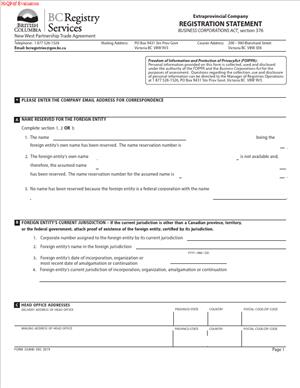

Form 33 – Registration Statement

Fill out nowJurisdiction: Canada — British Columbia

What is a Form 33 – Registration Statement?

Form 33 — Registration Statement is the application you use to register an extraprovincial company to carry on business in British Columbia. You file it with the BC Corporate Registry to create your legal presence in BC. Once accepted, the Registrar issues a certificate of registration and assigns your company a BC corporate number. That status allows you to operate, enter contracts, hold assets, hire employees, and sue or be sued in BC under your corporate name.

Who typically uses this form?

- Corporations, LLCs, ULCs, or other body corporate types formed outside BC (another Canadian province or territory, or a foreign country) that plan to do business in BC.

- Federal corporations planning to operate in BC.

- Corporate secretaries, in-house counsel, and legal assistants who handle registrations for their organizations.

- Law firms and corporate service providers acting for out-of-province clients.

Why would you need this form?

You need it when your non-BC company is “carrying on business” in British Columbia. That threshold is practical. If you have a physical presence, staff, assets, or regular operations in BC, you likely need to register before you start. Registration brings your company under BC’s corporate compliance framework. It ensures the public can find your official BC address for service and confirms you will meet ongoing reporting duties.

Typical usage scenarios

- A Delaware startup opens an office in Vancouver and hires a local team. It files Form 33 to register as an extraprovincial company.

- An Alberta construction company wins a year-long project in Kelowna. It registers before mobilizing crews and equipment in BC.

- An Ontario software firm signs multiple BC government contracts. It registers so it can invoice, pay BC taxes, and enforce contracts in BC courts.

- A UK engineering firm sets up a small branch in Burnaby to support a client facility. It registers and appoints a BC attorney for service.

By filing Form 33, you confirm your company details, appoint a BC address for legal service, and agree to keep BC records current. The form is the gateway filing that turns your non-BC corporation into a registered extraprovincial company under BC law.

When Would You Use a Form 33 – Registration Statement?

Use this form when your non-BC company crosses from occasional or incidental activity into sustained operations in BC. You should file it before you advertise, open an office, or start work. If you wait, you risk non-compliance and delays.

Common, practical triggers for registration

- You lease or buy office, retail, industrial, or warehouse space in BC.

- You place employees or contractors on the ground in BC on a continuing basis.

- You store inventory or equipment in BC for use in local projects.

- You open a local bank account linked to BC business operations.

- You obtain a municipal business licence or trade permit in a BC city.

- You sign recurring service agreements with BC customers and will perform work in BC.

- You’re awarded a BC public sector contract that requires local presence.

- You incorporate federally and intend to operate in BC as part of your rollout.

- You own or intend to acquire real property in BC in your corporate name.

Typical users

- Business owners and executives planning market entry into BC.

- In-house counsel coordinating multi-province compliance.

- Legal and corporate services teams managing entity registrations across Canada.

- External counsel and paralegals handling registrations for clients.

If you only sell into BC online without a fixed presence, registration may not be required. But once you have people, property, or repeat projects in BC, you should register. Many contracts, banking arrangements, and government clients will also require proof of BC registration as a condition to proceed.

Legal Characteristics of the Form 33 – Registration Statement

Is it legally binding?

It is a statutory filing. When you submit Form 33, you certify corporate facts to the BC Corporate Registry. The form is not a contract, but it is legally significant. The Registrar relies on your statements to grant your company legal status to operate in BC. False or misleading statements can lead to refusal, correction demands, penalties, or cancellation of registration.

What ensures enforceability?

- Statutory authority. The Corporate Registry has the power to accept, refuse, or cancel registration and to keep a public record of extraprovincial companies.

- Certification by an authorized signatory. The person who signs confirms the information is true and that they have authority to bind the company for registration.

- Appointment of an address for service in BC. You must provide a BC address where legal documents can be delivered. That makes you reachable for court proceedings and regulatory notices.

- Ongoing compliance duties. Once registered, you must keep your BC registered office current, file annual reports, and update changes to directors, name, or head office.

General legal considerations

- Carrying on business without registration can have consequences. You may be unable to enforce contracts in BC courts until you register. You may face administrative penalties and be required to back-file.

- Name conflicts. If your home-jurisdiction name is confusingly similar to an existing BC name, you may have to use an assumed name in BC. You can reserve a name before filing to avoid delays.

- Agent/attorney for service. If your company has no physical BC presence, appoint a reliable BC agent for service to receive legal documents. Keep that appointment current.

- Public record. Your registered and records office delivery addresses form part of the public record. Use business addresses that are staffed during business hours. A PO Box is not acceptable as a delivery address.

- Foreign-language documents. If your constitutional documents are not in English, provide a certified translation with your filing.

- Corporate type. Most corporations, including foreign entities, can register. If your entity type is unusual in Canada, confirm it is recognized and disclose your corporate structure as requested.

Remember: registration is permission to operate in BC, not a substitute for other approvals. You may still need municipal licences, sector permits, tax registrations, and workplace registrations.

How to Fill Out a Form 33 – Registration Statement

Before you start

- Confirm you need to register. If you will carry on business in BC, plan to file before operations begin.

- Decide on the name you’ll use in BC. If you cannot use your exact home name, obtain BC name approval for an assumed name.

- Gather corporate records. Have your certificate of incorporation or formation, any amalgamation or continuation documents, your current directors list, and proof of good standing if requested. If documents are not in English, arrange certified translations.

- Choose your BC registered office and records office addresses. These must be street addresses in BC (delivery addresses), open during business hours. You can list a separate mailing address.

- Line up your attorney for service in BC. Obtain their consent and confirm their delivery and mailing addresses.

1) Legal name of the company

- Enter your company’s full legal name exactly as shown in your home jurisdiction. Include corporate suffixes (Inc., Corp., Ltd., LLC, ULC) and punctuation. If you have an approved assumed name for BC, list it where indicated and attach the name approval details. Do not abbreviate or translate the legal name.

2) Home jurisdiction details

- State your jurisdiction of incorporation or formation (for example, Alberta, Delaware, England and Wales). Provide your home registration or incorporation number and the date of incorporation or formation. If you are the result of an amalgamation or continuation, disclose those facts and the effective date.

3) Corporate type

- Identify your entity type (corporation, LLC, ULC, limited company, or equivalent). If your entity type does not have a direct Canadian equivalent, describe it briefly and attach any explanatory schedule the form requires.

4) Head office address

- Provide the current head office address outside BC. Include full civic address and country. If the head office is in BC, you will still complete BC office sections below; the head office may be inside or outside BC.

5) Nature of business in British Columbia

- Describe, in plain terms, what you will do in BC. Example: “Software development and support,” “General construction,” “Wholesale distribution of health products,” or “Engineering consulting for mining projects.” Keep it specific but concise.

6) Date business will commence in BC

- Enter the date you expect to begin carrying on business in BC. If operations have already started, give the actual start date and be prepared to address any late filing.

7) Registered office in BC (delivery and mailing)

- Provide the BC registered office delivery address. This must be a physical location in BC where documents can be delivered in person during business hours. If you want correspondence mailed elsewhere, list a mailing address as well. Do not use a PO Box for the delivery address.

8) Records office in BC (delivery and mailing)

- Provide the BC records office delivery address, if different. This is where corporate records that must be available in BC are kept or can be accessed. Many filers use the same address for registered and records offices, often at a law firm or service provider.

9) Attorney for service in BC

- Name the individual or firm you appoint as your attorney (agent) for service. Provide their full name and BC delivery and mailing addresses. Ensure they sign the consent section. The attorney’s role is to accept legal documents on your behalf in BC.

10) Directors and officers

- List the current directors as the form requests. Provide full legal names and residential or business addresses as required. If the form requires officer information, list titles (for example, President, Secretary). If you need more space, add a schedule and cross-reference it on the form.

11) Authorization to use name (if required)

- If your BC name is similar to another registered name, attach consent or explanation as permitted. If you are using an assumed name, include the approval evidence. Ensure your signage, contracts, and invoices use the registered BC name or approved assumed name.

12) Home-jurisdiction status

- Confirm the company is in good standing in its home jurisdiction. If the form requests proof, attach a current certificate or extract. If not requested, be prepared to provide it on request by the Registrar.

13) Translations and certifications

- If any attached documents are not in English, attach certified translations. If your jurisdiction requires apostilles or legalizations for documents you export, ensure the copies you attach meet the Registrar’s certification requirements.

14) Authorized signatory

- Have an authorized officer or director sign the certification on behalf of the company. Print their name and office (for example, Director, CFO). By signing, they certify the accuracy of the information and confirm authority to bind the company for registration purposes.

15) Attorney for service consent

- Ensure your appointed attorney for service signs their consent on the form. If you appoint multiple attorneys, include an additional consent schedule if allowed, each with full addresses and signatures.

16) Payment of fees

- Calculate the filing fee and any name approval fee. Provide payment details as required by the filing method you use. Fees are generally non-refundable once processing begins.

17) Filing method

- You can file electronically or by submitting the completed paper form with payment. If filing on paper, use legible printing or type, and ensure all attachments are clearly labelled. Keep a complete copy of everything you submit.

18) Confirmation and certificate of registration

- After acceptance, you receive a certificate of registration and a BC corporate number. Save these in your corporate records. Many banks, insurers, and counterparties will ask for a copy.

Schedules and attachments you may need

- Additional directors/officers schedule if you run out of space.

- Name approval or consent schedule.

- Amalgamation or continuation details schedule.

- Certified charter documents or certificate of status/good standing, if requested.

- Certified translations for non-English documents.

- Attorney for service consent(s).

Common Mistakes to Avoid

- Using a PO Box for a delivery address. Delivery addresses must be physical BC locations.

- Omitting the attorney for service consent. The filing will not proceed without it.

- Listing a name that differs from your home jurisdiction records. Match your legal name exactly unless you have an approved BC assumed name.

- Forgetting to list all directors the form requires. Use a schedule if needed.

- Using nicknames or initials for directors when full legal names are required.

- Failing to indicate the planned start date in BC or leaving it blank.

- Not attaching translations for foreign-language documents.

After you file: ongoing obligations

- Keep your registered office and records office addresses current. File a change immediately if they change.

- File the annual report for your extraprovincial company each year by the anniversary of your registration.

- Update the Registrar when your name, directors, head office, or attorney for service change.

- Maintain your BC corporate records and be ready to produce them if required.

- Use your registered BC name or approved assumed name on contracts, invoices, signage, and marketing in BC.

Real-world examples

- Alberta contractor. You win a civil works project in Kamloops expected to last 18 months. You lease a yard and bring equipment to BC. You file Form 33, appoint your Kamloops office as the registered office, and list your Vancouver law firm as attorney for service. You receive your registration and can obtain municipal permits and open a BC bank account.

- Delaware technology company. You open a Vancouver satellite office and hire a team. Your US name conflicts with a BC company. You reserve an assumed name for BC, include it on your Form 33, and attach the name approval. You appoint a local agent for service. After registration, you complete tax and payroll registrations and sign a long-term lease.

- UK engineering firm. You staff a site office near Prince George for a multi-year client engagement. Your charter documents are in English. You attach a current certificate of status from your home registry and list all directors. You appoint a BC attorney for service and identify your records office at your BC counsel’s address. Your registration is accepted without delay.

If you prepare your information up front, you can complete Form 33 in one sitting. Confirm names and addresses, secure your BC addresses and attorney for service, and ensure your signatories are available. That reduces back-and-forth and speeds up your registration.

Legal Terms You Might Encounter

- Limited liability partnership (LLP) means a partnership where each partner’s liability is limited for certain acts of the other partners. On this form, you confirm the partnership is an LLP by using the correct name ending and completing the fields that identify it as such. This status is only effective once the registration is accepted.

- Partnership name is the legal name of the LLP you are registering. The form requires the exact name that has been approved or is available, including the required “LLP” or “Limited Liability Partnership” ending. The name must match what you’ll use on letterhead, invoices, and trust accounts.

- Registered office is the physical location in British Columbia where official documents can be delivered during business hours. The form asks for a street address (not a PO box) and, in many cases, a separate mailing address if different. This is where you’ll receive legal notices, so accuracy matters.

- Agent for service is the individual or firm in British Columbia authorized to accept legal documents for the LLP. If the form asks for an agent, you’ll list their name and BC address and confirm they consent. If you change the agent later, you must update the registry.

- Extraprovincial LLP refers to a partnership formed outside British Columbia that is registering to carry on business in the province. If you’re extraprovincial, the form will ask for your home jurisdiction, formation details, and proof you exist and are in good standing there.

- Designated representative is the person you authorize to sign and submit the form on behalf of the partnership. The form will capture this person’s name, role, and contact details. This person should be able to answer registry questions and coordinate follow-ups.

- Effective date is the date you want your registration to take effect. Some forms allow a future effective date. If you choose a future date, your LLP status starts then—not on the date of filing—so time your insurance, signage, and client communications accordingly.

- Nature of business describes what the partnership does. You’ll provide a brief description, such as “practice of law” or the specific services you’ll offer. Keep it clear and consistent with any professional approvals you hold.

- Partner particulars are the legal names and addresses of the partners in the LLP. The form typically requires a complete and current list. If a partner joins or leaves, you must file an update. Failing to keep this current can affect compliance and service of documents.

- Certificate of registration is the document you receive once the form is accepted. It confirms the LLP is registered to operate in British Columbia. Banks, insurers, landlords, and professional regulators may ask to see it, so keep both a digital and a hard copy.

FAQs

Do you need to reserve the name before filing the registration statement?

In most cases, yes. Reserving the name before filing avoids rejection for name conflicts and ensures you can use the exact name on the form. If your name includes restricted words or a professional designation, confirm any required approvals are in place before you submit the form.

Do you have to include “LLP” in the partnership name?

Yes. The name must include “LLP” or “Limited Liability Partnership.” If you omit it, the registry will likely reject the filing. Even after registration, you should display the suffix consistently on your website, signage, invoices, and trust accounts to avoid misleading clients and counterparties.

Do you need an address in British Columbia?

Yes. You must provide a BC street address for service of documents. A PO box is not enough for the registered office. If you are extraprovincial, you’ll also need to name a BC agent for service and confirm their consent.

Who can sign the form?

A designated partner or an authorized representative can sign. If the form requires a statutory declaration or certification, the signer must have authority to bind the partnership and knowledge of the facts. Use consistent signatures across all related filings to prevent holds.

How long does registration take?

Processing times vary. Online filings can be accepted quickly when complete, while manual filings can take longer. Plan for several business days. If your name approval or professional authorization is still pending, your registration will not be effective until those prerequisites are satisfied.

Do you need professional regulator approval?

If you are a regulated profession, you usually need confirmation from your regulator that the LLP structure and name are approved. Have that approval before or at the time of filing. The registry can place the filing on hold or refuse it without the required confirmation.

What if you add or remove partners later?

You must update the registry by filing a change statement within the required timeline after any change to partners, addresses, or the agent for service. Keep a checklist for onboarding and offboarding partners so you don’t miss the filing window. Insurers and your bank should also be notified.

Do you need to renew your LLP registration annually?

You must keep the registration active by filing ongoing maintenance documents required by the registry, such as annual filings and updates. Missing deadlines can lead to late fees or dissolution of your registration. Diarize due dates and assign responsibility internally.

Checklist: Before, During, and After the Form 33 – Registration Statement

Before you sign

- Confirm name availability and approval. Ensure the exact name with the “LLP” suffix is reserved and approved.

- Gather addresses. Have the registered office street address in British Columbia and mailing address (if different).

- Appoint an agent for service (if required). Confirm consent and collect their full name and BC address.

- List all partners. Full legal names, residential or business addresses, and start dates for each partner.

- Obtain professional approvals. If regulated, have proof of approval for the LLP structure and the LLP name.

- Prepare formation details. For extraprovincial LLPs, have the home jurisdiction, date of formation, and proof of good standing.

- Assign a designated representative. Choose who will sign and manage correspondence with the registry.

- Decide the effective date. Align with insurance, engagement letters, and launch plans.

- Confirm insurance. Verify that professional liability coverage aligns with LLP status and effective date.

- Review your partnership agreement. Ensure it addresses LLP-specific provisions, partner changes, and notice obligations.

During signing

- Verify the exact LLP name. Match the reserved name, including punctuation and suffix.

- Check the nature of business. Keep it brief, accurate, and consistent with any regulator approvals.

- Confirm BC addresses. Ensure the registered office is a street address accessible during business hours.

- Validate agent for service details. Name, BC address, and written consent if required by the form.

- Review partner particulars. Confirm spelling, addresses, and the completeness of the list.

- Set the correct effective date. Avoid post-dating that creates a gap in coverage or operations.

- Confirm signing authority. Make sure the signer is authorized and uses a consistent signature.

- Attach required approvals. Include regulator authorization, name approval, or certificates as needed.

- Check declarations. Ensure all certifications and statutory declarations are true and complete.

- Proofread contact details. Phone and email addresses should be current for registry questions.

After signing

- File the form with the registry. Use the accepted filing channel and pay the fee.

- Save evidence of filing. Keep submission confirmations, receipts, and copies of the form.

- Obtain the certificate of registration. Download and store it in your corporate records.

- Notify key parties. Inform your professional regulator, bank, insurer, landlord, and major clients.

- Update public-facing materials. Website, signage, engagement letters, invoices, and email signatures should show the LLP suffix.

- Register or update tax accounts. Align tax and payroll accounts with the LLP’s legal name and effective date.

- Set compliance reminders. Diarize annual filings, address changes, and partner change deadlines.

- Update internal records. Minute the registration, file regulator approvals, and store partner consents.

- Train staff. Explain how to use the LLP name and when to escalate service of documents.

- Monitor for acceptance. If you receive a deficiency notice, correct and resubmit quickly to protect your name reservation.

Common Mistakes to Avoid

Using a name without the LLP suffix

- If you leave off “LLP” or “Limited Liability Partnership,” the registry can reject the filing, and you risk confusing clients. Don’t forget to use the suffix exactly as approved across all documents and filings.

Listing a PO box as the registered office

- A PO box is not a valid registered office. If you use one, your filing can be refused or you could miss legal notices. Always provide a BC street address that is open during business hours.

Forgetting to obtain professional approval

- If your profession requires pre-approval for the LLP structure or name, filing without it will stall or fail. The consequence is delay, extra costs, and potential loss of your preferred name. Confirm approvals before you submit.

Incomplete partner information

- Omitting a partner or using outdated addresses can lead to deficiencies, late fees, or a need to refile. It also complicates service of documents. Verify every partner’s legal name, address, and effective dates.

Choosing the wrong effective date

- If you select an effective date that doesn’t align with insurance, regulator approvals, or launch plans, you can create a gap in coverage or operate without proper status. Confirm all dates align before you file.

Ignoring change and annual filing obligations

- Not filing updates when partners change, or missing annual filings, can trigger penalties or administrative dissolution. Set clear internal ownership of these tasks and use calendar reminders.

What to Do After Filling Out the Form

File the form and pay the fee

- Submit the completed form through the accepted filing channel. Pay the applicable fee and keep the receipt. If you’re filing on paper, use a trackable delivery method and keep copies.

Watch for acceptance or deficiencies

- Monitor for an acceptance notice or a deficiency notice. If you receive a deficiency, respond promptly with corrections or additional documents to avoid losing your name reservation.

Secure your certificate of registration

- Once accepted, download or request the certificate. Store it in your records book and share it with your bank, insurer, landlord, and any party that requests proof of status.

Notify your professional regulator

- If applicable, provide the certificate and any other required documentation. Confirm that your practice authorization reflects the LLP.

Update operational materials

- Revise your engagement letters, invoice templates, trust account name, website, email signatures, and marketing materials to include the exact LLP name. Replace signage and door plates where needed.

Align insurance and risk controls

- Confirm your professional liability coverage reflects the LLP structure and effective date. Update your practice management procedures to reflect the LLP’s internal approval and notice processes.

Coordinate tax and banking

- Open or update bank accounts in the LLP’s name. Align tax accounts to the LLP and confirm the responsible partner for filings and payments.

Inform clients and counterparties

- Send a concise notice to clients and key counterparties explaining the name change to an LLP, the effective date, and that services continue without interruption. Update retainer agreements for new matters to reflect the LLP.

Set up compliance routines

- Create a calendar for annual filings, registered office confirmations, and partner change deadlines. Assign responsibility and a backup. Keep a checklist for onboarding and offboarding partners that includes registry and insurer notifications.

Plan for amendments and changes

- If a partner joins or leaves, or if you change your registered office or agent for service, file the change with the registry within the required timeframe. Keep template documents ready so you can act quickly.

Maintain accurate records

- Keep copies of the filed form, approvals, certificate, annual filings, and change statements in a central digital folder and a physical records book. Record any resolutions approving the registration and subsequent changes.

Review your partnership agreement

- Make sure your agreement aligns with LLP requirements and your filing details. Address partner contributions, withdrawals, indemnities, and approval processes for changes that must be filed.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.