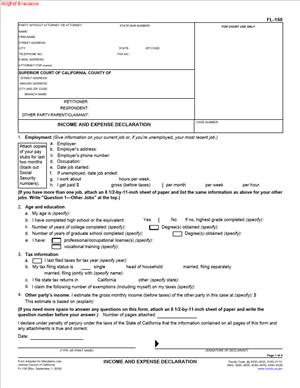

FL-150 – Income and Expense Declaration

Fill out nowJurisdiction: Country: United States | Province or State: California

What is an FL-150 – Income and Expense Declaration?

The FL-150 is a financial disclosure form for California family law cases. You use it to tell the court your income, deductions, and monthly expenses. It also covers your debts and certain child-related costs. The court relies on it to set support and decide fee requests.

You use this form in the Superior Court of California. It is a statewide Judicial Council form. Courts use it to calculate guideline child support. Judges also use it to assess temporary and long-term spousal support. They may review it to decide need-based attorney’s fees.

Who typically uses this form?

Any party to a family law case. That includes you if you are a petitioner or respondent. Attorneys submit it for clients. Many self-represented litigants file it themselves. Parents in parentage cases use it. Domestic partners use it. Spouses use it in divorce or separation. People seeking or opposing support also use it in restraining order matters.

Why might you need it?

You need it when support is an issue. You also need it if you ask for attorney’s fees. The court cannot set support without current financial data. You must complete it to show your ability to pay or need. It helps the court see the full financial picture.

Typical usage scenarios

You ask for child support in a Request for Order. You respond to a support request and need to show your income. You ask to modify support after a job change. You ask for temporary spousal support at the start of a case. You defend against a support increase by showing reduced income. You request attorney’s fees and must prove need. You oppose a fee request and must show you cannot pay.

The FL-150 captures monthly numbers. You reported last month and your average for the last 12 months. This helps with variable income. You also list payroll deductions and recurring expenses. You attach pay stubs and proofs. If you are self-employed, you attach a profit and loss statement. If you receive benefits or other income, you disclose those.

The court uses your entries to run a support calculator. Your tax filing status and deductions matter. Health insurance costs for you and the children matter. Childcare costs matter. Work-related travel or education costs may matter. The form standardizes these details so judges can compare data fairly.

When Would You Use an FL-150 – Income and Expense Declaration?

You use the FL-150 anytime support is in play. You submit it for child support, spousal support, or family support. You also use it with a fee and cost request. You file it when you want an order or when you oppose one.

Here are practical examples. You lost your job and seek to lower support. You complete the FL-150 to show your new income. You got a raise, and the other party seeks an increase. You file your FL-150 to present accurate numbers. You changed health insurance and now pay more. You update the form to reflect that change. You started paying for childcare. You list the monthly cost and attach proof.

You also use it at the start of a case. You may file it with your first motions. Many courts require it for temporary orders. Judges usually require it for any hearing involving support. Mediators and settlement officers often ask for it. It helps them propose fair numbers.

Different users complete it in different ways. Employees list wages, overtime, and taxes withheld. Self-employed business owners show gross receipts and business expenses. Gig workers’ average irregular weekly income over 12 months. Contractors report 1099 income and business costs. Retirees list pension and social security income. Disabled workers report disability benefits. Students with part-time jobs list wages and any aid that counts as income.

You may also use it if the local child support agency is involved. The agency often requests your FL-150. They use it to calculate support and prepare recommendations. The court relies on the same data at the hearing.

The form is also useful in negotiations. You and the other party can exchange FL-150s. You can see if a deal is likely under the guidelines. Accurate data can avoid a hearing. Many cases settle when both sides see the numbers.

Legal Characteristics of the FL-150 – Income and Expense Declaration

The FL-150 is a sworn declaration. You sign it under penalty of perjury. That means it has legal force. False information can lead to sanctions. It can also affect the court’s credibility findings. In serious cases, it can lead to contempt or monetary penalties.

The form is mandatory in many support matters. Courts rely on it for guideline calculations. The structure supports uniform results. The court reviews your tax status, income, and deductions. The judge can base orders on your entries and attached proofs. That makes the form functionally enforceable.

Your signature ensures accountability. You must confirm that the information is true and correct. You attach pay stubs and other records. Those attachments support your numbers. Judges can question and weigh your data. They can draw inferences if documents are missing. They can impute income if they find intentional underreporting.

The FL-150 is evidence. Courts often decide temporary support using declarations. Judges may rule based on papers without live testimony. They can still set a separate evidentiary hearing. If credibility is at issue, expect to testify. Your declaration can be used to question you.

Accuracy and completeness are key. You must disclose all income sources. You must include payroll deductions and support paid. You should average irregular income over time. You should explain unusual swings. You should update the form if things change. Courts value current, supported numbers.

Confidentiality rules still apply. Do not include full account numbers. Redact sensitive data on attachments. Only include what the form asks. Keep attachments relevant and legible. Attachments should match the amounts you list.

If you omit the FL-150, you risk delay. The court may continue your hearing. It can deny your request without it. It can also prevent you from opposing a request. Judges expect parties to file and serve this form on time.

How to Fill Out an FL-150 – Income and Expense Declaration

Before you start, gather records. Collect two months of pay stubs. Gather your most recent tax return. Include W-2s and 1099s if you have them. Download or prepare a profit and loss if self-employed. Pull statements for health insurance premiums. Gather childcare invoices and education receipts. Collect statements for recurring debts. Have recent bank or credit card statements handy.

1) Complete the caption

- Enter your name, address, and contact information.

- Check the “self-represented” box if you have no attorney.

- List the court’s county and courthouse address.

- Enter the case number exactly as it appears.

- Enter the parties’ names as Petitioner and Respondent.

- Use the same party labels used in your case.

2) Identify your role

- Check the box that shows if you are a Petitioner or a Respondent.

- If you are joining as another party, identify your role.

- Make sure the role matches the case caption.

3) Employment and status

- State if you are employed, self-employed, unemployed, or retired.

- If employed, list your employer’s name and address.

- Provide your job title and the date you started.

- Check your pay period (hourly, weekly, biweekly, monthly).

- Note union membership if you have dues.

- If unemployed, list the last date you worked.

- List unemployment or disability benefits, if any.

4) Age and education

- Enter your age.

- List the highest grade or degree completed.

- Include any vocational training or licenses.

- Add language skills if relevant to work capacity.

5) Tax information

- State the last tax year you filed.

- List your filing status (single, married filing jointly, etc.).

- Enter the number of exemptions or dependents you claim.

- If you did not file, explain briefly why.

- Identify whether you paid federal and state income tax.

6) Estimate the other party’s income

- Offer a good-faith estimate, if you can.

- Base it on known pay, job type, or prior records.

- If you do not know, write “Unknown.”

- Do not guess wildly or inflate the number.

7) Report your income

- Use “last month” and “average monthly” amounts.

- Average variable income over the last 12 months.

- List gross wages or salary before deductions.

- List overtime separately from base pay.

- Include tips, commissions, and bonuses.

- Add rental income after necessary expenses.

- Include investment income, dividends, and interest.

- List pension, social security, and annuity income.

- Report disability, workers’ compensation, or unemployment.

- Disclose any public assistance benefits you receive.

- If you receive spousal or partner support, include it.

- Identify any other cash or in-kind income.

- Do not include your new spouse’s income.

- Do not include gifts that are not regular or reliable.

- Attach two months of pay stubs to support wages.

Examples for special income:

- Teachers: average pay across the year, not just ten months.

- Firefighters: average overtime over 12 months.

- Gig workers: use weekly logs and bank deposits.

- Realtors: average commissions by month over a year.

- Military: include basic pay and regular allowances.

- Self-employed: report gross receipts and business expenses.

- Use a simple profit and loss statement for self-employment.

- Exclude personal living costs from business expenses.

8) Payroll deductions

- Enter taxes withheld for federal and state.

- Include Social Security and Medicare amounts.

- List mandatory retirement contributions.

- List union dues if mandatory.

- Add the health, dental, and vision premiums you pay.

- Enter the child support you pay for other cases.

- Enter the spousal support you pay by court order.

- Note voluntary retirement separately if allowed.

- Do not double-count the same deduction.

9) Child-related add-ons

- List job-related childcare costs.

- Show the monthly average, not a one-time spike.

- List health insurance premiums for the children.

- Separate child-only premium if possible.

- List uninsured healthcare costs for the children.

- Include education or special needs costs if recurring.

- Include reasonable travel expenses for visitation, if any.

- Attach receipts or statements when available.

10) Monthly expenses

- Estimate actual monthly spending with care.

- Include rent or mortgage and property taxes.

- Include homeowners’ dues or renters’ insurance.

- Add utilities, internet, and phone services.

- List groceries and household supplies.

- Add transportation and auto insurance.

- Include medical and dental not reimbursed.

- Add clothing and personal care amounts.

- Include child-related activities and supplies.

- Add minimum payments on credit cards.

- Keep estimates realistic and supported by statements.

- Explain unusual or temporary expenses on an attachment.

11) Installment payments and debts

- List the main debts you are paying monthly.

- Include creditor names, balances, and monthly payments.

- Include car loans, student loans, and signature loans.

- Include large medical payment plans.

- You do not need to list every small store card.

- Focus on debts that affect your monthly cash flow.

12) Attorney’s fees and costs

- List what you have paid to your attorney so far.

- List what you still owe.

- If you seek fees, note that here.

- The court will weigh need and ability to pay.

13) Self-employment details

- Attach a recent profit and loss statement.

- Show gross receipts and ordinary business expenses.

- Identify any depreciation claimed.

- Note any one-time business costs separately.

- Match months covered to the 12-month average used.

- Bring backup, like invoices and bank statements.

14) Special circumstances

- Use an attachment to explain income changes.

- Describe layoffs, new jobs, or schedule cuts.

- Explain health issues that affect work.

- Explain seasonal income patterns.

- Keep it factual, brief, and supported by documents.

15) Attachments checklist

- Two months of pay stubs for each job.

- Proof of health insurance premiums.

- Childcare invoices or provider statements.

- Proof of support paid for other cases.

- Profit and loss if self-employed.

- Any document that supports a claimed amount.

- Black out full account numbers on statements.

16) Review for accuracy

- Check math on totals and averages.

- Confirm each income category is addressed.

- Make sure deductions match pay stubs.

- Ensure expenses are monthly, not annual totals.

- Verify attachments align with the listed amounts.

17) Sign and date

- Read the declaration statement carefully.

- Sign your name under penalty of perjury.

- Date the form with the day you sign.

- Your signature certifies accuracy and completeness.

18) Make copies

- Make at least two copies for your records.

- One is for the court, one is for service.

- Keep a clean copy for your hearing.

19) File and serve

- File the original with the court clerk.

- Serve a copy on the other party.

- Include it with your request or response papers.

- Complete and file a proof of service form.

- Follow local deadlines for your hearing.

20) Update when needed

- Update the FL-150 if your income changes.

- Update if significant expenses change.

- File an updated form before each support hearing.

- Judges expect a current and complete declaration.

Practical tips:

- Use gross amounts unless the form asks for net.

- Average irregular pay rather than picking a peak month.

- Do not pad business expenses with personal costs.

- Separate child-only insurance premiums when you can.

- Be consistent across your form and attachments.

- If you estimated, say so and explain your method.

- Bring backup documents to the hearing.

Common mistakes to avoid:

- Leaving income categories blank without “$0.00.”

- Reporting net pay as gross wages.

- Forgetting to include overtime or bonuses.

- Mixing annual totals with monthly figures.

- Omitting public benefits or side income.

- Listing voluntary retirement as “mandatory.”

- Claiming children’s costs without proof.

- Failing to attach pay stubs.

If you have very simple finances, a shorter form may exist. Still, courts often prefer the FL-150. It captures more detail. It reduces follow-up questions. It helps your case move faster.

Finally, remember your audience. The judge needs clear numbers. They need reliable proof. They need a form that matches your story. Provide a complete, honest snapshot. You will help the court reach a fair order.

Legal Terms You Might Encounter

You sign FL-150 under penalty of perjury. This means you swear the information is true to the best of your knowledge. If you knowingly lie, the court can sanction you. You disclose both gross income and net income on this form. Gross income is what you earn before taxes and deductions. Net income is what you take home after required deductions. The form also separates mandatory deductions from voluntary ones. Mandatory deductions include taxes, Medicare or Social Security, and required retirement or union dues. Voluntary deductions include optional retirement contributions and loan repayments.

If you run a business or freelance, you report self-employment income. List gross receipts, ordinary and necessary business expenses, and your net monthly profit. The court may ask for a profit-and-loss statement to back up these numbers. Many people forget to include irregular income. Irregular income means bonuses, overtime, commissions, and tips. You should average irregular income across months to give a fair monthly figure. The form also asks about add-on child support costs. These are extra child expenses like child care and uninsured health costs. They can be split between parents on top of the base child support.

You will see the terms assets and debts on FL-150. Assets include cash, bank accounts, investments, and other property you own. Debts include credit cards, loans, and other amounts you owe. These help the court understand the ability to pay. The form also ties into the guideline child support. Guideline refers to the formula the court uses to estimate support. Your disclosures on FL-150 feed into that calculation. Filing and service are procedural terms that matter here. Filing means submitting your signed FL-150 to the court. Service means delivering a copy to the other party by an approved method. Another term you may see is stipulation. That is a written agreement between parties. If you and the other party agree on support, the court can use your FL-150s to confirm the numbers. Finally, you may hear about arrears. Arrears are unpaid support amounts that have built up. Accurate income and expense disclosure can affect how the court addresses arrears and future payments.

FAQs

Do you have to attach pay stubs to FL-150?

Yes. Attach your pay stubs for the last two months. If the amounts vary, average them. If you receive bonuses or commissions, include proof. If you are self-employed, attach a recent profit-and-loss statement. If you have benefits like unemployment or disability, attach the latest benefit letter.

Do you fill out FL-150 if you are unemployed or have no income?

Yes. You still complete the form. List zero income where appropriate and explain your situation. Include unemployment benefits, severance, or cash assistance if you receive any. If you have no income and rely on others, state who helps and how much. List your current monthly expenses based on your actual needs.

Do you include overtime, bonuses, and tips on the form?

Yes. Include all income, even if it is irregular. Average overtime, bonuses, commissions, and tips over a reasonable period, such as the last 12 months. If you cannot average a full year, use the most recent months and explain.

Do you include your new spouse or partner’s income?

No. You disclose your own income on FL-150. You do not add a new spouse or partner’s income. If someone helps pay your household expenses, list the monthly amount they contribute in the section that asks about others helping. Do not mix their income with your own.

Do you need to disclose all assets and debts?

Yes. Estimate your current balances for cash, accounts, investments, and other assets. Also, list your debts and minimum monthly payments. This gives the court a full financial picture. If you do not know the exact balance, provide your best estimate and note that it is an estimate.

Do you list health insurance premiums and child care costs?

Yes. These items matter for support decisions. List the monthly cost you pay for health, dental, and vision insurance for yourself and any children. If the premium covers several people, estimate the portion you pay for yourself and for the children. Include monthly child care costs needed for work or job training. Attach proof if you have it.

Do you need to convert weekly or biweekly amounts to monthly?

Yes. The form is monthly, so convert. For weekly amounts, multiply by 4.333. For biweekly amounts, multiply by 2.167. For twice-monthly amounts, multiply by 2. If your pay or bills vary, average over a reasonable period and show the monthly figure.

Is the form confidential?

The form is part of the court file. Court files are generally public records. Do not include full account numbers or sensitive identifiers in attachments. Black out social security numbers and most account numbers. If you have safety or privacy concerns, consider using a safe mailing address and ask the court clerk about options available in family cases.

Do you need to update FL-150 if your income changes?

Yes. Update the form when you have a new hearing or your income changes in a meaningful way. File and serve an updated FL-150 before the hearing as required in your case. If you discover a mistake after you file, complete a corrected FL-150 and serve it promptly.

Can you e-file and e-sign FL-150?

Many courts accept electronic filing. Whether you can e-sign depends on local procedures. You must still sign under penalty of perjury. Follow your court’s filing instructions for signatures and formats. If you are unsure, file in person or by mail with a wet signature.

Checklist: Before, During, and After the FL-150 – Income and Expense Declaration

Before you sign

- Gather pay stubs for the last two months.

- Collect proof of any variable income: bonuses, commissions, tips.

- If self-employed, prepare a current profit-and-loss statement and a recent balance sheet if available.

- Locate your most recent federal tax return and W-2s/1099s for reference.

- Print recent benefit letters for unemployment, disability, or workers’ compensation.

- Pull proof of health, dental, and vision insurance premiums.

- Compile monthly child care invoices or summaries.

- Gather records for uninsured medical and dental costs for children.

- Collect education or special needs expenses for children.

- Get your mortgage or rent statement and property tax/insurance amounts if applicable.

- Gather recent utility bills: electricity, gas, water, trash, internet, and phone.

- Collect transportation costs: car payment, insurance, fuel, public transit, and parking.

- Pull credit card statements and loan statements for minimum payments.

- List any spousal or child support you currently pay for other cases.

- Check bank account balances and any investment account statements for asset disclosure.

- Note any regular contributions to your household from others.

- Decide on a reasonable averaging period for irregular income and expenses.

During completion and signing

- Confirm your case caption and case number match your other court papers.

- Use a monthly figure for every income and expense line. Convert weekly or biweekly items.

- Report gross income before taxes and mandatory deductions. Then complete the deduction section.

- Separate mandatory deductions from voluntary ones. Do not list voluntary deductions as mandatory.

- List overtime, bonuses, and commissions as monthly averages. Explain if they vary.

- If self-employed, list gross receipts, ordinary and necessary business expenses, and net income.

- Do not include accelerated or non-cash items if they overstate expenses. Use actual cash outlays.

- Enter the health insurance premium you pay for yourself and the children. Estimate allocations if needed.

- Include monthly child care and other child-related add-ons. Attach proof when possible.

- Disclose assets and debts with your best current estimates.

- Check the math on totals and subtotals across pages.

- Attach pay stubs and any supporting documents in an organized order.

- Black out social security numbers and most account numbers on attachments.

- If you need more space, add an extra page and label the line number you are continuing.

- Read the perjury declaration. Sign and date in ink if filing on paper.

After you sign

- Make two copies of the signed FL-150 and all attachments.

- File the original with the court in your case.

- Serve a copy on the other party, and on any other required parties, by the deadline in your case.

- Use an approved service method. Do not serve documents yourself if the rules require another adult to do it.

- Have the server complete a proof of service and file it if your case requires it.

- Calendar your hearing date and any service or filing deadlines.

- Bring a set of your filed FL-150 and attachments to the hearing.

- Store a complete copy in a safe place. Keep digital scans for quick reference.

- Update and refile FL-150 if your income or expenses change before the hearing.

Common Mistakes to Avoid FL-150 – Income and Expense Declaration

- Leaving out attachments. Don’t forget to attach two months of pay stubs or a profit-and-loss statement if self-employed. Missing attachments can delay your hearing or weaken your position.

- Reporting net income as gross. Don’t enter your take-home pay in the gross income line. This can make support appear lower than it should be and may draw objections or sanctions.

- Failing to convert to monthly amounts. Don’t list weekly or biweekly figures without conversion. This skews the numbers and can cause the court to distrust your entire form.

- Ignoring irregular income. Don’t omit bonuses, overtime, commissions, or tips. Average them over a reasonable period. If you skip them, the court may assume an amount less favorable to you.

- Overstating deductions. Don’t treat voluntary items, like optional retirement contributions or loan payments, as mandatory deductions. Mislabeling them can lead to corrections at the hearing or an adverse order.

What to Do After Filling Out the Form FL-150 – Income and Expense Declaration

- File your signed FL-150 with the court handling your case. Include all attachments. If you e-file, upload clear, readable scans and follow the system’s labeling rules. If you file in person or by mail, staple or clip attachments neatly behind the form. Keep the original order of pages.

- Serve the other party with a complete copy. Use a service method allowed in your case. If a third-party server is required, arrange for that person to handle the service. Track the deadline tied to your hearing date or case schedule. Do not wait until the last minute. Late service can result in a continuance or the court refusing to consider your form.

- File a proof of service if your case requires it. Make sure the proof lists every document served and the correct addresses or emails used. Check spelling and dates. A defective proof can cause a delay.

- Prepare for your hearing. Bring a clean copy set of your FL-150 and attachments. Bring extra proof for any disputed items, like overtime, bonuses, or business expenses. Have a calculator and a short summary of your monthly totals. You should be ready to explain how you calculated averages.

- Amend if something changes. If your income or expenses change before the hearing, complete a new FL-150. File and serve it as soon as possible. Label it as an updated or amended declaration to avoid confusion. Attach updated pay stubs or revised profit-and-loss statements.

- Keep records current after the hearing. If the court orders support, keep your pay stubs, benefit letters, and receipts for child-related add-ons. This helps with future modifications and with tracking what you owe or have paid. If you reach an agreement with the other party later, you can submit updated FL-150s to support that agreement.

- Finally, store everything securely. Keep a digital and paper copy of your filed FL-150, attachments, and proofs of service. Create a simple index so you can find documents fast for future hearings or settlement talks. When in doubt, keep it. You rarely regret having too much organized documentation.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.