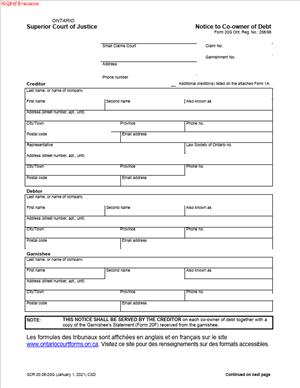

Form 20G – Notice to Co-owner of Debt

Fill out nowJurisdiction: Country: Canada | Province or State: Ontario

What is a Form 20G – Notice to Co-owner of Debt?

Form 20G is a Small Claims Court form under the Ontario Superior Court of Justice. You use it during enforcement. Specifically, you use it when you garnish a debt that is jointly owned by the judgment debtor and someone else. The “someone else” is the co-owner of the debt. Form 20G gives the co-owner formal notice that the court has issued a Notice of Garnishment and that the co-owned funds may be affected.

Think of it as a due process step within garnishment. A Notice of Garnishment tells a third party (the garnishee) to pay money they owe the debtor into court. If that money is co-owned with another person, you must alert that person. That is what Form 20G does. It does not start a lawsuit. It does not create a new debt. It ensures the co-owner gets a timely notice and has a chance to respond before any of their interest are affected.

Who typically uses this form?

Judgment creditors and their representatives. That could be a self-represented creditor, a paralegal, a lawyer, or a collections professional acting for a creditor. The co-owner does not fill it out. The co-owner receives it.

Why would you need this form?

Because you want to garnish money that is not held solely for the debtor, the most common example is a joint bank account. Other examples include joint receivables, joint investment accounts, and payments owed jointly to two or more people, one of whom is your debtor. If you skip this notice where it is required, you risk the garnishment being paused or set aside for not following the Rules of the Small Claims Court.

typical usage scenarios

- You have a Small Claims Court judgment. You learn your debtor keeps money in a joint chequing account with a spouse or business partner. You issue a Notice of Garnishment to the bank. Because the account is joint, you must serve Form 20G on the non-debtor account holder.

- A property manager holds rent collected for two co-landlords. One landlord is your judgment debtor. You garnish the property manager for funds payable to both landlords. You then serve Form 20G on the other landlord to notify them.

- A contractor owes a progress payment under a contract to two subcontractors jointly. One subcontractor is your debtor. You garnish that payment, then notify the other subcontractor with Form 20G.

In short, use Form 20G whenever the garnished funds are co-owned by your debtor and at least one other person. It protects the co-owner’s rights and helps your garnishment comply with the rules.

When Would You Use a Form 20G – Notice to Co-owner of Debt?

You use Form 20G after you have:

- A valid judgment or order for money in the Small Claims Court, and

- Issued a Notice of Garnishment to a garnishee who holds or owes money jointly to the debtor and another person.

The timing matters. You do not use Form 20G at the claim stage or during trial. You use it during enforcement, after the court issues the Notice of Garnishment.

Consider some practical examples. You are a landlord who obtained a judgment for unpaid rent. You learn that the debtor’s wages are paid into a joint account. You serve a Notice of Garnishment on the bank. Because the account is joint, you prepare and serve Form 20G on the other account holder. Or you are a supplier with a judgment. Your debtor and their partner bill clients together. You garnish a client who owes them money jointly. You then serve Form 20G on the partner who co-owns the receivable.

Here is when you would not use Form 20G. If you garnish wages paid by an employer, the wages are not co-owned. You would not send Form 20G. If you garnish a debt owed solely to the debtor, there is no co-owner. Again, no Form 20G. This form is only for co-owned debts that a garnishee holds or owes.

Typical users include:

- Small business owners enforcing a Small Claims judgment.

- Landlords collecting on rent arrears judgments.

- Trades and suppliers are enforcing unpaid invoices.

- Self-represented litigants with a judgment who discover joint assets.

- Paralegals or lawyers handling collections for creditors.

The key trigger is joint ownership of the money in the hands of the garnishee. If the garnishee’s obligation runs to the debtor and someone else together, use Form 20G and serve it promptly.

Legal Characteristics of the Form 20G – Notice to Co-owner of Debt

Form 20G is a court-prescribed notice under the Rules of the Small Claims Court. It forms part of the garnishment process. It is not an agreement between parties. It is not, by itself, an order that seizes money. Its legal force comes from the Rules and its link to the Notice of Garnishment.

Is it legally binding?

It is binding to the extent the Rules require it. You must use it when garnishing a co-owned debt to ensure procedural fairness. Proper notice helps make the garnishment enforceable against the garnishee while protecting the co-owner’s rights.

What ensures enforceability?

Compliance with the Rules. That includes using the correct form, completing it accurately, and serving it correctly to the co-owner. It also includes linking it clearly to the Notice of Garnishment and the underlying judgment. When done properly, the garnishment can proceed while the co-owner is informed and able to act. If the co-owner disputes the debtor’s share or the existence of joint ownership, the court can resolve that dispute.

The form also supports the court’s power to apportion co-owned funds. The court may only permit garnishment of the debtor’s share of a joint debt. That often becomes a factual question. Who contributed the funds? How are the parties entitled to the money? The court can make findings on that evidence. Sometimes, if there is no clear evidence, the court may treat joint shares as equal. Evidence from the co-owner can change that. Form 20G ensures the co-owner knows the garnishment is underway so they can give evidence or bring a motion.

General legal considerations:

- Use this form only where the garnishee’s obligation is to the debtor and another person. Do not use it for sole debts or wages.

- Be precise in identifying the co-owned debt, the garnishee, and the amounts. Ambiguity invites disputes.

- Serve the co-owner promptly using a permitted service method. Keep proof of service.

- Expect that the co-owner may dispute the debtor’s share or claim full ownership. Be ready to prove the debtor’s entitlement to a portion of the funds.

- Privacy matters. Limit sensitive account details in the form. Use partial account numbers or descriptors and, where needed, attach a schedule with details marked “confidential” for filing.

- If the co-owner brings a motion, attend and bring evidence. Bank statements, deposit records, and agreements can be critical.

If you do not serve Form 20G when required, the court can suspend the garnishment as it relates to co-owned funds. The garnishee may also be unsure how much to send into court. Proper use of the form reduces those risks.

How to Fill Out a Form 20G – Notice to Co-owner of Debt

You can complete this form yourself or through your representative. Follow these steps.

1) Confirm you are ready to use the form

- You must have a Small Claims Court judgment or order that requires the debtor to pay you money.

- You must have issued a Notice of Garnishment to a garnishee that holds or owes money jointly to your debtor and another person.

- You must know the identity and service address of the co-owner of that debt.

2) Gather the information you need

- Court file number and court location (the Small Claims Court office where your case is filed).

- Judgment creditor name and address (you) and representative details, if any.

- Judgment debtor name and address.

- Garnishee name and address (for example, the bank or payer).

- Date the court issued the Notice of Garnishment and the amount claimed under it.

- A clear description of the co-owned debt (for example, “Joint chequing account ending 1234 at [bank]” or “Invoice 4567 payable jointly to [names]”).

- The co-owner’s full legal name and service address.

3) Complete the court header

- At the top, write “Ontario Superior Court of Justice – Small Claims Court.”

- Add the court office address where the file is kept.

- Insert the court file number exactly as it appears on your judgment.

- Use the same party titles and spelling as on the judgment.

4) Identify the parties

- List the judgment creditor (you) with full mailing address, phone, and email.

- List the judgment debtor with full mailing address.

- Identify the garnishee by legal name and service address. For a bank, use the branch or legal service address appropriate for garnishments.

- Identify the co-owner by full name and service address. This is the person who co-owns the debt with your debtor. Do not list the debtor again as a co-owner.

5) Reference the Notice of Garnishment

- Insert the court location and date the Notice of Garnishment was issued.

- State the total amount owing under the Notice of Garnishment. Include principal, interest to date, and costs if applicable. Keep this consistent with your Affidavit for enforcement and the Notice of Garnishment.

- Refer to the file number again if the form prompts you to do so. Consistency helps the clerk and the recipient match documents.

6) Describe the co-owned debt

- Describe what the garnishee holds or owes, and why it is co-owned. Keep it clear and concise.

- Examples:

- “Funds in joint account in the names of [Debtor] and [Co-owner], account ending 1234.”

- “Payment owed under invoice 4567 issued jointly by [Debtor] and [Co-owner].”

- Avoid full account numbers or unnecessary personal details. If precision is needed for clarity, use only the last four digits or attach a schedule.

7) State the effect of the notice

- The form text explains that the co-owned funds may be paid into court under the garnishment.

- Confirm that only the debtor’s share is sought. You are not asserting rights to the co-owner’s share. You are notifying them so the court can determine the debtor’s portion if needed.

- If the form includes standard language about the co-owner’s right to dispute or request a hearing, leave that language intact. Do not alter court-approved text.

8) Include directions to the co-owner

- The co-owner may:

- Contact the garnishee for limited information about the garnishment.

- Bring a motion in the Small Claims Court to determine each person’s share, or for other directions.

- Attend a garnishment hearing if the court schedules one.

- If the form provides a blank to identify where to file or who to contact, insert the court office address and phone number from your file.

9) Add any schedules or attachments

- Use a Schedule “A” if you need more space to describe the co-owned debt or list multiple co-owners.

- Use a Schedule “B” for supporting detail that should not appear on the face of the form (for example, partial bank statement excerpts). Mark schedules with the court file number and your name. Keep attachments organized and paginated.

- Do not attach original bank cards, full account numbers, or unnecessary personal identifiers.

10) Sign and date the form

- Sign the form as the judgment creditor or have your representative sign.

- Print your name and role beneath the signature.

- Add the date and your contact information. If a representative signs, include their firm name and licence number where applicable.

11) Make copies

- Prepare at least three copies:

- One for the court file (if the court requires filing of this notice).

- One to serve as a co-owner.

- One for your records.

- You may need additional copies if there are multiple co-owners.

12) Serve the co-owner

- Serve the Form 20G on the co-owner using a permitted method under the Small Claims Court rules.

- Common methods include personal service or regular service by mail or courier. Follow the rules that apply to the type of document and the recipient.

- If you serve by mail or courier, allow time for delivery. If you have consent to serve by email or another method permitted by the rules, follow that consent closely.

- Keep proof of how and when you served the form. Retain tracking numbers, delivery confirmations, or a signed acknowledgment.

13) Complete proof of service

- Prepare an Affidavit of Service for the Form 20G and any schedules you served.

- Identify who served, when, where, on whom, and by what method.

- Attach exhibits such as courier receipts or mail slips if applicable.

- File the Affidavit of Service with the court if required or if a garnishment hearing or motion is scheduled. Keep a copy for your records.

14) Monitor and respond

- Watch for any response from the co-owner. They may contact you, the garnishee, or the court.

- If the co-owner disputes the debtor’s share, be prepared to attend a motion or garnishment hearing. Bring evidence about ownership and contributions to the co-owned funds.

- If no dispute arises, the garnishee may pay into court as directed. The court will then disburse according to the Rules, subject to any further orders.

Practical drafting tips

- Keep names and party titles consistent with the judgment and the Notice of Garnishment.

- Use plain descriptions for the co-owned debt. Avoid jargon and bank slang. Clarity reduces questions and delays.

- Be accurate with amounts. Match your numbers to the Notice of Garnishment and the running balance under the judgment. If interest is accruing, state the calculation date.

- If the co-owned debt involves a business, confirm whether the co-owner is an individual or a corporation. Serve the correct legal entity at the correct address.

- For joint bank accounts, expect scrutiny. Collect statements and deposit records now. You may need them if the co-owner asserts sole ownership of deposits.

Common mistakes to avoid

- Serving Form 20G in wage garnishments. Wages are not co-owned.

- Identifying the wrong co-owner. Confirm the exact names on the account or payable.

- Failing to serve the co-owner. This can delay or derail your garnishment.

- Overstating your claim to the co-owned funds. You can only reach the debtor’s share.

- Including full account numbers on the face of the form. Protect privacy and security.

Examples to guide your completion

- Joint bank account: You garnish a bank for “all funds owed to [Debtor].” You know the chequing account is joint with [Co-owner]. On Form 20G, identify the bank as the garnishee, describe “joint chequing account ending 1234,” list [Co-owner] with their address, and reference the Notice of Garnishment date. You serve [Co-owner] and file proof of service.

- Joint receivable: A customer owes $6,000 to “[Debtor] and [Co-owner]” for a project. You garnish the customer as garnishee. On Form 20G, describe “payment due under invoice 4567, payable jointly to [Debtor] and [Co-owner].” Serve [Co-owner] at their business address.

- Joint investment account: The debtor and a sibling hold a joint investment account. You garnish the investment firm. On Form 20G, describe “joint investment account ending 7890 in the names of [Debtor] and [Co-owner].” Serve the co-owner at their residential address.

If a dispute arises, the court can decide what portion of the co-owned funds belongs to the debtor. The court may rely on evidence of contributions, intent, and use. The result may be equal shares or another split. Your goal is to give timely notice and present clear evidence if asked.

Final check before you serve

- Is the court file number correct on every page?

- Do party names match the judgment exactly?

- Does the description of the co-owned debt make sense to someone who is not familiar with your case?

- Are your amounts consistent with the Notice of Garnishment?

- Do you have the correct service address for the co-owner?

- Have you prepared your Affidavit of Service template so you can complete it right after service?

By following these steps, you will complete and serve Form 20G properly. You protect the co-owner’s rights. You also protect your garnishment from avoidable challenges. That keeps your enforcement on track in the Ontario Superior Court of Justice – Small Claims Court.

Legal Terms You Might Encounter

- A “co-owner of debt” is someone who also has a legal interest in the money you are trying to garnish from the debtor. With this form, you tell that person you are enforcing your judgment against a debt they share with the debtor.

- A “judgment debtor” is the person or business who owes you money under a court order. This form references the debtor so the co-owner understands whose share is being targeted.

- A “judgment creditor” is you, the person or business who won the case and is owed money. The form identifies you so the co-owner knows who is enforcing the judgment.

- A “garnishment” is a court process that redirects money owed to the debtor and uses it to pay your judgment. This form notifies the co-owner that a garnishment may affect funds or receivables they share with the debtor.

- A “garnishee” is the third party that owes money to the debtor, like a bank or a customer. The form names the garnishee so the co-owner understands where the garnishment applies.

- “Joint account” or “joint receivable” describes money held or owed to more than one person, including the debtor and the co-owner. The form deals with these joint interests because garnishment can impact a co-owner’s share unless the court decides otherwise.

- “Exempt funds” are types of money the law protects from garnishment, sometimes in whole or in part. The co-owner may raise exemptions if protected funds are in a joint account. This form starts that conversation by giving notice.

- “Service” means delivering legal documents in a court-approved way. You serve this form on the co-owner to prove they had notice and a chance to respond.

- An “affidavit of service” is a sworn statement confirming how and when you served documents. You may need it to prove the co-owner received this form.

- A “motion” is a request asking the court to make a decision on a specific issue. After getting this notice, a co-owner may bring a motion to protect their share or challenge the garnishment.

FAQs

Do you have to send this form every time you garnish a joint debt or account?

Yes. If the funds or receivables belong to the debtor and another person, you must notify that co-owner. The purpose is to give them a fair chance to claim their share or raise a concern.

Do you serve one notice for each co-owner?

Serve a separate notice on every co-owner you can identify. If three people share the debt with the debtor, serve three notices and keep proof for each.

Do you send this form to the garnishee as well?

No. This form is directed to the co-owner. Keep a copy for your file. File or share it with the court only if the rules or clerk require it. The garnishee receives the notice of garnishment, not this notice, unless instructed.

Do you need to attach proof that the debt is co-owned?

It helps. Include or keep bank records, account statements, invoices, contracts, or other documents showing co-ownership. You may not have to attach them to the notice, but you should be ready to provide them if the co-owner or court asks.

What if you do not know the co-owner’s address?

Make reasonable efforts to find a current address. Check account documents, invoices, or prior correspondence. If you still cannot locate the co-owner, ask the clerk how to proceed. Do not skip service without a clear, rule-based reason.

Can the co-owner stop the garnishment?

They can challenge it, seek to protect their share, or raise exemptions. The court decides. Your job is to serve the notice properly and be ready to respond with facts and documents.

Do you have to wait for the co-owner to respond before collecting?

Not necessarily. Garnishment has its own timelines. Serve the co-owner promptly and follow the garnishment schedule. If the co-owner challenges, the court may change the flow of funds.

What if the debtor’s name is on a joint account, but most funds belong to the co-owner?

The co-owner can ask the court to recognize their share and reduce what is paid out. Your notice gives them the chance to do that. Keep records ready to support your position if there is a dispute.

Checklist: Before, During, and After the Form 20G – Notice to Co-owner of Debt

Before signing

Court details:

- Court file number matches your case.

- Correct court location.

Parties:

- Debtor’s full legal name and address.

- Your name and contact information.

Garnishment details:

- Garnishee’s full legal name and address.

- Type of debt you are garnishing (e.g., bank account, receivable).

- Amount owing on your judgment and any interest or costs claimed.

Co-owner details

- Co-owner’s full legal name and last known address.

- Evidence of co-ownership (e.g., joint account statement, shared invoice, contract).

Timing

- Date the notice of garnishment was or will be served.

- Any deadlines that may affect service on the co-owner.

Service planning

- Approved service method for the co-owner.

- Process server or person who will serve.

- Plan to complete an affidavit of service.

During signing

- Verify every name and address is spelled correctly.

- Confirm the described debt matches the garnishment target.

- Ensure amounts are accurate and current.

- Date and sign the form in ink or as required.

- If a commissioner or oath is needed for any attachment, arrange it.

- Make two copies: one to serve, one for your file. Keep the original as needed.

After signing

- Serve the co-owner using an approved method.

- Complete an affidavit of service with date, time, place, and method.

- If the rules require, file the notice and affidavit of service with the court.

- Note any response deadline for the co-owner in your calendar.

- Monitor garnishee payments into court or to you, as applicable.

- Store the form, proof of service, and supporting documents together.

- Be ready to respond if the co-owner files materials or contacts you.

Common Mistakes to Avoid

Not identifying all co-owners

- Consequence: A missed co-owner may later challenge the garnishment. The court could delay or limit payments.

- Tip: Review account titles, contracts, and invoices for additional names. Serve each co-owner.

Serving the wrong person or the wrong address

- Consequence: Service may be invalid. Payments could be paused or returned.

- Tip: Confirm the co-owner’s legal name and latest address. Keep proof of your search and service.

Vague description of the co-owned debt

- Consequence: The co-owner may claim confusion and seek time extensions or relief.

- Tip: Describe the debt clearly. Identify the account, invoice, or receivable so it’s unmistakable.

Miscalculating the amount owing

- Consequence: Overreaching can draw objections and reduce credibility with the court.

- Tip: Recalculate interest and costs. Align amounts with your judgment and any adjustments.

Skipping proof of service

- Consequence: You may not be able to show the co-owner had notice. The court may halt enforcement.

- Tip: Always complete an affidavit of service and keep it with your file.

Don’t forget to check whether funds might be exempt

- Consequence: Seizing exempt funds can trigger objections and court orders against you.

- Tip: Review the nature of the funds. Be ready to address exemptions if raised.

What to Do After Filling Out the Form

1) Serve the co-owner promptly

- Use a permitted service method. Personal service is often safest if allowed.

- Note the date, time, and method. Keep delivery receipts or declarations.

2) Complete your affidavit of service

- Record who served, how, and where.

- Attach any supporting delivery confirmations.

3) File documents if required

- If the rules call for filing the notice and proof of service, file them quickly.

- Bring your court file number and copies. Ask the clerk to confirm what is needed.

4) Track garnishment payments

- Watch for payments from the garnishee to you or into court.

- Reconcile amounts against what is owed, including interest and costs.

5) Respond to the co-owner if they contact you

- Stay professional and factual. Ask for any documents they rely on.

- If they object formally, review their materials and consider your response.

6) Prepare for a possible motion

- Keep all supporting documents organized. That includes the judgment, notice of garnishment, this notice, proof of service, and financial records linked to co-ownership.

- Be ready to explain how you calculated the amount and why garnishment applies.

7) Correct errors quickly

- If you discover a mistake, prepare a corrected notice.

- Re-serve the co-owner and, if required, advise the court of the correction.

8) Update addresses and contact details

- If the mail is returned or the co-owner moves, make reasonable efforts to find a new address.

- Re-serve if service was unsuccessful.

9) Close out when paid

- When the judgment is satisfied, stop the enforcement steps.

- Keep records of final payments, interest calculations, and any releases or acknowledgements.

10) Store your file securely

- Keep copies of all forms, proof of service, and correspondence.

- Maintain a clear timeline of events. This helps if questions arise later.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.