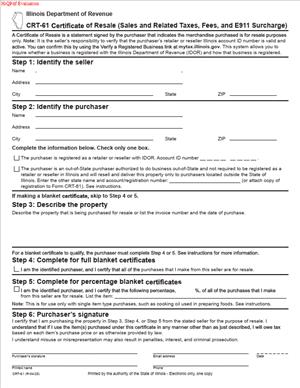

CRT-61 Certificate of Resale (Sales and Related Taxes, Fees, and E911 Surcharge)

Fill out nowJurisdiction: USA | Illinois

What is a CRT-61 Certificate of Resale (Sales and Related Taxes, Fees, and E911 Surcharge)?

The CRT-61 is Illinois’ standard certificate of resale. You give it to your supplier when you purchase items you will resell to your customers. When your supplier has a valid CRT-61 on file, they do not charge you Illinois sales tax on those purchases. You then collect and remit any tax due when you sell those items at retail. The same form also supports resale treatment for certain related taxes and fees, including prepaid wireless E911 surcharges and telecommunications-related charges, when the transaction is a sale for resale rather than an end-use sale.

You typically use a CRT-61 if you are a retailer, wholesaler, distributor, marketplace seller, or service provider that transfers tangible items to customers as part of your business. It also applies to businesses that resell prepaid wireless airtime, calling cards, or similar telecommunications products where an E911 surcharge or related fee would apply at retail. If you are buying inventory or taxable services to resell in Illinois, you will use this form.

You need this form because Illinois places the tax on the final retail sale to the end user. Purchases for resale are not end-use transactions. The CRT-61 documents that status. Without it, your supplier must treat your purchase as taxable. That would force you to pay tax on inventory, which you would not recover when you sell the goods. The CRT-61 prevents that tax-on-tax issue by shifting tax collection to the right point in the chain—your retail sale.

Typical usage scenarios

If you run a hardware store, you use the CRT-61 to buy tools, paint, and supplies for resale. If you operate a wireless store, you use it to buy prepaid wireless airtime cards for resale so your distributor does not collect the E911 surcharge or related fees from you. If you are a car audio installer, you use the CRT-61 to buy speakers and head units that you will resell to customers, even if you also install them. If you sell online and drop ship to Illinois customers, you use a CRT-61 with your drop shipper so they do not charge you tax on the items they ship for you. In each case, the form tells your supplier that you are not the end user.

The CRT-61 is not filed with the state. You give a completed copy to the seller, and both of you keep it with your records. A single form can cover one purchase, or it can serve as a “blanket” certificate for ongoing purchases of the same kind of items.

When Would You Use a CRT-61 Certificate of Resale?

You use a CRT-61 whenever you buy something you will resell in the regular course of business. That includes goods you sell as-is and items that you incorporate into other products before selling. A bicycle shop uses it to buy bikes and parts. A restaurant supply wholesaler uses it to buy cookware destined for restaurant customers. A reseller of prepaid wireless products uses it for airtime, SIM cards, and related telecommunications products that will be resold to end users, so the E911 surcharge and any related fees are properly collected at the retail level.

Service providers use the form when they transfer tangible personal property to customers as part of a service. A computer repair business uses a CRT-61 to buy replacement hard drives and RAM to resell as part of repairs. An HVAC contractor uses it for thermostats and filters sold to customers. In Illinois, these servicepersons are often liable for tax on the selling price of items they transfer to customers. The CRT-61 lets them buy those items without tax at the supplier level and address the tax when billing customers.

You also use the CRT-61 in drop shipment scenarios. Suppose you are an out-of-state retailer selling to an Illinois customer, and you ask an Illinois supplier to ship the item directly to your customer. Your supplier may accept your CRT-61 to treat the sale to you as a resale sale and avoid charging you tax. If you are not registered in Illinois, you can often provide your home-state registration number on the CRT-61; your supplier uses that to substantiate the resale status.

The form also applies to recurring wholesale purchases. If you routinely buy the same category of merchandise from the same seller, you can issue a blanket CRT-61. The seller will keep it on file and apply it to each qualifying transaction. This avoids repeated paperwork and cuts mistakes.

Do not use a CRT-61 when you are buying items for your own use. Office supplies, display racks, cleaning materials, and tools you consume in your business are taxable to you. The form only covers purchases for resale in the form of tangible items or qualifying taxable services you will sell to customers. Misusing it exposes you to tax, interest, and penalties.

Legal Characteristics of the CRT-61 Certificate of Resale

The CRT-61 is legally significant because it documents a sale for resale. Illinois tax law allows a seller to forgo charging tax if the seller takes a proper resale certificate in good faith. “Good faith” means the certificate appears complete and regular on its face and the seller has no reason to doubt its validity. When a seller relies on a valid CRT-61, the tax obligation shifts to the purchaser to collect and remit tax on the subsequent retail sale.

A CRT-61 is legally binding on both parties. You sign it under penalties of perjury. You attest that your purchases covered by the certificate are for resale and that your registration information is true. If you misuse the form, you can be assessed the tax that should have been paid, plus applicable interest and penalties. Your supplier can also be held liable if they accept a certificate that is clearly incomplete, fraudulent, or not taken in good faith. That is why suppliers insist on accurate registration numbers, clear descriptions of the items being purchased, and a signature by an authorized person.

Enforceability rests on proper completion, retention, and use. The form must identify the purchaser and seller, include a valid registration or explanation of why the purchaser is not required to register, and describe the goods or services being purchased for resale. It must be signed and dated. The seller must keep the certificate in their records and be able to match it to the invoices it supports. If the form is blanket in scope, it must describe the kind of property covered, and the seller should apply it only to purchases that fit that description.

There is no routine filing of the CRT-61 with the state. But it must be available on audit. Illinois requires sellers to keep supporting records for a defined retention period. If a seller cannot produce a valid CRT-61 for a tax-exempt sale, the state can assess the tax against the seller. That recordkeeping rule is what gives the form its practical force. Sellers have a strong incentive to collect and maintain accurate certificates.

The form also intersects with related taxes and fees. Some products have charges that function like taxes but are administered separately, such as prepaid wireless E911 surcharges. The CRT-61 supports the resale position for those items, too. It confirms that the sale is not to the end user, so the charge should not be collected at that stage. This alignment ensures that the right party charges the surcharge on the final retail transaction.

How to Fill Out a CRT-61 Certificate of Resale

1) Confirm that your purchase qualifies as a sale for resale.

Review what you are buying and how you will use it. If you will resell the same item, or you will resell it as a component of a product you sell, the CRT-61 applies. If you will use the item in your business, it does not. For telecommunications and prepaid wireless, confirm that the transaction is wholesale and that you will resell the product or service to end users or other resellers. If that is true, the CRT-61 will cover any associated sales tax, related fees, or E911 surcharge that would otherwise apply at retail.

2) Decide whether you need a single-purchase or blanket certificate.

Use a single-purchase certificate if you are making a one-time buy of specific items. Use a blanket certificate if you make recurring purchases from the same supplier. Blanket certificates remain effective until revoked and apply to the type of property described on the form. Suppliers often request a refresh periodically. If your product mix changes, issue a new certificate with an updated description.

3) Enter the purchaser’s information exactly as it appears on your tax registration.

List your legal business name and any trade name you use for sales. Provide your business address where you are registered for tax. Include your phone number. Use consistent, current information so your supplier can verify your status quickly.

4) Provide your registration number and state.

If you are registered in Illinois, enter your Illinois sales tax Account ID. If you are not registered in Illinois but are registered in another state where you make retail sales, enter that state’s sales tax registration number and name the state. If you are not required to be registered anywhere for this type of transaction, explain why. For example, a wholesaler with no retail sales may not be required to register. Be specific. Your supplier relies on this disclosure to accept the certificate in good faith.

5) Identify the seller.

Fill in the supplier’s legal name and address. This ties the certificate to the vendor who will rely on it. If you issue a blanket certificate, name the specific supplier who will apply it. Do not leave this field blank or generic. A certificate naming “various vendors” is not reliable. If you buy from multiple suppliers, prepare a separate CRT-61 for each one.

6) Describe the property or service you are purchasing for resale.

Be clear and specific. Avoid vague phrases like “all purchases” or “anything we buy.” Instead, describe the category of goods or services. For example, “Consumer electronics inventory, including laptops, tablets, accessories, and components,” or “Prepaid wireless airtime, SIM cards, top-up vouchers, and related telecommunications products for resale,” or “Automotive parts and audio equipment for retail sale and installation.” This description controls how the seller applies the certificate. If an item falls outside the scope, the seller should charge tax.

7) State whether the certificate is single-use or blanket.

Most CRT-61 formats provide a checkbox or a line to mark the type. For a single-use certificate, reference the purchase order or invoice number and the date. For a blanket certificate, indicate that it covers all future purchases of the described property until revoked. If your supplier’s form includes an expiration date field, enter a practical refresh date as agreed with the supplier.

8) If your purchases include related taxes, fees, or E911 surcharges at retail, clarify the resale application.

For telecommunications and prepaid wireless products, add a short note in the description indicating resale status for those charges. For example, “These items are purchased for resale. Any applicable telecommunications excise, infrastructure maintenance fees, and prepaid wireless E911 surcharge apply at retail sale by us.” This instruction helps your supplier match the resale treatment to non-standard charges tied to the product.

9) Indicate your type of business and resale intent.

Many CRT-61 versions ask for your line of business and how you will use the items. Provide a short, direct statement, such as “Retail electronics store reselling inventory in the ordinary course of business,” or “Wireless reseller reselling prepaid airtime to end users,” or “HVAC contractor reselling thermostats and parts as part of customer jobs.” This supports your resale claim and shows the supplier why the purchase is not end-use.

10) Sign and date the certificate.

The signer must be an owner, partner, corporate officer, member, or employee authorized to bind the business. Sign your name, print your name and title, and enter the date. You are signing under penalties of perjury, so confirm that all information is accurate. If you issue the certificate electronically, use a method that captures a reliable signature and date. Many suppliers accept electronic versions if they can retain a clear copy.

11) Give the certificate to the seller and keep a copy.

Provide the CRT-61 before or at the time of purchase. Your supplier should verify that the form is complete, legible, and signed. You should keep a copy in your records. If your information changes—business name, address, registration status, or product mix—issue an updated CRT-61 right away. Do not wait for an audit or a tax notice.

12) Match invoices to the certificate scope.

When you receive invoices with tax removed, check that the items fall within your description on the CRT-61. If your supplier missed applying the certificate, ask for a corrected invoice. If an item is not covered by your description, accept the tax. Do not pressure the supplier to stretch the certificate to non-qualifying items. That creates exposure for both of you.

13) Maintain records for the full retention period.

Keep your CRT-61s with related purchase invoices and purchase orders. Organize them by vendor and certificate type. Illinois audits often focus on exempt sales and purchases. If you can quickly produce a valid CRT-61 for each tax-free purchase, you minimize audit risk. Keep records for at least the statutory retention period measured from the later of the return due date or filing date.

14) Refresh blanket certificates as a best practice.

While a blanket certificate can remain valid until revoked, suppliers often request updated certificates. Refresh every few years or when you change addresses, entity type, registration numbers, or product lines. A refresh shows ongoing diligence and reduces disputes.

15) Avoid common errors that invalidate the certificate.

Do not leave the seller’s name blank. Do not omit your registration number without a clear, valid reason. Do not use a personal name or home address for a business purchase. Do not use a CRT-61 for items you consume, like packaging equipment or store fixtures. Do not write “all purchases” or “various items” in the description. Be precise and truthful.

Real-world example

You operate a convenience store that sells prepaid wireless top-ups. You buy top-up vouchers from a distributor. To avoid being charged the prepaid wireless E911 surcharge and related fees on your wholesale purchase, you complete a CRT-61. You identify your Illinois Account ID, describe the items as “Prepaid wireless top-up vouchers and related telecommunications products for resale,” and issue a blanket certificate. The distributor removes the surcharge and sales tax on your purchases. When you sell a top-up to a customer, you collect the E911 surcharge and any taxes or fees required at retail and remit them with your returns.

Another example: You are an online retailer in another state selling kitchen appliances to Illinois customers. You buy inventory from an Illinois wholesaler who drop ships directly to your customers. You provide a CRT-61 with your home-state registration number and a description of “Small kitchen appliances for resale.” The wholesaler treats your purchase as a sale for resale and does not charge you Illinois sales tax. You handle any tax obligations tied to your retail sale.

A service example: You are an auto repair shop. You use a CRT-61 to buy alternators and brake pads for resale as part of repair jobs. Your supplier does not charge you tax on those items. You bill customers for the parts and the labor, and you calculate and collect tax on the parts you transfer, as required. The CRT-61 ensures the tax triggers at the right place—your retail transfer of the parts.

If the supplier refuses your CRT-61 because it is incomplete or unclear, correct it rather than press for an exception. A clean, accurate certificate protects both sides. It proves your resale intent and allows the seller to treat the transaction as exempt. If your business model involves complicated bundles, such as service plans with devices, speak with the seller about how to word the description so it matches how you invoice customers. Your goal is to tie the certificate to the exact categories you will resell, including any related fees or E911 surcharges that apply only at retail.

Finally, remember your downstream duties. The CRT-61 does not eliminate tax; it defers it to your retail sale. You must register as required, collect tax or applicable surcharges from your customers, file returns on time, and keep accurate records. If you later decide to use inventory for your own business, treat that as a taxable withdrawal and accrue use tax. Keeping these obligations in view avoids costly assessments and maintains your good standing.

Legal Terms You Might Encounter

- Certificate of resale means a buyer’s signed statement that a purchase is for resale, not use. On CRT-61, you issue this certificate to your supplier so they do not charge tax or related fees that apply to end users.

- Resale means you buy an item or service to sell or lease it to someone else. You are not the final consumer. On CRT-61, you confirm this intent in the description field and by checking the resale purpose.

- Tangible personal property means physical goods you can touch and move. Many CRT-61 uses involve goods, like inventory for retail sale. Your description should match the type of goods you resell.

- Telecommunications services mean phone, VoIP, or data transmission sold as a service. CRT-61 can cover wholesale telecom purchases for resale. It signals that end-user taxes and the E911 surcharge will apply when you bill customers, not when you buy.

- E911 surcharge is a fee on certain telecom services to support emergency systems. If you buy telecom for resale, CRT-61 tells the supplier not to collect this fee from you at wholesale. You later collect applicable charges from your customers.

- A blanket certificate means one certificate that covers a series of qualifying purchases. On CRT-61, you can issue a blanket version to a vendor you use often. It remains in effect until you revoke it or your details change.

- Single-purchase certificate means a certificate tied to one order or invoice. You use this when you rarely buy from a vendor or when the resale purpose is narrow. You list the specific items or services on CRT-61.

- Illinois Account ID means your state sales tax registration number. It links your business to its tax account. On CRT-61, you include a valid registration number or other allowed identifier to prove you can buy for resale.

- Good-faith acceptance means the seller has enough detail to believe your resale claim. They rely on your complete CRT-61 to avoid charging tax and related fees. If your certificate is vague or wrong, the seller can reject it.

- Drop shipment means a vendor ships to your customer at your request. You still resells the goods, but you never handle them. CRT-61 helps the drop shipper document why it should not charge tax to you on that resale.

- Use tax means a tax on using or consuming goods when sales tax was not paid. If you use an item you bought with CRT-61, the purchase stops being for resale. You owe tax on that non-resale use.

- Exempt organization vs. resale means different bases for not paying tax at purchase. Resale is not about entity status; it is about intent to resell. Use CRT-61 for resale. Do not use it to claim other exemptions without proper proof.

FAQs – CRT-61 Certificate of Resale

Do you need a state registration number to use CRT-61?

Yes, you generally need a valid sales tax registration. You enter the number on the form to prove you buy for resale. If you are registered in another state, you usually include that number and state. If you are not required to register, explain your status clearly and expect vendor review.

Do you have to fill out a new CRT-61 for each purchase?

No. You can issue a blanket certificate to a vendor you use often. It covers ongoing qualifying purchases. You should refresh it if your business details, products, or registration change. You may also use a single-purchase certificate for one-time orders.

Do you need to describe every product you might buy?

No, but you must describe the resale category clearly enough for good faith. State the type of goods or services you purchase for resale. Avoid catch-all phrases with no context. Tie your description to your lines of business.

Do services qualify, or is the certificate only for goods?

Goods commonly qualify when you buy them for resale. Some services also qualify when you resell the same service, such as telecom. If you are reselling a service, identify the service type on CRT-61. Clarify how you resell it to end users.

Do you need to charge customers taxes or fees later if you use CRT-61 now?

Yes, if the items are taxable when sold to end users. When you buy for resale, you do not pay tax or certain fees at wholesale. You later collect the proper taxes and surcharges from your customers and remit them.

Do you need wet ink, or will an electronic signature work?

Most vendors accept electronic signatures if they can verify the signer and the integrity. The form needs a signature, printed name, title, and date. Confirm your vendor’s acceptance before sending.

Do out-of-state resellers need an in-state registration to use CRT-61?

Not always. Many vendors accept an out-of-state registration on CRT-61 for a resale transaction. Some vendors may require more support, such as proof of resale activity. Check with the vendor in advance.

Do you need to retain copies of CRT-61?

Yes. Keep a copy for your records and align with your retention policy. Vendors also keep your certificate to support the tax treatment. Retain matching documentation, like invoices and resale agreements, in the same file.

Checklist: Before, During, and After the CRT-61 Certificate of Resale

Before signing

- Confirm you are buying for resale, not consumption or internal use.

- Verify your legal business name and any “doing business as” name.

- Confirm your business address and contact details.

- Gather your Illinois Account ID or other valid registration number.

- If registered in another state, note that state and registration number.

- Identify the vendor’s legal name and address.

- List the types of goods or services you resell.

- Decide if this is a blanket or single-purchase certificate.

- Identify the location(s) where resales will occur, if relevant.

- For telecom, confirm the service will be resold to end users.

- Ensure the signer has authority to bind your business.

- Review your most recent tax filings to confirm your registration is active.

During signing

- Enter your business name, address, and contact information exactly as registered.

- Enter your registration number without transposition errors.

- Select blanket or single-use and mark the appropriate box or wording.

- Provide a clear, specific description of resale items or services.

- Include vendor name and address as it appears on quotes or invoices.

- Date the certificate and sign it with your name and title.

- If using out-of-state registration, identify the state clearly.

- Confirm that the resale scope matches your actual operations.

- Check any boxes or sections related to telecom and E911 surcharge, if applicable.

- Avoid overly broad terms like “all purchases,” unless fully accurate and defensible.

- Attach addenda only if needed, and label them clearly.

After signing

- Send the completed certificate to the vendor securely.

- Keep a copy with your purchase records and vendor file.

- Link the certificate to invoices and purchase orders in your system.

- Note the effective date and, if blanket, a review date on your calendar.

- Train purchasing staff to use the correct vendor certificate on file.

- Monitor for changes in your business name, address, or registration status.

- If your eligibility changes, promptly give written notice to vendors.

- Periodically re-verify vendor acceptance and the resale categories listed.

- For telecom resales, align your customer billing with taxes and the E911 surcharge.

- Store records per your retention policy and be ready for audits.

Common Mistakes to Avoid CRT-61 Certificate of Resale

- Using CRT-61 for items you consume internally

Consequence: You may owe tax with penalties and interest. The vendor could be assessed if your claim is invalid. Don’t forget to pay use tax if you pull resale inventory for your own use.

- Providing a vague or overbroad description

Consequence: The vendor may reject the certificate or charge tax. Auditors may disallow the exemption. Don’t forget to align your description with your actual resale lines.

- Missing or invalid registration information

Consequence: The vendor may suspend tax-free sales to you. You may face an assessment if audited. Don’t forget to confirm your account number is active and correct.

- Failing to sign and date the certificate

Consequence: An unsigned or undated certificate often fails to support. Vendors may treat the sale as taxable. Don’t forget the printed name and title of the signer.

- Treating a blanket certificate as “set and forget”

Consequence: Stale details undermine good-faith reliance. Changes in your business can void support. Don’t forget to refresh certificates when details or resale scope change.

What to Do After Filling Out the Form CRT-61 Certificate of Resale

- Send the certificate to your vendor. Do this before or at the time of the purchase. Ask the vendor to confirm receipt and acceptance.

- File a copy with your purchasing records. Keep it with the vendor master file, purchase orders, and invoices. Cross-reference the certificate number or date so staff can locate it quickly.

- If you issued a blanket certificate, schedule periodic reviews. Set a reminder to confirm that your registration and resale lines remain the same. Replace the certificate if anything changes, including your business name or address.

- If you discover an error, fix it fast. Prepare a corrected certificate, sign and date it, and mark it “replaces prior certificate dated [date].” Send it to the vendor and keep a copy.

- If you used the certificate in error, notify the vendor. Ask the vendor to charge tax on the affected purchase, or self-assess the appropriate tax. Document how you corrected the mistake.

- For drop shipments, coordinate with all parties. Provide the certificate to the shipping vendor. Ensure the ship-to information matches the customer on your resale invoice.

- For telecom resales, align your downstream billing. You should collect applicable taxes and the E911 surcharge from your end users. Reconcile billed amounts with your returns.

- Train your team. Make sure purchasing, accounts payable, and sales tax staff know when to use a CRT-61. Provide examples of qualifying and non-qualifying purchases.

- Maintain an audit-ready file. Keep the certificate, proof of your registration status, purchase documentation, and resale invoices. Confirm that the items purchased match your resale description.

- If you close or change entities, notify vendors. Issue new certificates if your legal name, registration, or tax ID changes. Revoke old certificates in writing to avoid confusion.

- If a vendor refuses your certificate, ask why. Clarify your resale description, provide registration support, or use a single-purchase certificate tied to a specific order. Escalate internally if needed.

- Plan for renewals. While blanket certificates do not always expire by rule, vendors may require refresh cycles. Agree on a cadence, such as annually or biannually.

- Document internal controls. Require approval for new vendors and review of new certificates. Log issuance dates, types (blanket or single), and the signer’s name and title.

- Monitor for mixed-use items. If you sometimes resell and sometimes consume the same item, track usage. Pay use tax on non-resale withdrawals from inventory.

- Prepare for questions from auditors. Be ready to explain how your business resells the listed items or services. Keep sample customer invoices that show resale to end users.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.