Form 30 – Full Restoration Application

Fill out nowJurisdiction: Country: Canada | Province/State: British Columbia

What is a Form 30 – Full Restoration Application?

Form 30 is the application you use to bring a dissolved British Columbia entity back to life on a full basis. Full restoration means the law treats the entity as if it had never been dissolved. Its legal personality revives for all purposes, not just a limited task.

You use this form when a company, society, or co‑operative registered in British Columbia has been struck or dissolved. Dissolution can happen for many reasons. Common causes include missed annual filings, voluntary dissolution that you now need to reverse, or an administrative strike for non‑compliance. If the entity still holds property, has contracts to complete, or faces claims, a full restoration may be essential.

Who typically uses this form?

Former directors, officers, or members. Shareholders of a company. Creditors who need an active entity to sue or pay. A buyer or seller stuck because property remains in the dissolved entity’s name. Executors or trustees handling estates. Insurers or lenders who need continuity for claims or security. Sometimes a lawyer or accountant files it as your agent.

Why would you need this form?

Because dissolution freezes the entity’s ability to act. Title to its property may have vested in the government by law. Banks may have closed accounts. Courts may refuse filings by or against a dissolved entity. Contracts can stall. You use Form 30 to restore the entity’s capacity, regularize title, continue litigation, and complete transactions.

Typical usage scenarios

- Your dissolved company still owns real estate. You need to transfer the land, refinance, or discharge a mortgage. Land Title Office will not accept filings from a dissolved company. Full restoration brings the company back so you can register documents.

- You discovered an outstanding tax refund or receivable after dissolution. Full restoration allows the entity to receive funds and issue receipts.

- You need to defend or start a lawsuit tied to pre‑dissolution events. Courts require a living entity. Restoration lets the entity sue or be sued.

- You dissolved a society and later found unspent grant funds with return conditions. Restoration lets the society meet those obligations and close correctly.

- You sold the business but left assets in the dissolved company. The buyer needs releases or assignments from the original entity. Restoration allows you to sign.

- You must correct a filing error that caused an unintended strike. Restoration fixes status and allows you to file missed annual reports.

- You want to reverse a voluntary dissolution after a change in plans. Full restoration revives the entity as if the dissolution never happened.

Full restoration differs from limited restoration. A limited restoration gives you a short window to do a specific act, then the entity dissolves again. Form 30 seeks a full return to active status. Choose full restoration when you need the entity back for ongoing operations, long‑term asset management, or open‑ended obligations.

In short, if a dissolved BC entity needs to act as a legal person again, this is the form you use. It restarts the clock, reopens the corporate record, and restores capacity for all purposes allowed by law.

When Would You Use a Form 30 – Full Restoration Application?

Use Form 30 any time you need the entity back in good standing for more than a single step. Think in practical terms. What must happen next, and who needs to rely on it?

If you need to convey land, you cannot sign valid transfers while dissolved. Restoration lets you complete a sale, grant an easement, or register a subdivision plan tied to the entity. If title or charges still show the dissolved entity, restoration clears the logjam.

If you need to deal with bank accounts or investments, institutions will not release funds to a dissolved entity. Full restoration allows you to appoint or confirm signing officers and access funds. You can also close accounts and distribute balances properly.

If you plan to continue business, you need the entity alive. This includes renewing permits, signing leases, or reopening vendor accounts. You may also need to re‑establish payroll or register for provincial taxes. Restoration is the first step.

If you face or plan litigation, you need a party that exists. A lender may want to enforce a guarantee. A past customer may assert a warranty claim. A director may need the company to defend an action and cover costs. Full restoration ensures proper standing.

If a dissolved entity holds intellectual property, you may need to license or transfer it. Registrars and counterparties expect a valid assignor or licensee. Restoration enables that transaction.

If you need to correct filings, you must restore first. You can then file missing annual reports, update directors, and confirm the registered office. That record of compliance protects directors and officers in later dealings.

If an entity was dissolved while it still held trust funds or third‑party property, restoration helps return or redistribute those assets correctly. It also avoids personal liability risk for individuals handling the assets.

Typical users

- Former directors or officers who need authority to act.

- Shareholders who need to protect or sell remaining value.

- Creditors who need an entity to pay or to sue.

- Buyers or sellers whose deals depend on the entity’s signature.

- Landowners or developers whose projects require clear title.

- Insurers, lenders, or escrow agents who need a valid counterparty.

- Advisors acting under a signed authorization for the interested party.

If you only need a one‑off act, like transferring a single property before winding up again, you might consider a limited restoration instead. But if the entity needs to carry on or you want the legal continuity restored fully, use Form 30.

Legal Characteristics of the Form 30 – Full Restoration Application

Form 30 is a statutory application. It does not, by itself, restore the entity. It triggers a legal process that ends with a Certificate of Restoration or an equivalent entry on the register. Once the registrar approves, full restoration is legally effective.

Full restoration has a powerful legal effect. The law treats the entity as though it was never dissolved. Contracts, rights, and obligations continue uninterrupted, subject to protections for third parties who acted during dissolution. Property that vested in the government by law can revest in the entity on restoration. The entity regains capacity to sue and be sued.

What ensures enforceability?

Clear statutory authority, proper standing, and full compliance with conditions. You must be a person entitled to apply. That usually includes a former director, shareholder, member, officer, liquidator, or a creditor with a demonstrable interest. You must provide accurate information and complete required supporting documents. You must pay restoration fees, and you may need to bring all filings current.

Name availability also matters. If another entity has taken the dissolved entity’s name, you may need a number or a new name on restoration. The register will not displace a new user of the name without legal grounds. This protects third‑party reliance on the register.

Certain consents may be necessary. If the entity owes provincial amounts or has compliance holds, the registrar may require proof of clearance or a plan. If the dissolution involved a bankruptcy, you may need consent from the trustee or evidence that the estate issues are complete. These requirements support the integrity of the register.

Accuracy is critical. You sign Form 30 with certifications that the contents are true. False statements can expose you to penalties. They can also void or delay the restoration. Always ensure the applicant has authority and evidence to support each point.

Time limits can apply. The deadline depends on why and when the entity dissolved. Some dissolutions can be restored administratively. Others require a court order. If a court order is required, the order binds the registrar and defines terms of restoration. Court‑ordered restorations often involve notice to interested parties and conditions.

In all cases, restoration becomes effective only when the registrar updates the public register and issues confirmation. From that point, third parties can rely on the entity’s status. Land titles, banks, and courts can accept filings from the restored entity.

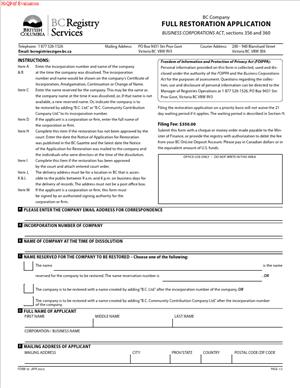

How to Fill Out a Form 30 – Full Restoration Application

Follow these steps to complete Form 30 accurately and avoid delays.

1) Confirm eligibility and the correct pathway

- Check that a full restoration is the right choice. If you need ongoing operations or broad capacity, you do.

- Confirm that an administrative restoration is available. If not, you may need a court order. If a court order is needed, prepare the order first, then file Form 30 with the order attached.

2) Gather key reference details

- Legal name of the dissolved entity as last shown on the register.

- Registration or incorporation number.

- Type of entity: company, society, or co‑operative.

- Date of incorporation or registration.

- Date and reason for dissolution or strike.

- Current name availability if you want to restore under the prior name. If the name is no longer available, choose a new name or accept a numbered name.

3) Identify the applicant and their authority

- Provide your full legal name, address, email, and phone number.

- State your relationship to the entity, such as former director, shareholder, member, creditor, or authorized agent.

- If you are an agent, attach a signed authorization from a person with standing.

- If you are a creditor, include evidence of the debt, such as an invoice, judgment, or agreement.

4) State the restoration type and reasons

- Tick or state “Full restoration.”

- Describe why restoration is required. Be specific and factual. Example: “The company owns property at [address], and we must register a transfer.” Or “The society must receive and distribute residual grant funds per agreement.”

5) Provide current registered office information

- List the proposed registered office address in British Columbia.

- Include the delivery address and the mailing address, if different.

- Ensure the location can accept service of documents during business hours.

6) List current directors or equivalent

- Provide full legal names of all proposed directors (or society directors).

- Include residential addresses and dates of appointment upon restoration.

- Confirm each director has consented to act. Keep signed consents in your records. If the form includes a consent section, complete it for each director.

7) Update records information

- If the entity has a records office separate from the registered office, provide its address.

- Confirm who holds the central records and where they can be inspected.

8) Address name issues

- If you intend to restore under the former name, state that clearly.

- If the former name is not available, provide the proposed new name. Ensure the proposed name meets naming rules and is distinctive. If in doubt, use the assigned number name and file a name change after restoration.

9) Confirm outstanding filings and fees

- Identify missed annual reports and other filings. You will need to file or bring them current as part of the process.

- Calculate statutory restoration fees and any past‑due charges. Plan payment when you file the form.

10) Disclose property and liabilities, if required

- If the form asks about property held at dissolution, list key assets. Include real property legal descriptions if you plan Land Title filings soon after.

- If there were liabilities or claims, summarize them. Keep supporting documents ready. You may need to provide them if asked.

11) Attach supporting documents

- Authorization for agent, if an agent signs or files.

- Proof of standing for the applicant, if not obvious from the public record.

- Any required clearances or consents requested by the registrar for this entity type.

- If restoration requires a court order, attach a certified copy of the order. Ensure the order clearly authorizes full restoration and any conditions.

- If directors changed since dissolution, attach a schedule listing all current directors and their consents.

12) Complete declarations and certifications

- Read the certification language carefully.

- Confirm all statements are true and complete to the best of your knowledge.

- Initial any pages that require it, if instructed by the form.

13) Sign the form

- The applicant signs. If the applicant is a company or firm, an authorized signatory signs with title.

- If the form requires a witness or commissioner, arrange the signing accordingly. Use full legal names and dates. Do not leave blanks.

14) Prepare schedules

- If you need more space for directors, offices, or property, create Schedule A, B, etc.

- Label each schedule clearly. Example: “Schedule A – Directors on Restoration.”

- Cross‑reference schedules in the main form where indicated.

15) Review for conflicts and compliance

- Confirm the registered office is a BC address and is correct.

- Confirm director residency requirements, if any, are met.

- Ensure there is no name conflict. If there is, adjust your approach before filing.

16) File the application and pay fees

- Submit the completed Form 30 with all attachments to the registrar.

- Pay the restoration fee and any outstanding charges.

- Keep copies of all documents and receipts.

17) Respond to examiner requests

- The registrar may request clarifications or additional documents.

- Respond promptly. Provide concise answers and attach requested proof.

18) Receive proof of restoration

- Once approved, you will receive confirmation of full restoration. This is often a certificate and an updated register status.

- Verify the restored name, incorporation number, and effective date.

19) Complete post‑restoration tasks

- File any overdue annual reports that remain outstanding.

- Update directors and offices if needed.

- If you restored with a numbered name but want a custom name, file a name change.

- For real estate, file any pending transfers or charges now that the entity is active.

- Notify banks, lenders, insurers, and counterparties of the restored status.

Practical tips

- Be precise about why you need full restoration. A clear reason speeds review.

- Match names and numbers to the dissolved record exactly. Small mismatches can delay processing.

- If you know you will need a new name, decide that before filing Form 30. This avoids amendments later.

- If property vested in the government on dissolution, note it in your reasons. That flags the need to revest property on restoration.

- If there is a related court proceeding, include the case style and number in your reasons. That helps link records.

Common errors to avoid

- Applying for full restoration when a limited restoration would suffice for a single act. Choose appropriately to save time and cost.

- Forgetting to list all current directors. The register should reflect the actual leadership on restoration.

- Using a P.O. box as the delivery address for the registered office. A physical address is required.

- Omitting the applicant’s authority. If you are not a director or shareholder, show your interest or attach authorization.

- Ignoring open compliance issues. If you know of outstanding filings or holds, address them early.

Form 30 is your gateway to restore full legal capacity. Complete it carefully, attach clear evidence, and plan your follow‑up filings. Once restored, act promptly to update records and complete the tasks that drove the restoration.

Legal Terms You Might Encounter

- Restoration means bringing a dissolved company or society back onto the public register. In this form, you request that status change. Once restored, the entity again has legal capacity to hold assets, sign contracts, and operate.

- Full restoration puts the entity back as if dissolution never happened. Rights and obligations revive, except where the law says otherwise. You use this form when you want full, ongoing status, not a temporary revival.

- Limited restoration is a temporary revival for a narrow purpose. It is often used to complete a lawsuit or deal with a single asset. If you want permanent status, you should apply for full restoration instead.

- Dissolution is when the public register removes the entity for not filing, not paying, or by choice. After dissolution, the name can be taken by others. Restoration reverses that removal, subject to name availability and requirements.

- Registrar refers to the government office that maintains the register of companies and societies. The registrar reviews your form and supporting documents. The registrar decides if the requirements are met and then issues the restoration.

- Registered office is the official address for legal delivery. Records office is where you keep corporate records. Your form must list a current registered and records office in the province.

- Directors are the people who manage the entity. Officers are appointed roles like president or treasurer, if used. You confirm or appoint directors in this form so the registrar knows who is in charge after restoration.

- Share structure refers to the types and numbers of shares a company can issue. Societies use members instead of shareholders. Your form may require you to confirm the structure or membership details so filings match existing records.

- Name reservation secures a legal name before restoration. If your former name is taken, you may need a new approved name. Your form should match the approved name or propose one if required.

- Affidavit or declaration is a sworn statement confirming facts that support your application. You may use it to explain why you seek restoration or to confirm searches were done. Attach it when the process requires sworn evidence.

- Court order is a judge’s order permitting restoration in specific circumstances. Some restorations proceed administratively; others need a court order. If your situation needs one, your form must reference and attach that order.

- Liability for pre-dissolution obligations means debts and contracts can revive. Full restoration usually brings back those responsibilities. Use this form with awareness of what obligations may return upon restoration.

FAQs

Do you need a new name before you file?

Only if your old name is no longer available. Search the register to confirm availability. If the name is taken, secure a different approved name first. Then use that name on your form. If available, you can restore with your former name.

Do you need a court order to restore?

Not always. Many restorations proceed administratively with this form and supporting documents. You may need a court order if the entity has been dissolved for a long time, assets moved to the government, or special circumstances exist. If an order is required, attach it and reference it in the form.

Do you need tax clearance?

The registrar may need confirmation that tax accounts are in good standing. This can include returns, payments, and filings up to the dissolution date and beyond. If the registrar requests clearance or consents, obtain them and attach the confirmations. Build time into your timeline for this step.

Do you have to file missing annual reports first?

Plan to file all outstanding reports as part of the restoration process. The registrar may require you to bring filings current up to the present year. Your application can include a plan to file missing reports and pay related fees. Expect the restoration to complete only when those filings are accepted.

Do you need to notify shareholders, members, or creditors?

You may need to notify people affected by the restoration. This can include directors, shareholders or members, and known creditors. If the process requires published notice or direct notice, follow those instructions. Keep proof of notice for your records.

Does full restoration revive contracts and assets?

Generally, yes. Full restoration usually treats the entity as if it had not been dissolved. Contracts and liabilities can revive, subject to legal limits and third-party rights. If assets transferred during dissolution, you may need extra steps to recover them after restoration.

How long does restoration take?

Timelines vary based on completeness, consents, and review volume. Simple files with complete documentation move faster. Files that need tax clearance, notices, or a court order can take longer. Build a buffer of several weeks to a few months, depending on complexity.

Do you need a local registered office and current directors at filing?

Yes. Your form must list a registered and records office in the province. You also confirm active directors who will manage the entity post-restoration. Verify addresses and consent from directors before filing to avoid delays.

Checklist: Before, During, and After the Form 30 – Full Restoration Application

Before you sign

- Confirm your entity type and number. Locate the incorporation or registration number. Match the legal name on the register.

- Check name availability. If your former name is taken, complete a name reservation for a new name.

- Gather director information. Full legal names, delivery addresses, and consents to act from all directors.

- Confirm registered and records office. Secure a street address in the province and consent from the office provider.

- Identify missing filings. List all outstanding annual reports and required updates since incorporation.

- Review financial obligations. Identify unpaid fees, penalties, and arrears. Estimate costs to bring filings current.

- Collect supporting documents. Affidavits or declarations, proof of name reservation, consents, or tax confirmations if requested.

- Review reason for restoration. Prepare a clear statement of purpose that aligns with full restoration (ongoing operations).

- Check asset and contract status. Make note of assets, licenses, and contracts impacted by dissolution.

- Confirm if a court order is needed. If yes, obtain the order and certified copy for attachment.

During signing

- Verify entity details. Legal name, incorporation or registry number, and type must match the public record.

- Confirm the restoration type. Tick or state “full restoration,” not limited restoration.

- Check directors and offices. Ensure each director’s name and address are correct. Confirm the registered and records office.

- Cross-check dates. Ensure the dissolution date and any key dates are correct and consistent.

- Attachments match the form. Number and label affidavits, consents, name reservation, and any order.

- Signing authority. Ensure the signer has authority (director, authorized applicant, or legal representative). Use the correct signature block.

- Sworn statements. If a declaration or affidavit is required, sign before the appropriate witness or officer.

- Payment details. Confirm fee amount and payment method. Include any service request numbers if required.

After signing

- File the form promptly. Submit the form, attachments, and fees in the manner required by the registrar.

- Track submission. Record the filing date, confirmation number, and a copy of the submission.

- Respond to examiner requests. If the registrar asks for more information, respond quickly and completely.

- File outstanding annual reports. Submit missing reports and pay late fees until the entity is current.

- Update internal records. Record new directors, office addresses, and the restoration date in your minute book.

- Notify stakeholders. Inform banks, insurers, landlords, key suppliers, and major clients of the restoration.

- Recover assets and access accounts. Use the restoration evidence to reinstate accounts and title where applicable.

- Calendar future deadlines. Schedule your next annual report deadline and any internal governance meetings.

- Store proof. Keep the approved restoration, filed form, and all correspondence in secure records.

- Review contracts. Confirm the status of leases, licenses, and agreements to ensure compliance post-restoration.

Common Mistakes to Avoid

- Using the wrong restoration type

- If you choose a limited restoration when you need full, you will face limits on operations. You may need a second application. Don’t forget to select “full restoration” and confirm ongoing business plans.

- Missing or outdated director and office details

- Incorrect names or addresses cause examination delays or rejection. Banks and partners rely on the registry. Verify each director and the registered and records office before filing.

- Skipping name availability checks

- If your old name is taken, the registrar will not restore under it. You will lose time and may incur extra fees. Search the register and secure a new name early when needed.

- Ignoring outstanding filings and fees

- Unfiled annual reports and unpaid penalties can stall approval. They can also trigger further notices. Identify and plan to file all missing reports as part of your application.

- Failing to attach required consents or orders

- Missing a tax confirmation, affidavit, or court order causes holds. Examiners will request more documents. Check the attachment list and label everything clearly before you submit.

What to Do After Filling Out the Form

File your package with the registrar

- Submit the signed form with all attachments and the fee. Include the name reservation if applicable. Keep a copy of everything you send.

- Note the confirmation number or receipt. Use it to track status and respond to any queries.

Bring filings current

- File all outstanding annual reports and related updates. Pay late fees and penalties where applicable. Aim to complete these immediately after submission if allowed.

- Update director and office records to match your form. Consistency helps avoid follow-up requests.

Prepare to respond to examiner questions

- Monitor your inbox for any requests. Timely responses keep your file moving.

- If asked for clarifications, reply with concise, complete answers. Attach proof where needed and label documents clearly.

Receive and record the restoration

- Once approved, you will receive evidence of restoration. Save the approval and any related notices.

- Update your minute book and internal registers with the restoration date and details.

Notify and re-engage key parties

- Inform directors, shareholders or members, and key creditors. Share proof of restoration when they request it.

- Contact financial institutions, insurers, landlords, and major partners. Provide the restoration evidence to reinstate services and accounts.

Address assets and titles

- If assets were transferred due to dissolution, begin the recovery process. Use the restoration evidence and follow the required procedures.

- Update any registries for assets where needed. Keep proof of changes for your records.

Review contracts and compliance

- Check leases, licenses, permits, and major contracts. Confirm you meet post-restoration requirements.

- If any rights lapsed during dissolution, take steps to reinstate them or negotiate replacements.

Plan governance and reporting

- Hold a directors’ meeting to confirm officers, banking resolutions, and signing authority.

- Set a calendar for annual reporting, meetings, and record-keeping. Assign an owner to track deadlines.

Build a compliance file

- Store the filed form, approval, correspondence, and receipts in one place. Include director consents and office agreements.

- Keep this file accessible for audits, due diligence, or financing.

Consider internal communications

- Tell employees the entity has been restored. Share any changes to authority, banking, or process.

- Provide a point of contact for questions about the restoration and compliance schedule.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.