the enforcement you choose. Garnishment needs the correct payor details. A writ benefits from accurate addresses and asset clues. If you lack information, you can still file where appropriate, or consider tools that help you gather it.

Can an employee or agent swear Form 20P for a business creditor?

Yes, if they have personal knowledge of the creditor’s records. The deponent must be able to explain how the balance was calculated and what records support the affidavit. They should say they have access to the records and authority to swear.

How current should your information be?

Make your affidavit current as of the date you swear it. Confirm the balance and any recent payments. If anything material changes after filing, advise the court or enforcement office and amend or re‑swear as needed.

Checklist: Before, During, and After the Form 20P – Affidavit for Enforcement Request

Before signing

- Court file details. Have the correct court location and file number.

- Judgment details. Keep a clear copy of the judgment and any amended or consent orders.

- Parties’ names. Confirm the legal names for the creditor and debtor, including any business names or aliases.

- Debtor identifiers. Gather addresses, employer details, business locations, known bank branch details, or asset clues that support enforcement.

- Balance owing. Prepare a clean ledger showing principal, costs awarded, post‑judgment interest, and total.

- Interest calculation. Set the rate, start date, end date, and show the math.

- Payments to date. List all payments received after judgment with dates and amounts.

- Enforcement method. Decide the tool you plan to use (for example, garnishment or writ), and collect any method‑specific information needed.

- Supporting documents. Collect proof such as payment receipts, correspondence showing partial payments, or search results that identify employers or assets.

- Authority to swear. If you are an employee or agent, confirm your role and access to records.

- Commissioner appointment. Arrange a time with a commissioner or notary and confirm ID requirements.

- Copies. Prepare a filing copy, your working copy, and any copies required for service.

During signing

- Names and file number. Verify spelling and numbers exactly match the court record.

- Judgment details. Confirm the judgment date and any amendments match your attachments.

- Balance math. Double‑check principal, interest, costs, credits, and total owing.

- Interest specifics. Ensure the rate and dates are correct and consistent with your calculation sheet.

- Debtor details. Confirm that addresses, employer, or bank information are current and specific.

- Exhibits. Mark exhibits clearly. Reference them in the affidavit and label each with an exhibit stamp or cover page.

- Oath or affirmation. Swear or affirm in front of the commissioner. Do not sign in advance.

- Corrections. If you make corrections, initial them and ensure the commissioner initials them too.

- Commissioner’s section. Make sure the commissioner completes their name, capacity, location, and date.

- Completeness. Leave no blanks. Use “N/A” where something truly does not apply.

- Page checks. Number the pages and ensure all pages and exhibits are present and legible.

After signing

- Assemble the package. Include Form 20P, the judgment, calculations, and any required method‑specific forms.

- Filing. File where required for your enforcement method and pay any fees.

- Service. If service is required for your method, serve the right parties and keep proof of service.

- Tracking. Note any reference numbers from the court or enforcement office.

- Follow‑ups. Diarize follow‑up dates, such as return dates, response deadlines, or renewal dates.

- Communication. Respond quickly to any notices from the court, sheriff, or garnishee.

- Payments. Record any payments received. Send receipts and adjust the balance.

- Updating. If the debtor pays in full, stop enforcement and file the required satisfaction document.

- Storage. Keep the sworn original secure. Store copies and proof of service with your file.

- Privacy. Limit sensitive data to those who need it. Store employer and banking details securely.

Common Mistakes to Avoid (Form 20P – Affidavit for Enforcement Request)

- Misstating the balance or interest. Don’t guess the numbers. An incorrect total can lead to rejection or an over‑collection claim. Reconcile your ledger, show your math, and attach the calculation.

- Missing or mislabeled exhibits. Don’t forget to attach the judgment or proof of payments. Missing exhibits or exhibits not referenced in the text can stall your enforcement.

- Signing without a commissioner. Don’t sign alone at your desk. If you sign without a proper oath or affirmation, the affidavit is invalid and your request can be refused.

- Outdated debtor details. Don’t use old addresses or stale employer information. Wrong details can misdirect your effort, increase costs, or cause a failed garnishment or writ.

- Vague statements or blanks. Don’t leave gaps or use vague language about amounts or parties. Incomplete or unclear affidavits trigger delays or requests for clarification.

What to Do After Filling Out the Form (Form 20P – Affidavit for Enforcement Request)

1) Assemble and review your package

- Include the sworn Form 20P, a copy of the judgment, your interest calculation, and any supporting proof.

- Add any enforcement‑specific forms or notices required by your chosen method.

- Confirm names, file number, and totals match across all documents.

2) File your enforcement materials

- File the package in the correct place for your enforcement step and pay any fees.

- Obtain a receipt or reference number. Record the date of filing and who accepted the documents.

3) Serve required documents

- Some enforcement steps require service on the debtor or a third party, such as an employer or bank.

- Serve as required and keep proof of service. Note timelines for any responses.

4) Coordinate with the enforcement office or payor

- For writs, provide details the sheriff needs to act, and respond to requests for more information.

- For garnishments, confirm the payor received the notice and understands where to remit funds.

- Follow up at reasonable intervals. Keep communication factual and documented.

5) Monitor payments and adjust the balance

- Apply each payment to the balance and update your ledger.

- Send receipts and adjust interest calculations as needed.

- When paid in full, stop enforcement and complete any required satisfaction or withdrawal steps.

6) Handle amendments and corrections

- If you discover an error or circumstances change, prepare a corrected affidavit or a fresh Form 20P.

- Swear or affirm the updated affidavit and file it where needed.

- Notify the court or enforcement office that you are substituting updated materials.

7) Decide on next steps if results are limited

- If one method is not effective, consider another tool.

- Update debtor information before switching methods.

- Avoid duplicate or conflicting steps that cause confusion or extra cost.

8) Keep your records clean and secure

- Store the sworn original, copies, proof of filing, and proof of service together.

- Keep a clear running balance sheet with dates and amounts.

- Limit access to sensitive debtor details and comply with privacy obligations.

9) Close the file properly

- When the judgment is satisfied, complete any required filing to show it has been paid.

- If you filed a writ, follow any steps to close it.

- Confirm internally that no further enforcement is active, then archive the file.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.