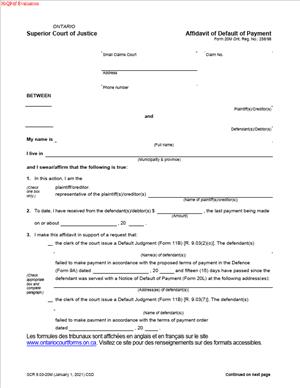

Form 20M – Affidavit of Default of Payment

Fill out nowJurisdiction: Country: Canada | Province or State: Ontario

What is a Form 20M – Affidavit of Default of Payment?

Form 20M is a sworn statement used in Small Claims Court. You use it to confirm that a debtor missed a required payment. The payment must be under a court order or a filed settlement. The form tells the court that a default occurred. It also confirms the balance now due. It supports your right to enforce the judgment.

This form belongs to the Small Claims Court rules. The Small Claims Court is part of the Ontario Superior Court. The form records facts, not arguments. It sets out the payment terms and what went wrong. It also explains how much is still unpaid. A commissioner or notary must commission the affidavit. That means you swear or affirm its truth.

Who typically uses this form?

A judgment creditor uses it. That may be a person or a business. It can also be a landlord, a contractor, or a supplier. Often, a paralegal or lawyer prepares it for a client. A collection agent with authority can also swear it. The deponent must know the records. They must understand the payment plan and any default.

Why would you need this form?

Many Small Claims orders include payment plans. Some settlements include “pay-by-date” terms. Courts often suspend enforcement if payments are made. If the debtor misses a payment, the suspension ends. You need Form 20M to show that default. You then move to enforcement. You may garnish wages or seize funds. You may also seek a writ. The form is your foundation for those steps.

Typical use cases

After the trial, the judge orders monthly payments. The debtor pays for a few months, then stops. You file Form 20M and enforce. Or you settle for a lump sum due on a set date. The debtor does not pay by that date. You file Form 20M to confirm default and pursue collection. Another example is partial payments under a plan. A shortfall is still a default if terms require full payments. You can file Form 20M in that case as well.

Form 20M is not a new claim. It is a proof tool. It links the court’s order or settlement to a missed payment. It puts you back in the enforcement lane. The court clerk relies on it when issuing enforcement documents. Accuracy matters. The form is sworn evidence.

When Would You Use a Form 20M – Affidavit of Default of Payment?

You use Form 20M when the debtor falls behind. There must be a filed settlement or a court order. The order or settlement must describe the payment duty. It might require instalments. It might require a lump sum by a date. It could be “pay X by the 1st of each month.” It could be “pay $3,000 by June 30.” If that duty is missed, you have a default. That is the trigger for this form.

Here is a practical example. You won $5,000 plus costs. The judge ordered $200 monthly. The order also stayed in enforcement while payments were made. After six months, the debtor fails to pay. You file Form 20M. You state the default date. You show the remaining balance. You resume enforcement for that balance.

Another scenario is a settlement filed with the court. It may say the debtor will pay $2,500 by a set date. It may also say that if they default, the full claim becomes due. If the debtor misses the date, you swear Form 20M. You attach the settlement. You describe the default and the amount now due. You then ask the clerk to issue enforcement documents.

Landlords often use this form when rent arrears survive a settlement. Contractors use it for unpaid work accounts. Retailers use it for defaulted payment plans. Professionals use it for fee agreements that become court orders. Small businesses use it after customer settlements go unpaid. The common thread is a clear payment term filed with the court.

Use Form 20M only after a true default. A payment is late if the plan says so. Many settlements allow a short grace period. For example, “default if unpaid for 15 days.” If a grace period exists, wait until it passes. Then file Form 20M. If there is no grace period, a missed due date is enough. If you are unsure, review the exact wording. The document must support your position.

You also use Form 20M when enforcement was stayed. Many payment plans suspend enforcement. The stay ends by default. The affidavit confirms that shift. It tells the clerk that enforcement can proceed. You can then seek garnishment. You can request a writ. You can schedule an examination hearing. Each step has its own form. Form 20M prepares the file for those steps.

Legal Characteristics of the Form 20M – Affidavit of Default of Payment

Form 20M is a sworn affidavit. It is evidence under oath. It is not a judgment on its own. It does not create a new debt. It proves a default under an existing order or settlement. It shows the amount now due, with interest if applicable. It supports your request to enforce. The clerk can rely on it for issuing enforcement documents.

Why is it legally effective?

The Small Claims Rules allow payment plans. They also allow enforcement to resume on default. The affidavit shows the facts that trigger that result. The form ties the filed order or settlement to what happened. It identifies the missed payment. It explains the math. It affirms that the balance is now due. The rules accept sworn affidavits for these steps.

What ensures enforceability?

First, there must be a valid order or filed settlement. It must clearly state payment terms. It must also address what happens on default. Many orders state that enforcement is stayed while payments continue. Many settlements state that the entire balance becomes due on default. The affidavit must match those terms. It must include dates and amounts. It should include exhibits for clarity.

Second, the affidavit must be properly commissioned. The deponent must sign before a commissioner or notary. The commissioner must complete their section. The date and location must be recorded. The exhibits must be marked and referenced. If commissioning is missing, the court can refuse the filing.

Third, the facts must be true and complete. Misstatements can have serious consequences. The court can set aside steps taken. The debtor may seek costs against you. Swearing a false affidavit can lead to penalties. Accuracy protects your position.

You should also consider interest. Many orders include postjudgment interest. If interest applies, calculate it correctly. Use the contractual rate if ordered. Use the standard rate if the order is silent. Apply it only to unpaid amounts. Do not include interest on amounts already paid. State your calculation method and period. Attach a schedule to show your math.

Privacy and scope are also important. Use the same party names as in the court file. Do not add new parties. Do not include sensitive numbers that are not required. Attach only documents that prove the default. Keep the affidavit focused and precise.

Finally, the debtor can still seek relief. They may ask the court to vary payments. They may seek time to pay. They may dispute your math. Your affidavit should be clear enough to withstand that review. A clean record helps you avoid any enforcement.

How to Fill Out a Form 20M – Affidavit of Default of Payment

Follow these steps to complete the form correctly. Keep it simple and accurate. Use the same details as your court file.

Step 1: Confirm you have a qualifying order or settlement

Find the court order or the filed terms of settlement. Read the payment terms. Identify the due dates and amounts. Check for any grace period. Confirm what happens on default. Many documents say the balance becomes due. Others lift a stay of enforcement. You need those exact words. You will rely on them in your affidavit.

Make a clean copy of the order or settlement. You will attach it as an exhibit. If the document is not filed, file it first if required. The court needs it on the record.

Step 2: Verify the default and the balance

Review all payments received. Match them against the schedule. Identify the first missed or short payment. Record the due date and the amount missed. If there is a grace period, calculate its end date. Confirm that the default date has passed.

Calculate the current balance. Start with the amount ordered or the settlement sum. Subtract payments made. Add court-awarded costs if unpaid. Add postjudgment interest if ordered. Calculate interest only on unpaid amounts. Calculate interest to a clear date. State that date later in your affidavit.

Prepare a simple ledger. Show each payment and the date. Show the running balance. Show the interest calculation. You will attach this as a schedule.

Step 3: Complete the court header

Use the same court location as your case. Copy the exact court file number. Copy the parties’ names as they appear on the file. Do not change the order of names. Mark yourself as the deponent. Include your role if you act for a business. For example, “accounts manager” or “law clerk.”

Step 4: Identify the order or settlement in the body

State the type of document. It is either a court order or a filed settlement. State the date it was signed or filed. State who made the order, if known. For example, “by the deputy judge” or “by consent.” Attach it as Exhibit A. Refer to it as “the Order” or “the Settlement” in your text.

Quote the key payment clause. Keep it short. For example, “$200 on the first day of each month.” Or “$2,500 on or before June 30.” Also, quote the default clause. For example, “On default, the balance becomes due.” Or “Enforcement is stayed while payments are made.” This shows the legal trigger for default.

Step 5: Describe the default clearly

Set out the default as facts. State the due date. State the payment amount due. State what was paid, if anything. State the date you confirmed the default. If a grace period exists, state its length and end date. If the settlement requires a notice of default, include that detail. State the date you sent the notice. Attach a copy as Exhibit B if required by the settlement.

Use direct language. For example, “The payment due March 1 was not received.” Or “Only $50 of the $200 March payment was received.” Then state, “A default occurred on March 2.” Or state the default date after the grace period.

Step 6: State the amount now due and the math

Set out the outstanding balance. Break it into components. State the unpaid principal balance. State accrued postjudgment interest, if any. State the rate and the period used. For example, “at the postjudgment rate from January 1 to March 31.” If the order uses a contractual rate, state that rate. If there is no interest, state that none is claimed.

Do not add unawarded fees. Do not add collection fees unless ordered. Do not add legal fees unless awarded. Keep the amount consistent with the order or settlement. Refer to your ledger as Exhibit C. That helps the clerk follow your math.

Step 7: Include statements about compliance

Confirm that the debtor has not cured the default. Confirm that no variation order exists. Confirm that the payments you recorded are accurate. If you rely on business records, state your role. State how you know the records are accurate. For example, “I have access to the accounts system.” That shows your basis of knowledge.

Step 8: Add any required requests or notices

If the order stayed enforcement, state that the stay has ended. Tie that to the default clause. If the settlement says the balance becomes due, state that effect. Clarify that you intend to proceed with enforcement. You do not need to ask for a new judgment. You are confirming a default under an existing one. Keep the request short and neutral.

Step 9: Attach your exhibits and schedules

Attach the order or settlement as Exhibit A. Attach the default notice, if required, as Exhibit B. Attach the payment ledger and interest math as Exhibit C. Label each page of each exhibit. Mark the exhibits during commissioning. Refer to each exhibit in your affidavit text. Ensure names and dates match.

Step 10: Commission your affidavit

Do not sign until you are before a commissioner or notary. Bring government ID and your unsigned form. The commissioner will ask if you understand the contents. You will swear or affirm that it is true. Sign in ink. The commissioner will complete their section. They will sign, date, and stamp. They will also initial each exhibit. Remote commissioning may be allowed in some cases. Follow the commissioner’s instructions.

Step 11: File the form with the court

File the commissioned affidavit with the Small Claims Court office. File it in the same court where your case is. Keep a copy for your records. Ask the clerk to place it in the file. If you plan immediate enforcement, prepare those documents. The clerk may ask to see the 20M. Have it ready.

You do not usually need to serve the affidavit itself. You must still serve documents required by each enforcement step. For example, certain garnishment notices require service. Follow the service rules for each tool.

Step 12: Proceed with enforcement

With the 20M on file, you can enforce the balance. Choose the tool that fits your case. You may garnish wages. You may garnish a bank account. You may seek a writ of seizure and sale. You may schedule an examination hearing. Each step has its own forms and costs. Attach a copy of your 20M if asked. Use the amounts stated in your affidavit.

Practical tips and common pitfalls

Use the exact court file number. Many filings fail on this point. Match party names exactly. Do not shorten or expand names. Do not add new parties in this step.

Attach the full order or settlement, not a partial copy. Ensure it is readable. Ensure the date is visible. Ensure all signatures are visible. An incomplete exhibit causes delays.

Do not overstate the balance. Subtract every payment. Do not add pre-judgment interest after the judgment date. Apply postjudgment interest only if ordered or allowed. State your rate and period. Keep the math simple and clear.

Do not forget a required default notice. Some settlements demand a notice and a cure period. If the settlement requires notice, serve it and wait for the period. Then file Form 20M. Attach the notice and proof of service if the terms call for it.

Make sure the deponent has knowledge. A random employee is not enough. Use someone with access to the records. State that role in the affidavit. That increases reliability.

Commission the affidavit properly. No blanks should remain. The commissioner should mark the exhibits. If you make a mistake, initial the correction. Do not use white-out. Clarity avoids rejection.

Keep your language factual and neutral. Avoid arguments. Do not include settlement negotiations that are not in the filed terms. Stick to dates, amounts, and clauses. The affidavit is about facts, not opinions.

What happens after filing

The court adds the 20M to your file. The clerk relies on it when you request enforcement. If your order stayed enforcement, the stay is considered lifted. You can proceed with the balance you swore. If the debtor disputes the default, they may bring a motion. They may ask to vary payments. They may ask to set aside steps. Your affidavit will be reviewed. If it is accurate, your enforcement stands.

If the debtor pays the full balance later, advise the court. You should not continue enforcement after full payment. If you receive partial payment, update your math. Use updated numbers for any new enforcement step. Keep your ledger current.

Real-world example

Assume a judgment for $4,000 plus $200 costs. The order sets $250 monthly due on the 1st. Enforcement is stayed while payments are made. The debtor pays four months. The fifth payment due June 1 is missed. No grace period exists. You prepare Form 20M. You attach the order as Exhibit A. You prepare a ledger as Exhibit B. It shows $1,000 paid and $3,200 outstanding. You calculate postjudgment interest on $3,200 from the judgment date. You swear the affidavit and file it. You then file for a wage garnishment using the $3,200 plus interest figure. The clerk issues the garnishment.

Another example involves a settlement. The settlement filed says “$2,500 due September 15. On default, the full balance becomes due, less payments.” No payments were made. September 15 passes. You send a default letter if the settlement requires it. The cure period ends with no payment. You swear Form 20M. You attach the settlement as Exhibit A. You attach your letter and proof of delivery as Exhibit B. You state $2,500 plus any interest allowed. You file and proceed to garnish a bank account.

These examples show the flow. Identify the term, show the default, show the math, and enforce. Form 20M sits at the center of that process. It is the sworn bridge between the plan and enforcement. Keep it accurate and complete.

Legal Terms You Might Encounter

- Affidavit means a written statement of facts that you swear or affirm are true. Form 20M is an affidavit. You sign it in front of a commissioner.

- Deponent is the person who swears or affirms the affidavit. You are the deponent when you sign Form 20M.

- Default means a missed or late payment under a court order or a settlement. Your affidavit states when the default happened and what remains unpaid.

- Judgment creditor is the person owed money under the judgment or settlement. If you are enforcing payment, you are the judgment creditor.

- Judgment debtor is the person who owes money under the judgment or settlement. You identify the debtor clearly on Form 20M.

- Terms of settlement are written terms that resolve the case. They often set instalments and due dates. Default under those terms triggers this affidavit.

- Instalment order is a court order that sets payment amounts and dates. A missed instalment creates the default you describe on Form 20M.

- Arrears are the payments that are overdue. The balance outstanding is the total still owed. You calculate and state both in your affidavit.

- Post-judgment interest is interest that accrues after judgment. You can claim it if allowed by the order or the standard rate. Show your calculation in the affidavit.

- Commissioner for taking affidavits is the official who witnesses your signature. You must sign Form 20M in front of a commissioner or a notary.

FAQs

Do you have to wait before filing Form 20M after a missed payment?

You can file once a default occurs under the order or settlement. Check if the terms include a grace period. If they do, wait until it expires. If the due date fell on a weekend or holiday, use the next business day. Keep proof of the due date and the missed payment.

Do you need to serve the debtor with the filed affidavit?

You should give the debtor a copy of the sworn and filed affidavit. Keep proof of delivery. Some enforcement steps also require formal service. Follow the service rules for the enforcement you plan to use. Early notice can prompt payment and avoid extra steps.

Can you include interest and costs in your default amount?

Yes, if allowed. Include post-judgment interest at the correct rate. Include your filing fee and swearing fee. List each amount and the date to which interest is calculated. Attach a schedule if the math is long.

What happens if the debtor makes a late partial payment after you file?

Update your ledger and reduce the balance outstanding. Before starting any enforcement, revise your numbers. If needed, swear a fresh affidavit that reflects the latest balance. Do not overstate the amount owed.

Do you need a lawyer to complete and file Form 20M?

No. You can file it yourself. Read the order or settlement carefully. Keep your facts precise. Swear the affidavit before a commissioner. If you are unsure about interest or calculations, get help.

Can you use Form 20M if the judgment did not set instalments?

No. Form 20M addresses default on scheduled payments. If your judgment is payable right away in full, use other enforcement steps. If you later agreed to a written payment plan, attach it and explain the default.

Do you file Form 20M at the same court location as your case?

Yes. Use the same court file number and court location. This keeps the record complete. It also lets the clerk process your filing against the correct case.

How long does the court take to process Form 20M?

Processing times vary by location and volume. Many filings are processed within several business days. Build in extra time if you plan urgent enforcement. Ask the clerk about current timelines when you file.

Checklist: Before, During, and After the Form 20M – Affidavit of Default of Payment

Before signing: Information and documents you need

- The court order or terms of settlement that set the payment schedule.

- The court file number and court location.

- Full names and addresses of all parties, as on the court file.

- The exact instalment amounts and due dates.

- A payment ledger showing dates, amounts, and payment methods.

- Proof of missed or late payments, such as bank records or receipts.

- The date of default under the order or settlement.

- The interest rate allowed and the date interest starts.

- Your calculation of post-judgment interest to a specific date.

- Any costs you intend to claim (filing fee, swearing fee).

- Copies of any amendments to the payment terms.

- A calculator and calendar for verifying dates and amounts.

- A commissioner appointment, if needed, to swear the affidavit.

During signing: Sections to verify

- Court file number matches your case exactly.

- Court location is correct and current.

- Your name and contact information are correct.

- Debtor’s legal name matches the order or settlement.

- Judgment date and payment schedule are stated correctly.

- The default date is accurate and supported by your ledger.

- Total arrears are calculated correctly as of a stated date.

- Post-judgment interest rate is correct and authorized.

- Interest calculation shows the period covered.

- Costs listed are actual and reasonable.

- All figures add up to the balance outstanding.

- Any exhibits are labeled and referenced in the affidavit.

- You sign only in front of a commissioner or notary.

- The commissioner completes and signs the jurat section.

- No blanks remain. Strike-outs, if any, are initialed.

- Pages are numbered and in order. Attachments are secured.

After signing: Filing, notifying, and storing

- File the sworn original at the same court location as the case.

- Pay the filing fee and obtain a stamped copy for your records.

- Mark your calendar for the date the interest was calculated to.

- Deliver a copy to the debtor and any co-debtor named in the order.

- Keep proof of delivery in your file.

- Update your ledger with any payments received after filing.

- If you plan enforcement, ensure your affidavit matches the latest balance.

- Store the original or certified copy securely. Keep all exhibits together.

- Set a reminder to follow up with the court if processing is delayed.

- If you discover an error, prepare a corrected affidavit and file it.

- When paid in full, record satisfaction in your file and consider notifying the court.

Common Mistakes to Avoid Form 20M – Affidavit of Default of Payment

Filing before a true default occurs

- Consequence: The clerk may reject your filing. You may face delays and added costs.

- Don’t forget to confirm any grace period and business day rules.

Miscalculating the interest or the balance

- Consequence: The court or debtor may dispute your amount. You may need to refile.

- Don’t forget to show the rate, the dates, and the math behind each figure.

Not swearing the affidavit properly

- Consequence: The court will not accept the document. You must swear again.

- Don’t forget to sign only before a commissioner and have the jurat completed.

Leaving out proof of the payment schedule or default

- Consequence: The clerk may question your filing. Enforcement may stall.

- Don’t forget to attach or clearly reference the order or settlement and your ledger.

Using old party names or wrong court file details

- Consequence: Your filing may be misfiled or refused. You lose time.

- Don’t forget to copy names and the file number exactly as they appear in the case.

What to Do After Filling Out the Form 20M – Affidavit of Default of Payment

- File the sworn affidavit at the court where the case was heard.

- Pay the filing fee and ask for a stamped copy for your records.

- Note the date to which you calculated interest and costs.

- Send a copy to the debtor. Keep proof of mailing or delivery.

- Decide on your next enforcement step based on the updated balance.

- Before you start enforcement, reconcile your ledger again.

- If the debtor pays partially, credit it right away and recalculate the balance.

- If your numbers change meaningfully, swear a fresh affidavit.

- Keep your file organized. Include the order, the settlement, the ledger, your affidavit, and all receipts.

- Track deadlines and interest accrual to avoid stale numbers on later filings.

- If you reach a new written payment plan, keep it in the file. Note how it affects the default.

- If the debt is paid in full, record the final payment date and amount. Close your ledger.

- Consider filing any paperwork needed to reflect satisfaction on the court record.

- Review your process for errors. Update your templates and checklists for next time.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.