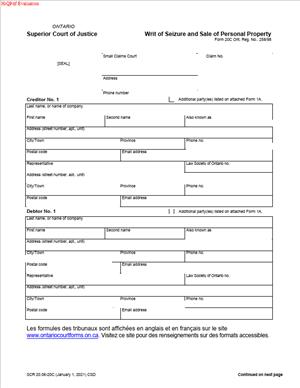

Form 20C – Writ of Seizure and Sale of Personal Property

Fill out nowJurisdiction: Country: Canada | Province or State: Ontario

What is a Form 20C – Writ of Seizure and Sale of Personal Property?

Form 20C is a Small Claims Court enforcement document. It authorizes an enforcement officer to seize and sell a debtor’s personal property. The goal is to collect the amount of the money judgment you already won. “Personal property” means goods and chattels. Think of vehicles, equipment, inventory, and other tangible items. It does not include land.

This form belongs to the Ontario Superior Court of Justice, Small Claims Court. It is used after judgment. It is not part of starting a claim. You use it when a debtor has not paid what the court ordered.

Who typically uses this form?

Judgment creditors do. In Small Claims Court, that is usually the successful plaintiff. It can also be a successful defendant who received a costs order. Legal representatives often prepare and file it for clients. Self-represented parties can also complete it.

Why would you need this form?

Because a judgment is a court’s decision, not a payment, if the debtor will not pay, you must enforce it. The writ gives the enforcement office authority to act. Without it, the enforcement office cannot seize goods. A writ is often one tool in a broader strategy. You may combine it with other enforcement steps. Examples include garnishment and examination hearings.

Typical usage scenarios include unpaid invoices after judgment, unpaid damages, or cost awards. You may know the debtor owns seizable assets. For example, a contractor’s work truck, business equipment, or retail inventory. The writ lets the Sheriff or enforcement officer seize those goods. They can then sell the goods and apply the proceeds to your judgment. The process respects legal exemptions. Some property cannot be seized. The enforcement office will screen for those limits.

Here’s how it works in practice. You file Form 20C at the Small Claims Court that issued your judgment. You also file an Affidavit for Enforcement Request that sets out the balance owing. The court clerk issues the writ. You then file the writ with the local enforcement office. Usually, that is the Sheriff in the region where the debtor’s goods are located. The Sheriff enforces the writ. If a sale occurs, proceeds pay enforcement fees first. The balance pays your judgment and interest. If funds remain, they go back to the debtor.

The writ does not guarantee recovery. If the debtor has no eligible assets, there may be nothing to seize. Secured creditors may rank ahead of you on specific items. Exemptions protect certain property. Despite these limits, the writ is effective where tangible assets exist.

When Would You Use a Form 20C – Writ of Seizure and Sale of Personal Property?

You use Form 20C after you obtain a Small Claims Court money judgment, and the debtor does not pay. It fits best when you know the debtor owns valuable, non-exempt goods. You might learn this from prior dealings, social media, site visits, or an examination hearing.

A business owner might use the writ against a debtor’s delivery van or equipment. A supplier might target a store’s inventory on hand. A homeowner might use it where a contractor keeps tools beyond the protected limit. A landlord with a Small Claims judgment might use it against a former tenant’s non-exempt goods in a storage unit. A contractor might enforce against another contractor’s trailer or generators.

If you have reliable asset details, this writ can be a direct route. For example, you have the debtor’s vehicle make, model, and plate. Or you know where the debtor stores high-value equipment. The enforcement office needs that information to act fast and cost-effectively.

You may also use the writ as part of a layered approach. You can file writs in multiple regions where the debtor operates. You can combine the writ with a garnishment of bank accounts. You can also examine the debtor under oath to discover more assets. If the debtor pays in full after you issue the writ, you should stop enforcement. You can direct the enforcement office to release the writ and close the file.

Tenants, landlords, sole proprietors, incorporated businesses, and individuals all use this form. The key factor is the presence of tangible, seizable goods within the enforcement office’s reach. If the debtor only has wages or bank funds, garnishment may be more effective. If the debtor only has land, a writ against land is the better tool.

Timing also matters. Check whether any stay of enforcement exists. Confirm the judgment is final and enforceable. If the court ordered payment by installments and the debtor is current, you cannot enforce. You may enforce if the debtor defaults under an installment order. If an appeal is filed and stayed, do not enforce until the stay is lifted.

Legal Characteristics of the Form 20C – Writ of Seizure and Sale of Personal Property

Form 20C is a court-issued writ. It is legally binding because it flows from a valid judgment. The court clerk issues it under the Small Claims Court Rules. It directs the enforcement office to seize and sell the debtor’s personal property. It empowers the enforcement office to apply the sale proceeds to the judgment.

Enforceability rests on a few core conditions. You must have a money judgment from the Small Claims Court. The writ must be issued by the court clerk. The writ must be filed with the correct enforcement office. The enforcement office can only act within its territorial area. You must pay the required fees and any requested deposits. You should provide clear directions and asset information. Without that, enforcement can stall.

The writ has a life span. It is valid for a set period, commonly up to six years from issue. You can seek renewal before it expires. If it lapses, you must renew or issue a new writ before the enforcement office can act again. Keep an eye on expiry dates and diarize renewal.

The writ’s scope is limited by law. Some property is exempt from seizure. Examples include basic household goods and a portion of tools of the trade. Motor vehicles may have a protected equity threshold. Exemption amounts change from time to time. The enforcement office applies current limits. If the debtor proves the item is exempt, the Sheriff will not seize it.

Ownership matters. The enforcement office cannot seize goods that do not belong to the debtor. Leased or rented items are off-limits. Goods under a valid security interest may be subject to a secured creditor’s priority. Co-owned goods can be complex. The Sheriff may only seize the debtor’s share. The Sheriff may require proof before acting.

Debtors may challenge enforcement. They can ask the court to set aside a default judgment. They can ask to vary terms or seek a stay. They can claim exemptions or ownership issues. You should maintain accurate records of amounts owed, payments received, and interest calculations. If the debtor pays, you must update the balance and stop enforcement when satisfied.

The enforcement office charges fees for each step. Fees come off the sale proceeds before you get paid. If proceeds are not enough, you may still owe costs or deposits. To avoid unexpected costs, give precise instructions. Identify assets with value above likely fees and exemptions. Practical planning helps ensure the writ achieves recovery.

How to Fill Out a Form 20C – Writ of Seizure and Sale of Personal Property

Follow these steps to prepare, issue, and use Form 20C.

1) Confirm you can enforce

- Make sure you have a Small Claims Court money judgment. Have a copy of the order.

- Check that there is no stay of enforcement in place.

- If there is an installment order, confirm the debtor is in default.

- Confirm the correct legal names of all parties on the judgment.

2) Gather the figures

- Determine the unpaid balance today. Start with the judgment principle.

- Add any costs and disbursements awarded.

- Add pre-judgment interest if the judgment granted it and remains unpaid.

- Identify the post-judgment interest rate. Use the court-ordered rate or the default rate allowed by law.

- Deduct any payments received since judgment.

- Calculate the “per diem” post-judgment interest. Multiply the current principal by the annual rate and divide by 365, round to cents.

- Keep your worksheet. You will use it in the supporting affidavit.

3) Identify where to enforce

- Find out where the debtor’s goods are located. Think city, county, or district.

- Locate the enforcement office that serves that area. In Ontario, the Sheriff enforces writs.

- If assets are in multiple regions, plan to file the issued writ in each region.

4) Complete the heading of Form 20C

- Enter the court file number from your Small Claims case.

- Enter the court address and location where your case was heard.

- Insert the parties’ names exactly as on the judgment. Use full legal names. Include any trade names that appear on the judgment.

- If there are multiple debtors or creditors, list each one. If space is tight, attach a Schedule A with the additional names and addresses. Title it clearly and refer to it in the form.

5) Fill in the judgment details

- Insert the date of the judgment or order for payment of money.

- State the total judgment amount as awarded. Break out costs if the form asks.

- State the balance owing as of a specific date. Use your calculations from Step 2.

- Enter the rate of post-judgment interest. If the judgment specifies a rate, use that. Otherwise, use the applicable rate allowed by law for your case.

- Provide the per diem interest amount. Show it as a dollar amount per day from the date stated.

- If the debtor has made partial payments, show the net balance after credits.

6) Address the writ to the enforcement office

- The form will direct the writ to an enforcement officer. Identify the county or district office where you will first file it.

- If you plan to file in more than one office, that is fine. You typically use the same issued writ. You file copies with each additional office.

7) Check the debtor details for enforcement

- Include the debtor’s last known address. Add additional addresses where assets may be found.

- Provide any known identifiers that aid enforcement. For example, vehicle plate, VIN, make, and model. Or serial numbers for equipment.

- If the form does not have a field for identifiers, include them in your covering letter to the enforcement office. You can also add a Schedule B titled “Directions to Enforcement Office.”

8) Complete and swear the required affidavit

- Small Claims enforcement requires an Affidavit for Enforcement Request. It confirms the balance owing and interest details.

- Prepare that affidavit with the same figures used on the writ.

- Swear or affirm the affidavit before a commissioner for taking affidavits.

- Ensure names and amounts match exactly across the writ and affidavit.

9) File the writ for issuance

- File Form 20C and the supporting affidavit with the Small Claims Court office that issued the judgment.

- Pay the court filing fee. Fees change from time to time, so confirm the current amount.

- The court clerk reviews and issues the writ. The clerk signs, dates, and seals it. You do not sign the writ itself.

10) Obtain issued copies

- Ask for several certified copies of the issued writ. You will need them to file with enforcement offices.

- Keep one copy for your records. Store it with your interest worksheet and affidavit.

11) File with the enforcement office

- Take or send the issued writ to the Sheriff serving the region where the goods are located.

- Include your directions. Identify specific assets and their locations. Provide access details for gated yards, warehouses, or storage units.

- Pay the enforcement office filing fee. Be prepared to pay a deposit toward costs. The Sheriff may not act without it.

- Ask for confirmation of receipt and a file number.

12) Support the enforcement action

- Be responsive to calls from the enforcement office. Provide any extra details they request.

- If premises access requires coordination, arrange it promptly.

- If a vehicle is targeted, provide proof of ownership by the debtor if asked. Registration lookups and records help.

- If you learn of new assets, send an updated direction in writing.

13) Monitor interest and payments

- Keep a running balance. Add daily interest until payment or sale.

- If the debtor pays the enforcement office, the net proceeds will be applied. You will receive a statement of distribution.

- If partial payment is made, update your balance and decide whether to continue.

14) Handle exemptions and disputes

- If the debtor claims an exemption, the Sheriff will assess it. You may be asked for comments or proof.

- If ownership is disputed, the Sheriff may hold the goods until the issue is resolved. You may need to seek a court direction if the dispute persists.

- If the writ cannot be enforced cost-effectively, consider other remedies. Garnishment or an examination hearing may be better.

15) Renew before expiry

- Note the writ’s issue date. Diarize the expiry date.

- Apply to renew before it lapses if the debt remains unpaid.

- File the renewal documents well in advance to avoid gaps in enforceability.

16) Close the file when paid

- When you are paid in full, write to the enforcement office. Ask to close their file.

- If the court requires it, file a satisfaction or withdrawal with the Small Claims Court.

- Keep final statements and receipts with your court file.

Key sections of the form to review before filing

- Parties: Names must mirror the judgment. Accuracy is critical for enforcement.

- Judgment details: Date, amounts, and interest rate must be consistent with the order and your affidavit.

- Enforcement direction: Ensure the writ identifies the enforcement office region.

- Signatures and seal: The clerk signs and seals the writ on issuance. Your signature appears on the supporting affidavit, not the writ.

- Schedules: Use schedules for extra parties or directions. Label them clearly as Schedule A, Schedule B, and so on. Cross-reference them in the form.

Practical tips

- Use exact legal names, including corporate suffixes. For example, “Inc.” or “Ltd.”

- List any “also known as” names that appear on the judgment. This helps locate assets.

- Do not overstate amounts. Interest must be calculated correctly. Keep your math sheet.

- Give the Sheriff precise, current asset locations. Vague directions add cost and delay.

- Budget for fees and deposits. Seizure and sale can be expensive if assets lack resale value.

What this writ does not do

- It does not seize land. Use a writ against land for real property interests.

- It does not garnish wages or bank accounts. Use a garnishment for those.

- It does not override valid security interests or legal exemptions.

- It does not compel entry without lawful authority. The Sheriff manages access within legal limits.

If you follow these steps, your Form 20C will be complete and enforceable. You will give the enforcement office what it needs to move quickly. You will also reduce the risk of rejection or delay. This increases your chances of recovery while keeping costs in check.

Legal Terms You Might Encounter

- Judgment means the court’s final decision on your claim. You use Form 20C only after you have a judgment that orders the debtor to pay you money. The writ enforces that judgment when the debtor does not pay.

- Judgment creditor is you, the person or business owed money under the judgment. You complete and file Form 20C to start enforcement against the debtor’s personal property.

- Judgment debtor is the person or business that owes the money. The debtor’s correct legal name and current address must appear on Form 20C. Accuracy here helps the enforcement office identify the right person.

- Writ is the official court document that authorizes enforcement. When the court issues your Form 20C as a writ, the enforcement office can act to seize and sell the debtor’s personal property.

- Seize and sell describes what the enforcement office may do under the writ. “Seize” means taking legal control of the debtor’s non-exempt personal property. “Sell” means disposing of that property, usually by public auction, to pay your judgment and approved costs.

- Personal property is movable property other than land. It includes equipment, inventory, vehicles, electronics, and other goods the debtor owns. Form 20C targets personal property, not land. A different writ is used for land.

- Exempt property is property that the law protects from seizure. Typical examples include basic household furnishings and certain tools of the trade, up to set limits. When you request enforcement under Form 20C, the enforcement office will not seize exempt items.

- Enforcement office (Sheriff) is the office that carries out the writ. You file the issued writ with the enforcement office in the area where the debtor’s property is located. The office may require directions, proof of ownership, and a deposit.

- Levy means the act of enforcing the writ to collect money. This includes seizing goods, arranging storage and sale, and applying net proceeds to your judgment, interest, and allowable enforcement costs.

- Priority refers to the order in which creditors are paid from seized property. Secured creditors and certain statutory claims may be paid first. If another creditor has priority on a particular item, you may receive less or nothing from its sale.

- Post-judgment interest is interest that accrues on the unpaid judgment after the court’s order. You include the interest rate and calculation up to the date you complete Form 20C, and it continues to accrue until paid.

- Co-owned property is property that the debtor owns with someone else. The enforcement office will assess the debtor’s share. Only the debtor’s interest can be seized and sold. This can affect saleability and proceeds.

FAQs

Do you need a judgment before you file Form 20C?

Yes. Form 20C enforces a money judgment you already won. If you do not have a judgment, seek judgment first through the court process.

Do you have to know exactly where the debtor’s goods are?

You should provide practical information that helps locate the property. List known addresses, business locations, storage sites, and vehicle details. The more specific you are, the more efficient enforcement becomes.

Can you seize any item the debtor owns?

No. Some items are exempt by law. Essential household goods and tools of the trade are protected up to certain limits. The enforcement office will not seize exempt items.

Should you file the writ in more than one place?

You can file in each enforcement office where the debtor has, or is likely to have, personal property. If the debtor has goods in different areas, consider filing in each relevant area.

How long does a writ under Form 20C stay in force?

Writs remain in effect for a set period, commonly up to six years. You can usually renew before expiry to keep enforcement alive. Track the expiry date and start renewal early.

Can you add interest and enforcement costs to the writ amount?

Yes. Include the unpaid judgment balance, post-judgment interest up to the date you complete the form, and allowable court-awarded costs. Ongoing enforcement costs may be added as they are incurred and approved.

What happens if the debtor pays after you file the writ?

You must update the amount owing. If the debt is fully paid, notify the enforcement office to stop action and arrange any required discharge. If paid in part, instruct the office to continue only for the reduced balance.

Can the Sheriff seize a vehicle with a loan or lien on it?

The enforcement office will consider any registered security interests. Secured creditors are paid first from the sale proceeds. If the secured debt equals or exceeds the vehicle’s value, there may be nothing left for your judgment.

Do you have to be present when goods are seized?

No. The enforcement office handles the seizure. You may be asked to assist with information, access details, or logistics. Be available by phone to answer questions quickly.

What if the debtor claims the goods are someone else’s?

The enforcement office may pause and ask for proof of ownership. You can submit documents showing the debtor’s ownership, like registrations, invoices, or asset lists. Third parties can assert claims, which may reduce what can be seized.

Checklist: Before, During, and After the Form 20C – Writ of Seizure and Sale of Personal Property

Before signing

- Confirm you have a valid, enforceable judgment.

- Gather the court file number and court location.

- Verify the judgment debtor’s exact legal name.

- Individuals: full legal name and any known aliases.

- Corporations: full registered name, including suffix (Inc., Ltd.).

- Collect the debtor’s last known residential and business addresses.

- Identify where the debtor’s goods are likely located.

- List specific assets, if known, with details.

- Vehicles: make, model, colour, plate, VIN if available.

- Equipment/inventory: quantity, serial numbers, distinguishing features.

- Calculate the current amount owing.

- Principal judgment balance.

- Post-judgment interest rate and interest to today’s date.

- Court-awarded costs not yet paid.

- Note any payments received after judgment and apply them.

- Check for known security interests or liens that may affect priority.

- Select the enforcement office(s) where the debtor’s goods are located.

- Prepare proof of ownership for items you identify (invoices, registrations).

- Arrange funds for court and enforcement office fees and any deposit.

- Set a reminder to track writ expiry and potential renewal.

During signing

- Confirm that names, addresses, and the court file number are correct.

- Review the amount claimed and the interest calculation date.

- Ensure the interest rate matches the judgment or applicable rate.

- Verify that the location fields match the court and enforcement office.

- Check that each debtor is listed if there are multiple debtors.

- Confirm you included all known aliases for name-matching.

- Read every figure and date aloud to catch transposed numbers.

- Sign where required and ensure the court issues and seals the writ.

- Request multiple certified copies for filing in different enforcement offices.

After signing

- File the writ with the Small Claims Court for issuance if not already issued.

- Obtain the sealed writ and enough copies.

- File the writ in the enforcement office(s) where seizure may occur.

- Pay the enforcement office’s filing fee and any required deposit.

- Provide written directions to the enforcement office.

- Identify property, locations, access issues, and timing constraints.

- Include any supporting documents proving debtor ownership.

- Keep a file with:

- A copy of the issued writ and proof of filing.

- Your interest calculations and payment ledger.

- Receipts for fees and deposits.

- Notes of all communications with the enforcement office.

- Monitor progress and respond quickly to requests from the office.

- Record any partial payments and promptly update the balance.

- If the judgment is paid, notify the enforcement office to stop action.

- Calendar the writ expiry date and start renewal early if needed.

Common Mistakes to Avoid Form 20C – Writ of Seizure and Sale of Personal Property

Don’t forget to use the debtor’s exact legal name.

- If the name is wrong or incomplete, the enforcement office may not match the debtor. Seizure can be delayed or blocked, and you may need to correct and refile.

Don’t miscalculate post-judgment interest.

- An incorrect interest rate or period can cause overclaims or underclaims. Overstating the amount can undermine credibility and slow enforcement while corrections are made.

Don’t target exempt goods.

- Listing or insisting on exempt items wastes time and money. The enforcement office will not seize protected property, and you may lose your deposit on failed attempts.

Don’t file in the wrong enforcement office.

- If you file where the debtor has no goods, nothing happens. File where the property is located. If in doubt, file in each area where goods are likely to exist.

Don’t ignore secured creditors and liens.

- Trying to seize heavily encumbered property may yield nothing after priority payouts. You risk fees with no recovery. Consider the likely net value before pushing that asset.

Don’t let the writ expire.

- If you miss the renewal window, you may have to start over with new filings and fees. Track the expiry date and renew early to avoid gaps in enforcement.

What to Do After Filling Out the Form 20C – Writ of Seizure and Sale of Personal Property

1) Get the writ issued by the court

- Submit the completed form to the Small Claims Court for issuance.

- Pay any issuance fee.

- Obtain the sealed writ and several certified copies. Keep one for your records.

2) File with the right enforcement office(s)

- File the sealed writ with the enforcement office in each area where the debtor’s goods are located.

- Pay the enforcement office filing fee and any required deposit.

- Note the enforcement file number for each office you use.

3) Provide clear enforcement instructions

- Send written directions describing the property to seize, exact locations, and access notes.

- Include supporting documents that show the debtor owns the items.

- Flag any timing constraints, such as business hours or seasonal closures.

4) Coordinate logistics and access

- Respond quickly to questions from the enforcement office.

- Help plan access where premises are gated, shared, or require special entry.

- Be ready to arrange third-party services if needed, such as towing or moving.

5) Track costs, payments, and interest

- Update your ledger for all enforcement costs, deposits, and receipts.

- Record any payments received from the debtor after the writ issues.

- Recalculate interest as time passes so your balance stays accurate.

6) Manage claims and disputes

- If a third party claims ownership, provide your evidence and await the office’s direction.

- If the debtor asserts exemptions, the office will assess them.

- Be prepared to redirect efforts toward non-exempt goods with real value.

7) Prepare for sale and distribution

- The enforcement office handles storage and sale, often by public auction.

- Sale proceeds pay approved costs, then apply to your judgment and interest, subject to priority rules.

- You receive an accounting of proceeds and remaining balance, if any.

8) Decide on next steps if recovery is incomplete

- If the sale does not satisfy the debt, consider continued enforcement against other assets.

- You can maintain the writ within its validity period and renew it before expiry.

- Keep monitoring the debtor’s situation for new assets or locations.

9) Suspend or withdraw if the debt is paid

- If the debtor pays in full, notify the enforcement office to stop action.

- If paid in part and you accept a plan, ask the office to hold action while payments continue.

- Keep written confirmation of any pause or withdrawal.

10) Renew before the writ expires

- Calendar the expiry date and start renewal well in advance.

- File the required renewal materials so enforcement remains continuous.

- Keep proof of renewal with your original writ documents.

11) Close out your file

- When the judgment is paid or you stop enforcement, organize your records.

- Keep copies of the writ, filings, receipts, and the final accounting.

- Store the file securely in case questions arise later.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.