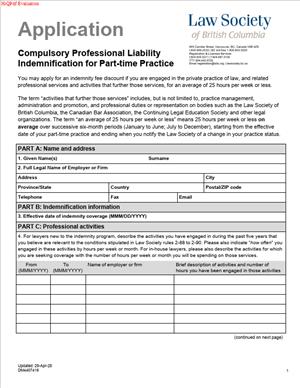

DM4407416 – Application for Compulsory Professional Liability Indemnification – Part-time Practice

Fill out nowJurisdiction: Country: Canada | Province or State: British Columbia

What is a DM4407416 – Application for Compulsory Professional Liability Indemnification – Part-time Practice?

This form is the Law Society’s application for compulsory professional liability indemnification when you practise part-time. You use it to confirm that you will practise law on a part-time basis. You also use it to secure the mandatory indemnity coverage that applies to your practice in British Columbia.

The form gathers details about you, your practice setting, and your expected hours. It records your areas of practice, your claims history, and your proposed start date. It includes your declaration that the information is true and complete. It also includes your consent to the program’s terms and conditions.

Who typically uses this form?

Practising lawyers in British Columbia who meet the Society’s definition of part-time practice. That includes sole practitioners who have scaled down. It includes associates who have reduced hours. It includes lawyers returning from leave who plan limited practice. It includes in-house counsel with a small external practice. It includes semi-retired lawyers who maintain a modest file load. It can also include contract or locum lawyers working on defined, limited schedules.

You would need this form if you plan to practise law in British Columbia, but not full-time. All practising lawyers must hold the compulsory indemnification, unless they qualify for an exemption. Part-time practice is eligible for a specific category under the program. The form lets you apply for that category so the insurer can set your coverage and premium. It also ensures your coverage aligns with how you actually practise.

Typical usage scenarios

- You are returning from parental leave and will work three days per week.

- You leave a full-time role and open a part-time solo practice.

- You accept a part-time academic role and keep a few private files.

- You are an in-house lawyer who does limited pro bono or external work.

- You are easing into retirement and will only handle select matters.

In each case, you still provide legal services to clients and need coverage. The form places you in the correct indemnification stream for that practice profile.

When Would You Use a DM4407416 – Application for Compulsory Professional Liability Indemnification – Part-time Practice?

You use this form when you plan to carry on practice on a part-time basis during a policy year. The most common time is at annual renewal, when you set your coverage for the new year. It is also used mid-year if your practice changes from full-time to part-time. It applies when you reinstate to practicing status with a limited schedule. It applies when you transfer firms and reduce your workload below the program threshold. It applies when you return from leave and limit your files to a small number. It applies when you maintain a small practice while holding another role.

Typical users include sole practitioners, associates, counsel, and in-house lawyers who also serve external clients. It includes contract and locum lawyers with limited engagements. It also includes retired or semi-retired lawyers who practice occasionally. You would not use this form if you are non-practicing or exempt from the program. You would not use it if you expect to practice full-time for most of the policy period. In that case, you apply for the standard compulsory indemnification category.

Timing matters. You should submit the form before your intended start date. Do not assume coverage will adjust automatically. If you switch to part-time mid-year, you file this form when the change occurs. If your hours rise above the part-time threshold during the year, you must notify the program. The program will move you back to the full-time category from the date of change. Coverage cannot be backdated to fix gaps that arise from late reporting. File early, confirm acceptance, and keep proof of your effective date.

Legal Characteristics of the DM4407416 – Application for Compulsory Professional Liability Indemnification – Part-time Practice

This application has legal consequences. Your statements are relied upon by the Law Society and the indemnification program. They affect the coverage offered to you and the premium you pay. When you sign, you certify that the information is accurate and complete. You also acknowledge your duty to update the program if your practice changes. This duty continues throughout the policy period.

The coverage that follows approval is a binding insurance contract. It is compulsory indemnification issued to practicing lawyers in British Columbia. The policy responds to claims that arise from your professional services as a lawyer. The policy is typically written on a claims-made basis. That means it responds to claims first made and reported during the policy period. Prior acts coverage generally depends on your continuous participation in the program. The retroactive date on your file is important. It reflects the earliest date from which your prior acts are covered. Interruptions can affect that date. You must disclose prior coverage and any gaps so the program can assess continuity.

Enforceability flows from the Society’s regulatory authority and the policy terms. The program issues coverage based on the information you provide. The program can adjust, deny, or rescind coverage if material facts are misrepresented or withheld. For example, failure to disclose a known potential claim can affect coverage for that matter. Under-reporting practice hours to qualify as part-time can lead to reclassification. It can also lead to premium adjustments and discipline consequences. Accuracy is critical. Keep contemporaneous records of your practice hours and activities. If the program audits your file, you will need those records.

General legal considerations also apply. The policy includes exclusions and conditions. Examples include exclusions for dishonest acts, fines and penalties, and business pursuits outside legal services. There may be limits related to services in other jurisdictions or through non-licensed entities. Defense costs and indemnity payments are subject to policy limits and deductibles. Some areas of practice carry higher risk and stricter underwriting. Real estate, securities, and plaintiff personal injury often fall in that group. If you work in those areas, describe your controls and supervision arrangements. Strong file management and conflict systems can support your application.

Privacy and consent clauses appear in the form. You consent to the collection and use of your information for underwriting and claims administration. You authorize the program to verify details with your firm or prior insurers when needed. You also agree to notify the program promptly of any material change. That includes changes in hours, practice areas, firm affiliation, or jurisdiction.

How to Fill Out a DM4407416 – Application for Compulsory Professional Liability Indemnification – Part-time Practice

Start by blocking time to complete the form carefully. Most delays come from missing information. Have your records and dates ready before you begin.

Step 1: Confirm your eligibility and timing.

- Decide your intended start date for part-time coverage. Confirm that your expected hours fit the part-time category for the period. The program assesses average weekly practice hours across the policy period. Administrative tasks and marketing often count toward practice hours if tied to active files. Pro bono legal work can also count. Keep your estimate conservative and supportable. If you will exceed the threshold in any sustained way, apply for standard coverage instead. If your status changes mid-year, apply on the change date and keep proof.

Step 2: Gather required information and documents.

- You will need your Law Society membership number and contact details. Gather your firm name and address, or your solo practice address. List other firms where you will work, if any. Prepare your practice areas and the percentage of time for each. Pull your prior claims history, including dates and outcomes. Note any potential claims or circumstances you are aware of. Identify your prior insurers and your retroactive date, if known. Collect details on trust accounting activity, if you handle trust funds. Prepare a simple schedule showing your expected hours per week. Keep employment or leave letters that support your part-time status. If you are reinstating, have your reinstatement date and conditions available.

Step 3: Complete the applicant information section.

- Enter your full legal name as on the Society register. Include your Law Society member ID. Add your business address, phone, and email. If you have multiple offices, list the primary office for your practice. Confirm your preferred mailing address for notices. Ensure your contact information matches the Society’s records.

Step 4: State your practice status and effective date.

- Indicate that you are applying for part-time practice coverage. Provide the date you want coverage to start. If you are moving from full-time, use the date your hours changed. If you are reinstating or transferring, use your return-to-practice date. Avoid gaps by aligning dates with your actual work schedule. If you are unsure, select a date before you begin any legal work.

Step 5: Describe your practice arrangement.

- Identify whether you are a sole practitioner, associate, or in-house counsel with external files. Provide your firm name and the name of your supervising lawyer, if applicable. If you contract through multiple firms, list each arrangement. State if you will work remotely, in-office, or both. Confirm whether you will hold yourself out to the public as available for work. If you use a law corporation, identify the corporation.

Step 6: Declare your hours and scope.

- Estimate your average weekly practice hours for the policy period. Break down how you calculated the average. For example, three days per week at six hours per day. Indicate whether you expect seasonal fluctuations. Explain any months when you will not practice. Clarify if you will handle urgent matters outside your usual schedule. This helps the program assess whether your pattern fits part-time criteria.

Step 7: Identify your areas of practice and clients.

- Allocate your practice by percentage to core areas, such as real estate, wills, litigation, corporate, or immigration. Ensure the total equals 100 percent. Describe your typical clients, such as individuals, small businesses, or charities. Note any high-risk activities, such as issuing opinion letters or handling large transactions. Confirm whether you accept referrals and how you screen for conflicts.

Step 8: Provide trust and financial activity details.

- State whether you will receive or disburse client trust funds. Identify any trust accounts you operate or access. Confirm that you follow trust accounting rules and reconciliations. If you do not handle trust funds, state that you do not. If your firm handles trust funds for your files, clarify the firm’s role. This helps the program assess risk controls.

Step 9: Disclose prior claims and potential claims.

- List any professional liability claims made against you. Include the date, allegation, and outcome if known. If a claim is open, state that it is open and handled by the program or prior insurer. Disclose any known circumstances that might reasonably lead to a claim. Examples include missed deadlines or trust shortages. Provide a concise summary without revealing unnecessary client identifiers. Honesty here protects your coverage. The program can only respond properly if it knows the facts.

Step 10: Address prior coverage and retroactive date.

- State your prior insurers, policy periods, and whether coverage was continuous. If you have a retroactive date, list it. If there were gaps, explain why and when. If you are moving from non-practising to practicing, note the duration of the gap. The program will consider these facts when setting your coverage. If you have an extended reporting endorsement from a prior policy, indicate that.

Step 11: Confirm any external jurisdictions or special roles.

- If you will provide services related to other jurisdictions, disclose that. If you hold another licence, such as in another province, state whether you will rely on it. If you will act through a legal clinic or pro bono program, describe the scope. If any external program offers separate indemnity, note it. The program needs to know how the coverage layers or interacts.

Step 12: Read the declarations and consents.

- This section sets your legal obligations. You confirm that your statements are true and complete. You agree to notify the program of any material change. You consent to the collection and use of your information for underwriting and claims. You confirm that you understand the policy is claims-made. You acknowledge responsibilities around reporting claims promptly. Read every clause. Ask questions internally if anything is unclear.

Step 13: Sign and date the application.

- Sign the form yourself. Print your name and include your Law Society number. Date the signature. If the form asks for a second signature from a firm representative, obtain it. Some programs request a firm officer to confirm your role and hours. Keep a copy of the signed application for your records.

Step 14: Attach supporting documents.

- Attach your hour schedule or plan that supports part-time status. Include any leave or employment letters that explain your reduced hours. Provide claims summaries if requested. If you are reinstating, attach your reinstatement letter. If you run a law corporation, include the corporation registration details if asked. Label each attachment clearly.

Step 15: Submit and confirm receipt.

- Submit the completed form through the Law Society’s designated channel. Do not assume submission until you receive confirmation. Keep the confirmation with your records. If you do not receive confirmation promptly, follow up. Record the date and method of submission.

Step 16: Monitor for approval or inquiries.

- The program may contact you with questions. Respond quickly and completely. If the program requests clarification on hours or practice areas, provide detail. If you are approved, you will receive confirmation of your coverage and effective date. Share the confirmation with your firm’s administrator if needed.

Step 17: Manage mid-year changes.

- If your hours increase beyond the part-time threshold, notify the program immediately. Your coverage will move to the full-time category from the change date. Expect a premium adjustment. If your hours decrease and you seek part-time status mid-year, apply on the date of change. Keep timesheets and calendars that support your change.

Step 18: Renew annually with accurate data.

- Part-time status is not automatic year to year. Review your actual hours before renewal. If you exceeded the threshold, do not apply as part-time for the next period. Use realistic projections for the coming year. Update your practice areas and any new risk controls. Submit on time. Late submissions can cause coverage issues.

Common mistakes to avoid

- Do not underestimate hours to qualify.

- Do not omit potential claims because you hope they resolve quietly.

- Do not choose a start date after you begin working.

- Do not leave percentages that total more than or less than 100 percent.

- Do not forget to sign and date.

- Do not ignore follow-up questions from the program.

Each of these mistakes risks delays or coverage problems.

Two quick examples illustrate good practice. You are an associate returning from leave. You plan 18 hours per week for nine months, then none for three months. You apply with an effective date before your first file. Your hour calculation shows the average across 12 months. You disclose one potential limitation issue and your remedial steps. Approval follows without delay. Another example: You are a sole practitioner winding down. You will handle wills and two conveyances per month. You do not hold trust funds. You keep your hours under the threshold. You disclose a prior claim that was closed with no payment. Your plan and records support the part-time status.

Treat the form as part of your risk management. Accurate, timely information protects you and your clients. Keep your records. Update the program when your practice changes. That discipline helps ensure your coverage is there when you need it.

Legal Terms You Might Encounter

- Professional liability indemnification: This protects you if a client alleges negligence. The form asks about your practice so the indemnifier can assess your risk. You confirm you want this protection while practicing part-time.

- Part-time practice: This means you intend to work reduced hours or volume. The form asks you to declare part-time status for a set period. You must monitor your hours to stay within the part-time limits you declare.

- Claims-made coverage: This responds to claims made and reported during the coverage term. The form may ask for your start date and prior coverage. That helps align your claim reporting timeline.

- Retroactive date: This is the earliest date your past work is covered. The form may ask if you have prior coverage and when it began. Listing the correct date helps avoid gaps for earlier matters.

- Limits of indemnity: This is the maximum amount the indemnifier will pay on claims. The form may show standard limits that apply to you. Confirm that the limit matches your risk profile.

- Deductible: This is the amount you pay on a claim before indemnity applies. The form may specify a standard deductible for part-time lawyers. Know the amount so you can budget for it.

- Prior acts: These are services you performed before the current term. The form may ask if you maintained continuous coverage. You must disclose any gaps that could affect prior acts protection.

- Exclusions: These are matters the indemnifier will not cover. The form may reference excluded activities or settings. Confirm your services fit within the covered scope.

- Material change: This means a significant change in your practice details. The form expects you to update changes, like moving to full-time. Report promptly to maintain proper coverage.

- Declaration: This is your signed confirmation that your answers are true. The form ends with a declaration and signature block. Read it carefully, then sign to certify accuracy.

FAQs

Do you qualify for part-time practice under this form?

You qualify if you expect to work reduced hours or volume for the term. You should be able to track your hours and scope of work. You must also accept that your eligibility may be reviewed. If your practice becomes full-time, you must update your status. Submit an amendment as soon as your plans change.

Do you include pro bono or volunteer work in your hours?

You should count any legal services you provide to clients. That includes pro bono legal work if it uses your license. Administrative tasks that are not legal services may not count. When in doubt, record the time and keep a short note. You can then classify it correctly if asked.

Do you need to list all your practice areas on the form?

Yes. The form uses your practice areas to assess risk. List what you actually plan to do during the term. If you add a new area later, update your application. This helps avoid disputes during a claim.

Do you report changes if you exceed part-time expectations?

Yes. You must report a material change to your practice status. Notify the administrator if your hours or workload increase. Ask for a status change to full-time if needed. Doing nothing risks coverage issues on later claims.

Do you need to keep proof of your part-time status?

Yes. Keep time records and a simple monthly summary. Note hours, file counts, and key matter types. Save invoices and engagement letters. If asked, you can demonstrate part-time activity. Good records also help with renewals.

Do you need to disclose other indemnity or insurance you carry?

Yes. The form may ask about other professional coverage. Disclose any policy that covers your legal services. Include workplace programs and corporate policies. Double coverage can affect how claims are paid.

Do you need to file this form every year?

Yes, you typically reapply or renew each term. Expect to confirm current hours and practice areas. Update any new claims or complaints. Renewal is also your chance to adjust your status. Calendar the renewal date to avoid a lapse.

Do you get a lower fee for part-time practice?

Part-time status may qualify you for a reduced fee. The form collects data to confirm your eligibility. The actual fee depends on program rules. If your status changes, your fee may change mid-term. Ask about any pro-rated adjustments.

Checklist: Before, During, and After the DM4407416 – Application for Compulsory Professional Liability Indemnification – Part-time Practice

Before signing

- Confirm your planned part-time schedule for the term.

- Pull last year’s total hours and matter count.

- Prepare a simple forecast of hours and file types.

- List your current and planned practice areas.

- Gather your current start date for coverage.

- Note any gaps in past coverage or licensing.

- List any prior claims, notices, or complaints.

- Identify any other indemnity or insurance you have.

- Confirm your employment setup and firm contact.

- Note any contract or in-house roles you hold.

- Verify your contact details and preferred email.

- Prepare your business address and mailing address.

- Confirm the date you want part-time status to start.

- Check if you need to name affiliated entities.

- Have your payment method ready if fees are due.

During signing

- Verify your full legal name and license number.

- Check the effective date for part-time status.

- Confirm the retroactive date if requested.

- Ensure practice areas match your actual plans.

- Answer claims and complaint questions fully.

- Disclose any gaps in coverage or practice.

- Review declarations about accuracy and changes.

- Confirm contact details and mailing preferences.

- Read any exclusions or special conditions.

- Review the deductible and limits shown to you.

- Initial any requested confirmations or attestations.

- Sign with the required signature type and date.

- If electronic, follow the exact signing steps.

- Take screenshots or notes of confirmation screens.

After signing

- Save a full copy of the signed form as a PDF.

- Store it in a secure folder with access controls.

- Submit the form by the approved method only.

- Note the submission confirmation number.

- Calendar the renewal and follow-up dates.

- Tell your firm administrator your status and date.

- Adjust your timekeeping to track hours monthly.

- Create a trigger to alert you if nearing limits.

- Update client engagement letters if needed.

- Review your practice for excluded activities.

- Confirm fee adjustments or payment schedules.

- Ask for a coverage certificate if available.

- Verify that your listing reflects part-time status.

- Plan a mid-year check-in on your hours and scope.

Common Mistakes to Avoid DM4407416 – Application for Compulsory Professional Liability Indemnification – Part-time Practice

- Underestimating your hours to qualify for part-time. This can cause eligibility disputes and claim issues. Don’t guess. Use past data and a realistic forecast.

- Omitting prior claims or complaints. Non-disclosure can lead to denial of a claim. Don’t forget to list all matters, even if resolved.

- Leaving gaps in coverage history unexplained. Gaps can limit prior acts protection. Don’t leave blanks. Explain any lapse and its dates.

- Selecting the wrong effective date. A bad start date can create uncovered work. Don’t backdate or choose a date you cannot support.

- Failing to update after your practice grows. Unreported changes can void terms. Don’t wait. Notify the administrator as soon as your workload increases.

What to Do After Filling Out the Form DM4407416 – Application for Compulsory Professional Liability Indemnification – Part-time Practice

- Submit the completed form through the approved channel. Use the online portal if required. If mail is required, send a clean, signed copy. Keep proof of delivery.

- Confirm receipt and status. Watch for an email or written acknowledgment. If you do not receive confirmation, follow up. Keep the confirmation with your records.

- Address fees or payment steps. If a fee applies, pay by the approved method. Note any pro-rated fees for part-time status. Save the receipt.

- Request or download your coverage confirmation. Some programs issue a certificate or notice. Save it and share it with your firm if needed. Keep it with your license records.

- Adjust your internal controls. Set up timekeeping to track hours monthly. Use a threshold alert for part-time limits. Review engagement letters to match your covered work.

- Notify stakeholders. Tell your firm manager or finance contact. Inform any contracting entities about your status. Confirm they have your current certificate if they require one.

- Monitor your practice mix. Check that you stay within listed practice areas. If you expand, update your application. Capture the date and reason for any change.

- Plan for changes mid-year. If you move to full-time, file an amendment. Confirm the new fee and effective date. Ask how this affects claims within the year.

- Correct errors promptly. If you find a mistake, submit a revised form. Include a short note on what changed and why. Keep both versions in your records.

- Prepare for renewal. Calendar the renewal window and document pull. Update hours, matters, and any new claims. Review whether part-time status still fits.

- Handle a claim or potential claim properly. If something arises, follow reporting steps right away. Provide the details requested, with dates and documents. Reporting early protects your position.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.