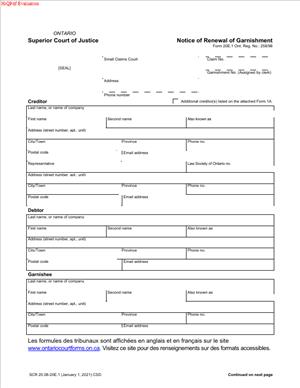

Form 20E.1 – Notice of Renewal of Garnishment

Fill out nowJurisdiction: Country: Canada | Province or State: Ontario

What is a Form 20E.1 – Notice of Renewal of Garnishment?

Form 20E.1 is an Ontario Small Claims Court document. It renews an existing Notice of Garnishment under the Rules of the Small Claims Court. It keeps a garnishment active so you can keep collecting on a judgment. It does not create a new garnishment. It extends the life of one who already exists.

A garnishment lets you collect money from someone who owes the debtor. Common examples are an employer or a bank. The court issues a Notice of Garnishment after you get a Small Claims Court judgment. The notice binds the garnishee to pay money to the court for your debt. A garnishment is not endless. It expires after a set period. If you still have a balance, you can ask the court to renew it. That is the purpose of Form 20E.1.

You use this form when the original garnishment is nearing expiry. You also use it if the original garnishment expired recently and you need continuity. By renewing, you preserve the garnishment’s effect on the same garnishee. You also update the outstanding balance, interest, and costs. You then serve the renewed notice so the garnishee keeps making payments.

Who typically uses this form?

Judgment creditors who have not been paid in full. That includes self‑represented creditors, lawyers, legal assistants, and collection agents. Landlords, contractors, and small businesses use it often. So do professional firms and lenders. If you won a Small Claims Court case and set up a garnishment, you are the intended user.

You need this form if the debtor still owes money and payments are ongoing or sporadic. Renewing keeps the garnishee obligated to pay the court. It avoids gaps in the collection. It also protects priority against other competing enforcement steps. If you do nothing, the garnishment ends. The garnishee then has no duty to keep withholding.

Typical scenarios are straightforward. You garnished wages at 20% and the debtor changed jobs twice. You have collected something, but not all. The expiry date is approaching. You renew, so the employer keeps withholding. Or you garnished a contractor’s receivable from a customer. The customer pays the debtor irregularly. You renew to catch each new payment. Another example is a bank garnishment that did not catch funds at the time of service. You renew to bind the account for the allowed period and pick up later deposits. In each case, the goal is the same. You want continued enforcement without starting over.

When Would You Use a Form 20E.1 – Notice of Renewal of Garnishment?

You use this form before the current Notice of Garnishment expires. The renewal keeps the original garnishment alive. It applies to the same court file and the same garnishee. You do not need a new judgment to renew. You only need an unpaid balance and a still‑valid judgment.

Suppose you hold a judgment for $7,500. The debtor’s employer has been sending payments for a year. The total paid is $1,200. Interest and costs continue to accrue. The notice is set to expire soon. You file Form 20E.1 to renew. This keeps the employer sending payments until the debt is satisfied or the renewed notice expires.

Or consider a bank garnishment that caught only $300 on day one. You still have a $4,000 balance. You expect more funds to flow through the account. A renewal keeps the binding effect on the bank for the renewal period. This lets you capture new deposits as they become payable to the debtor, where the rules allow.

If you are a landlord who won a judgment for rent arrears, you may garnish wages. Tenants often change jobs or hours. Payments may be sporadic. Renewal prevents a lapse. It helps you collect through job changes as long as the same garnishee remains bound.

If you are a contractor owed money by a debtor, you may garnish the debtor’s receivables from a client. The client pays the debtor in stages. Renewal keeps the garnishment attached to each stage payment. You avoid having to re‑establish the process every time.

Law firms and in‑house credit teams use the form in portfolio recoveries. They track expiry dates and renew in advance. This preserves their place in line. It can prevent a rival creditor from jumping ahead. It also avoids the cost of re‑serving a new notice if avoidable.

If payments stopped because the debtor went on leave, you may still renew. The garnishment remains in place, and payments can resume when wages resume. If the debtor changed employers, renewal does not move the garnishment to the new employer. You need a new Notice of Garnishment to bind a new garnishee. Form 20E.1 renews only what already exists. It does not change who must pay.

You should also use the form when you need to update the balance owing on the court record. Renewal requires you to set out the current balance, interest, and costs. This helps the garnishee know the target amount. It also helps the court allocate payments properly.

Legal Characteristics of the Form 20E.1 – Notice of Renewal of Garnishment

Form 20E.1 is legally binding when properly issued and served. It derives its force from the Small Claims Court judgment and the enforcement rules. The court clerk issues the renewal once your paperwork is in order and fees are paid. After issuance, service on the garnishee creates the duty to continue payment. Service on the debtor ensures notice and fairness.

Enforceability rests on several elements. First, a valid judgment remains outstanding. If the judgment has been satisfied or set aside, renewal will not stand. Second, the original Notice of Garnishment was properly issued and served. Renewal extends that document, not a new right. Third, you comply with the renewal timing rules. You file before expiry or within the allowed renewal window. Fourth, you serve the renewed notice correctly. You must use approved service methods for a person or a corporation. You must file proof of service where required.

The content of the renewal also matters. The form must correctly identify the court, the file number, the creditor, the debtor, and the garnishee. The balance must be accurate. The interest rate must match the judgment or the applicable post‑judgment rate. Costs must be legitimate and permitted. Clerical mistakes can be fixed, but material errors can delay or defeat enforcement.

Statutory exemptions and priorities still apply. Ordinary wages are usually subject to a cap, often 20%. Some sources of income are exempt. Examples include most social assistance payments and some pension benefits. Family support orders often have priority over other garnishments. If a support deduction is in place, your garnishment may be delayed or limited. The renewal does not override those rules. It continues to be subject to them.

The garnishee’s obligations are strict. Once served, the garnishee must pay as directed. If the garnishee ignores the renewed notice, the court can hold the garnishee liable. The court can also order a garnishment hearing. At that hearing, the garnishee must explain non‑payment. The garnishee can face a payment order or costs if at fault.

Due process matters. The debtor must receive notice of the renewal. The debtor can bring a motion to vary or suspend the garnishment. The debtor can argue exemptions, hardship, or errors in the balance. The court can make directions on fair terms. Your careful paperwork reduces disputes and delays.

Renewal does not extend the life of the judgment itself. Judgments have their own enforcement lifespan. If the judgment is stale and not renewed, garnishment renewal will not help. You must ensure the judgment remains enforceable under the broader rules. Renew early. Calendar all limitation and expiry dates. Keep a running ledger of payments and interest.

How to Fill Out a Form 20E.1 – Notice of Renewal of Garnishment

Follow these steps to complete and process the form with confidence.

1) Confirm you should renew

- Check the original Notice of Garnishment. Note the issue date and expiry date.

- Confirm an unpaid balance remains. Review your ledger of payments and interest.

- Confirm the same garnishee still owes or will owe the debtor. If the garnishee has changed, a new notice is needed.

2) Gather your information

- Court location and Small Claims Court file number.

- Exact names of the judgment creditor and debtor as shown on the judgment.

- Legal name and service address of the garnishee. Use the corporate name if applicable.

- Original Notice of Garnishment issue date.

- Payments received to date through the court or directly.

- Post‑judgment interest rate and interest accrued to the renewal date.

- Enforcement costs you seek on renewal. Include the filing fee and reasonable disbursements.

- Your contact information for service and questions.

3) Complete the court header

- Enter the court name: Ontario Superior Court of Justice, Small Claims Court.

- Enter the court address for the location where your case is filed.

- Enter the court file number exactly as it appears on your judgment file.

4) Identify the parties

- List your full name as the creditor. Use the same spelling as the judgment.

- List the debtor’s full legal name. Include any known aliases noted on the judgment.

- If there are multiple judgment debtors, list each one that remains liable.

5) Identify the garnishee

- Enter the garnishee’s legal name. For a company, use the corporate name, not a trade name.

- Provide the full mailing address for service. Include the suite number and the postal code.

- For an employer, include the payroll or legal department, if known.

- For a bank, identify the branch or head office address for service.

6) Reference the original garnishment

- State the date the court issued the original Notice of Garnishment.

- Confirm that it was served and that payments have been received, if any.

- If no payments were received, state that the balance remains due.

7) Calculate the balance owing

- Start with the judgment amount still unpaid before interest.

- Add post‑judgment interest from the judgment date or the last calculation date.

- Use the correct interest rate from the judgment or the applicable rule.

- Deduct all payments received to date, including any paid directly to you.

- Add the costs you seek for the renewal. Include court fees and reasonable service costs.

- Show the total balance now claimed. Keep your math clear and supportable.

8) Complete the payment directions section

- The form will include standard directions to the garnishee. It tells the garnishee to continue payments to the court.

- Confirm the court address for remittance is correct. Do not change standard wording unless the court allows it.

9) Provide any required schedules or attachments

- Attach a simple statement of account. Show the original judgment, credits, interest, and costs.

- Attach an interest calculation sheet. Show the rate, period, and amount.

- Attach any name change evidence if a party’s legal name has changed.

- Keep attachments concise and factual. Label each page with the court file number.

10) Sign and date the form

- Sign the form as the creditor or as the creditor’s representative.

- Print your name, role, and contact details beneath your signature.

- Date the form on the day you file it.

11) File the form with the court

- File at the Small Claims Court location on your file.

- Bring at least two copies for stamping. Keep one for your records.

- Pay the filing fee. Record the receipt number in your file.

- Ask the clerk about processing timelines for issuing the renewal.

12) Obtain the issued Form 20E.1

- The clerk will issue the renewal. The issued form bears the court seal or stamp.

- Check all details on the issued form. Ensure names, file numbers, and amounts are correct.

13) Serve the issued renewal

- Serve the garnishee with the issued Form 20E.1. Use an approved method for that entity.

- Serve the debtor with the issued Form 20E.1 as required. Use an approved method for individuals or corporations.

- Serve promptly after issuance. Do not let service lag and risk confusion.

14) Prepare and file proof of service

- Complete an affidavit of service for the garnishee. Attach any delivery receipts.

- Complete an affidavit of service for the debtor. Include details of date, time, and method.

- File the affidavits with the court as required. Keep stamped copies in your file.

15) Monitor compliance and payments

- Track payments received by the court and passed to you.

- Compare each payment against your ledger. Update interest and balance regularly.

- If the garnishee fails to pay, consider a garnishment hearing request.

- Communicate professionally with the garnishee’s contact to resolve issues early.

16) Address special issues early

- If a support deduction has priority, adjust expectations. You may receive reduced or delayed payments.

- If the debtor claims an exemption, review it promptly. Respond with facts and documents.

- If the debtor has filed to vary or suspend garnishment, attend the hearing with your ledger and calculations.

17) Correct or amend if needed

- If you discover an error in the balance, correct your ledger. Notify the garnishee if it affects payments.

- If the garnishee’s name or address is wrong, re‑serve correctly. File updated proof of service.

- Do not ignore returned mail. Investigate and cure service issues right away.

18) Know what renewal does not do

- Renewal does not bind a new garnishee. If the debtor has a new employer, start a new garnishment for that employer.

- Renewal does not change statutory caps on wages. Standard limits still apply.

- Renewal does not revive an expired judgment. Keep the judgment itself enforceable.

19) Close the loop when paid

- When the judgment is satisfied, advise the court in writing.

- File the appropriate satisfaction notice on the court file.

- Notify the garnishee to stop withholding once the balance is paid.

20) Practical tips for accuracy

- Use the exact names from the judgment to avoid identity disputes.

- Reconcile your numbers before filing. Small errors can cause delays.

- Calendar all key dates: expiry, service deadlines, and hearing dates.

- Keep a single, clean statement of account. Update it after each payment.

Common mistakes to avoid

- Waiting until after expiry to act risks a gap in collection.

- Misstating the interest rate undermines your credibility.

- Serving the wrong address for a corporate garnishee.

- Failing to serve the debtor can lead to a suspension.

- Including unapproved costs in the balance and provoking a dispute.

By following these steps, you keep your garnishment effective and clean. You protect your position and maintain steady pressure for payment. You also reduce the risk of avoidable challenges.

If you manage many files, standardize your process. Use a checklist for renewal dates, service, and affidavits. Maintain a template ledger that shows principal, interest, costs, and credits. Consistency reduces errors and saves time.

Finally, stay professional with garnishees. Provide the issued form, the file number, and your contact details. Confirm where they should send payments. A helpful approach encourages cooperation and faster compliance.

Legal Terms You Might Encounter

- Judgment creditor means you, the person or business owed money under a court judgment. On this form, you confirm your details so the court and the garnishee know who receives payments.

- Judgment debtor is the person or business who owes the judgment. You list their full legal name and last known address. Accurate identification helps the garnishee match deductions to the right person.

- Garnishee is the third party that owes money to the debtor. It is often an employer or a bank. On this form, you confirm the garnishee’s legal name and address so the renewed garnishment reaches the right place.

- Garnishment is a court process that directs a garnishee to pay money they owe the debtor toward your judgment. The renewal keeps that court process active so deductions can continue.

- Notice of renewal of garnishment is the document you file to extend an existing garnishment before it expires. It keeps the order in effect for another term, so you can continue collecting.

- Enforcement period is how long the garnishment remains active. The renewal restarts that period from the date the court issues the renewal. You should diarize the new expiry date.

- Amount owing is the unpaid balance of your judgment at the time of renewal. It includes principal, allowed costs, and interest to a specific date. You must update this figure and show your math.

- Interest is the extra amount that accrues on the judgment balance over time. You calculate it to the date of renewal. You then continue to calculate interest during the renewed period.

- Statutory deductions are amounts an employer must withhold from wages by law, such as taxes. When wages are garnished, the deduction is applied to net pay after those statutory deductions.

- Affidavit of service is a sworn statement that proves you served the renewal on the debtor and the garnishee. The court may require this proof to show proper notice was given.

- Exempt income refers to money protected by law from garnishment. Common examples include some social assistance and certain pension income. If the debtor’s income is exempt, garnishment may not reach it.

- Continuing garnishment describes a garnishment directed at ongoing payments like wages. It captures amounts due in each pay cycle within the enforcement period. A renewal keeps it going.

- Costs are expenses you can add to the judgment, such as filing and service fees. If allowed, include them in the updated amount owing when you renew.

- Court file number links all documents in your case. Use the exact file number from your judgment and original garnishment. Errors can delay the issuance of the renewal.

FAQs

Do you need to pay a fee to renew?

Yes. Expect a filing fee when you submit the renewal. The clerk will advise the amount and how to pay. Keep your receipt and add the fee to your running costs if allowed.

Do you have to serve the debtor and the garnishee again?

Yes. You must serve both with the issued renewal. Then file proof of service. Without proper service, the garnishee may not make deductions, and you risk delays.

Do you need a hearing to renew?

Usually no. The clerk issues the renewal if your paperwork is complete and the garnishment has not expired. A hearing might occur later only if someone disputes the process or seeks directions.

Do you update the amount owing on the renewal?

Yes. You must show the current balance. Start with the unpaid principal, add allowed costs, add interest to the date of renewal, and subtract all payments received. Show your calculation.

How long does a renewal last?

A renewal extends the garnishment for another defined term from the date the court issues it. The term is set by the rules for garnishment. Diarize the new expiry date and plan an earlier renewal if needed.

Can you renew more than once?

If the judgment remains unpaid and the garnishment has not expired, you can file another renewal before the new expiry date. Always track expiry dates to avoid gaps.

What if the debtor changes jobs or banks during the renewal?

Update your enforcement strategy. If the garnishee changes, a renewal aimed at the old garnishee will not reach the new one. You may need to issue a new garnishment against the new garnishee.

What if you miss the renewal deadline and the garnishment expires?

You may have to start a new garnishment. Payments may stop until the new notice is served and takes effect. Act early to avoid an enforcement gap.

Do you need the original notice of garnishment to renew?

You need the original court file number and details of the existing garnishment. Bring your judgment, original garnishment, and your payment ledger so you can calculate the current balance accurately.

Can the garnishee challenge the renewal?

The garnishee can raise issues such as employment ending, income exemptions, or calculation errors. If questions arise, be ready to provide your ledger, the judgment, and the renewal math.

Checklist: Before, During, and After the Form 20E.1 – Notice of Renewal of Garnishment

Before signing

- Gather the court file number and the court location.

- Bring a copy of the judgment and the original garnishment.

- Confirm the debtor’s full legal name and last known address.

- Confirm the garnishee’s correct legal name and service address.

- Review all payments received to date and keep a ledger.

- Calculate the current balance: principal, allowed costs, interest to date, minus payments.

- Identify the interest rate that applies and your calculation period.

- Note the original garnishment issue date and current expiry date.

- Check whether income is wages or another receivable.

- Confirm the debtor’s pay cycle if this is a wage garnishment.

- Plan your service method for the debtor and the garnishee.

- Confirm the filing fee and your payment method.

- Prepare enough copies for filing, service, and your records.

During signing

- Verify the court file number matches your judgment.

- Check spelling of names and addresses for debtor and garnishee.

- Enter the accurate amount owing as of the date of renewal.

- Show interest calculation dates and totals. Double-check your math.

- Ensure the garnishee’s address is complete and current.

- Sign and date the form in the proper space.

- Print your name and contact details clearly.

- Avoid blanks. Write “N/A” where something does not apply.

- Keep the form legible. If you correct an entry, initial the change.

- Attach any required schedules if the form calls for them.

After signing

- File the form with the court clerk and pay the fee.

- Ask for the issued and sealed renewal back for service.

- Make the required number of copies for service.

- Serve the garnishee and the debtor as the rules allow.

- Complete and file an affidavit of service if required.

- Calendar the new expiry date and a renewal reminder well before that date.

- Track deductions received after the renewal takes effect.

- Match each payment to your ledger and update the balance.

- Follow up with the garnishee if deductions do not start on the next cycle.

- Store the filed renewal, proof of service, and receipts in your case file.

Common Mistakes to Avoid

- Don’t forget to renew before expiry. If you miss the deadline, the garnishment can lapse. Payments may stop, and you may need to start over with a new notice.

- Don’t use outdated garnishee details. If the employer or bank changes, the renewal will not reach the right party. You could lose time and miss deductions.

- Don’t overstate the amount owing. If your interest in math is wrong or you ignore payments, you could collect too much. That triggers disputes, refunds, and possible court time.

- Don’t skip service or proof of service. If you do not serve the debtor and the garnishee, the renewal may not take effect. You risk invalid deductions and delay.

- Don’t ignore income limits and exemptions. Garnishees will not deduct beyond what the law allows. Overreaching instructions cause refusals or shortfalls and stall collection.

What to Do After Filling Out the Form

- File the renewal with the court. Bring your completed form and fee. The clerk will review the filing and issue the renewal if it is complete. Ask for a sealed copy for service.

- Serve the garnishee and the debtor. Deliver the issued renewal to both as required by the rules. Use a reliable method of service. Keep records of when and how you served each party.

- File your affidavit of service. Complete it for each party served, if the court requires proof. File it promptly so the court file shows proper notice to everyone involved.

- Monitor the next pay cycle. For wage garnishments, deductions usually appear on the next scheduled paycheck after service. For bank garnishments, monitor the time needed for processing.

- Follow up with the garnishee if payments do not start. Confirm they received the renewal and have the correct file number and instructions. Offer the debtor’s identifying details if requested by the garnishee.

- Keep a precise ledger. Record each payment date and amount. Apply payments consistently to interest, costs, and principal. Update the running balance after each payment.

- Handle changes fast. If the debtor leaves the job or closes the account, deductions will stop. Identify a new garnishee if possible, and consider a new garnishment. The renewal does not move with the debtor to a new garnishee.

- Address disputes or objections. If the debtor or garnishee raises an issue, respond with your judgment, ledger, and form details. Be open to correcting an error if you find one.

- Manage overpayments and satisfaction. If you collect the full amount, stop further deductions. File the appropriate notice to end the garnishment. Serve it on the garnishee and the debtor so future deductions cease.

- Plan for the next renewal. Note the new expiry date, the day you get the issued renewal. Set calendar reminders several months in advance. Start the next renewal early if a balance remains.

- Store your documents. Keep the issued renewal, proof of service, payment ledger, and receipts together. Organized records help you respond to questions and support your calculations.

- Consider complementary enforcement if needed. If deductions are small or inconsistent, explore other enforcement tools allowed by the court. Use the mix of tools that best fits the debtor’s situation.

- Review interest regularly. Update interest calculations at set intervals. Make sure your method matches the rate that applies to your judgment. Reconcile your ledger with the garnishee’s remittances.

- Communicate with the debtor when appropriate. If the debtor offers direct payment, consider whether it will speed up collection. If you agree to direct payment, coordinate with the garnishee and the court so you do not double collect.

- Maintain professional contact with the garnishee. Garnishees process many files. Clear, courteous communication helps keep your file moving. Provide the court file number and your contact details in every message.

- Reassess the strategy if there is little to garnish. If the debtor’s income is exempt or too low for deductions, adjust your plan. The renewal keeps your rights alive, but you may need a different approach to collect.

- Confirm address changes. If you learn of a new address for the debtor or the garnishee, update your records. Use the best address available for any future filings or service.

- Use checklists for each renewal cycle. Repeatable steps reduce errors. A short checklist saves time and protects your collection efforts.

- Track total costs. Add allowed costs to your balance when you incur them. Keep receipts. Be ready to show how you arrived at the final amount.

- Prepare for year-end reconciliations. If the garnishee is an employer, year-end processes can affect timing. Build in extra time for deductions around holidays and payroll cutoffs.

- Stay organized until the last dollar is paid. The renewal is a tool, not a finish line. Keep disciplined records until the judgment is fully satisfied and the garnishment is closed.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.