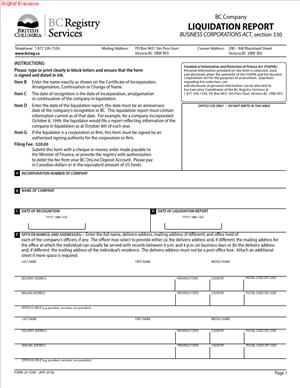

Form 24 COM – Liquidation Report

Fill out nowJurisdiction: Country: Canada | Province/State: British Columbia

What is a Form 24 COM – Liquidation Report?

Form 24 COM – Liquidation Report is a court form used in British Columbia for company liquidations. You use it to report to the Supreme Court of British Columbia on the status and progress of a liquidation. It is prepared by the liquidator or the liquidator’s counsel. It becomes part of the official court record in the company’s liquidation proceeding.

You use the report to tell the Court what has happened since the liquidator’s appointment. You set out the assets you found, what you sold, and the cash collected. You list the creditors, the claims you received, and how you reviewed and ranked them. You detail payments made and distributions proposed. You also ask the Court for directions or approvals where needed. Examples include approval of a sale, approval of fees, or approval of a final distribution.

“COM” identifies it as a commercial matter form within the court’s companies jurisdiction. You will see the same file’s “style of cause” at the top of the form. That shows the company’s full legal name, the registry location, and the court file number. The form is structured to support a full, transparent liquidation record. It uses schedules to capture the financial detail. It also includes a signature and, where required, a verifying affidavit.

Who typically uses this form?

Court‑appointed liquidators, their legal counsel, and sometimes a voluntary liquidator seeking court oversight. Receivers who become liquidators may also use it. Company directors do not complete it unless they act as liquidator in a supervised wind‑up. Creditors and contributories do not fill out the form. They receive and review it.

Why would you need this form?

Because the Court expects regular, clear reporting during a liquidation. The Court relies on the report to decide if sales should be approved, if fees are reasonable, and if distributions should proceed. If you are the liquidator, you file it to comply with the appointment order and the governing statutes. If you are counsel, you use it to support applications for directions or approvals. If you are a creditor, you read it to understand when you may receive a dividend.

Typical usage scenarios

- You have just been appointed as liquidator and must file an initial report. You need to outline the company’s assets, bank accounts, books, and immediate steps.

- You have realized key assets and seek court approval of the sale. You file an interim report with a sale summary and a recommendation.

- You have reviewed claims and are ready to propose a first distribution. You file a report that sets out your claims process and a draft distribution schedule.

- You are near the end of the administration and want your discharge. You file a final report, attach your accounts, and seek approval of your fees and a discharge order.

- You face a complex issue and need directions. You file a report that explains the facts and requests a specific court direction.

In each case, the report gives the Court and stakeholders a clear picture. It helps ensure the liquidation proceeds in a fair, orderly way.

When Would You Use a Form 24 COM – Liquidation Report?

You use this form whenever the Court requires a status update or decision in a liquidation proceeding. The timing is set by the appointment order, the rules, or practical necessity. An initial report usually follows promptly after appointment. It confirms that you have taken control of records, secured premises, and opened trust accounts. It identifies immediate risks, such as perishable inventory or expiring contracts.

You use it for interim reporting. A common trigger is a proposed asset sale. The report outlines the marketing process, bids received, and your recommendation. It may include an independent valuation as an exhibit. Another trigger is a claims process milestone. You report how many claims came in, how you adjudicated them, and any disputes. You also identify any priority claims you propose to pay.

You file the report with applications for approval of your fees. You present time summaries, rates, fee budgets, and results achieved. You explain the reasonableness of disbursements. You also detail the benefit to the estate. This reporting lets the Court test the value and fairness of the fees.

You use it before any distribution to creditors or shareholders. The report shows the funds available and the ranking of claims. It sets out any holdbacks or reserves. It explains treatment of disputed claims and contingency reserves for tax or litigation. The Court relies on the report to ensure the distribution respects priorities.

You use it for cross‑border issues. If the company has assets in other provinces or countries, you explain recognition steps and any foreign proceedings. The Court needs to know how those processes affect local creditors and assets.

You use it when you seek a discharge. A final report summarizes the entire administration. It includes a comprehensive receipts and disbursements schedule. It confirms that all required filings and remittances are complete. It states that books and records have been dealt with. It confirms that any remaining funds are addressed. It asks the Court to approve your accounts and discharge you.

Typical users

- Professional liquidators

- Insolvency lawyers

- Accounting firms acting as officers of the court

Company officers may assist by supplying records and facts, but the liquidator signs and takes responsibility. Creditors, landlords, employees, tax authorities, and secured lenders use the report to protect their interests. They assess holdings, challenge steps if needed, and prepare for distributions.

Legal Characteristics of the Form 24 COM – Liquidation Report

The form is part of a court‑supervised process. It is not a contract. It is nonetheless legally significant. It informs the Court and supports orders that bind the company, the liquidator, and stakeholders. When you file a report and seek approval, the Court may rely on your facts and analysis. The order made on that basis is enforceable. That gives the report practical legal weight.

What ensures enforceability?

Enforceability flows from proper process. You must file the report in the correct court file. You must serve it on the required parties within the timelines set by the rules or the appointment order. Proper service gives stakeholders a chance to respond. The Court expects a complete record. That includes schedules for receipts and disbursements, claims registers, and any expert or valuation evidence.

Accuracy is critical. You often verify the report by affidavit. A sworn affidavit makes your statements evidence before the Court. Misstatements can have serious consequences. They can lead to cost consequences, directions to redo steps, or personal liability for a liquidator who acts outside authority. If the appointment order requires periodic reporting, failure to report can result in directions, adjournments, or removal.

The report must be clear, neutral, and fact based. Avoid advocacy language unless you seek a specific direction and explain the reasons. Use the report to lay out the facts. Then state the decision you recommend and why it benefits the estate. The Court needs sufficient detail to test your judgment. But do not over‑disclose confidential terms where it would harm value. If needed, seek a sealing or redaction direction using the report to justify it.

You must respect privacy and privilege. Do not attach personal information that is not necessary. Do not waive privilege by summarizing legal advice. If you rely on advice in making a decision, say so without disclosing the substance of the advice.

Finally, the report should align with the governing law and the appointment order. Follow any reporting format set out in that order. Use trust accounts for estate funds and report balances clearly. Ensure tax filings are current before proposing a final distribution. Flag any asset‑specific statutes that affect sale or priority. The Court will expect you to identify those constraints in your analysis.

How to Fill Out a Form 24 COM – Liquidation Report

Follow these steps to complete the form thoroughly and efficiently.

1) Gather your base documents.

- Collect the appointment order, any prior reports, and the file endorsement sheet.

- Pull the company’s incorporation details and business numbers.

- Assemble bank statements, asset lists, and accounting records.

- Gather all claims received and your adjudication notes.

2) Complete the style of proceeding.

- Insert the registry (e.g., Vancouver, Victoria) and the court file number.

- Use the company’s full legal name as it appears in the order.

- List the parties as shown in prior orders. Keep the style consistent.

3) Identify the liquidator.

- State your full name and capacity as liquidator.

- Insert your firm name if applicable and contact details.

- Confirm the date and terms of your appointment.

4) Define the reporting period.

- State the start and end dates covered by this report.

- If this is the first report, note that it also provides background.

5) Provide a concise executive summary.

- In one short paragraph, set out the purpose of the report.

- State key events since the last report and the relief you seek now.

6) Describe your authority and mandate.

- Summarize the powers granted by the appointment order.

- Note any limits on those powers that affect decisions you report.

7) Summarize steps taken since appointment or last report.

- Secured premises, terminated access, and preserved perishable assets.

- Taken control of bank accounts and opened an estate trust account.

- Collected books and records and arranged backups of electronic data.

8) Inventory and status of assets.

- List each asset class: cash, receivables, inventory, equipment, real estate, IP.

- For each, note estimated value, condition, and realization strategy.

- Identify encumbrances and any consents or releases required.

9) Realizations to date.

- Provide a receipts and disbursements schedule as Schedule A.

- For each asset sold, state the method (auction, tender, private sale).

- Include gross proceeds, costs, and net realized amounts.

10) Ongoing sale processes.

- Outline the marketing steps taken: outreach, listing, data room access.

- Summarize bids or expressions of interest. Avoid naming bidders if sensitive.

- State the proposed next steps and expected timing.

11) Bank accounts and cash management.

- Identify all accounts under your control and current balances.

- Confirm interest earned and any bank charges.

- Reconcile cash with your Schedule A totals.

12) Contracts and leases.

- List key contracts you disclaimed, assigned, or kept in place and why.

- Note any landlord issues and mitigation steps.

- Flag any deposits held and your plan for them.

13) Claims process and results.

- Explain how creditors were notified and the filing deadline.

- State how many claims were received and total dollar amount.

- Summarize your adjudication of each class: secured, preferred, unsecured.

14) Priority claims and statutory remittances.

- Identify any priority claims you propose to pay before others.

- Confirm status of payroll, source deductions, and GST/PST filings.

- Note any clearance certificates requested or received.

15) Employee and pension matters.

- State whether there are unpaid wages, vacation, or severance claims.

- Confirm records of employment were issued where required.

- Note any pension plans, wind‑up steps, and plan asset status.

16) Litigation and recoveries.

- List any claims you are pursuing on behalf of the estate.

- Summarize status, budgets, and prospects of success.

- Identify any settlements reached and settlement approvals required.

17) Transactions with related parties.

- Disclose any sales or payments involving directors, officers, or affiliates.

- Explain why the transaction is fair and how you tested the market.

- Attach an independent assessment if you rely on it.

18) Professional fees and expenses.

- Summarize your time, rates, and total fees to date.

- List third‑party disbursements and why they were necessary.

- Attach fee details as Schedule B and any supporting invoices.

19) Distributions made to date.

- Show dates, amounts, and recipients by class.

- Reconcile with Schedule A and the claims register.

- Explain any holdbacks and the rationale for each.

20) Proposed distribution or relief sought.

- State the exact orders you request in plain language.

- If proposing a distribution, attach a draft distribution schedule as Schedule C.

- Explain the basis for the ranking and the pro rata calculation.

21) Remaining tasks and timeline.

- List what remains: asset sales, claim disputes, tax clearances.

- Provide a target timetable for completion.

- Flag any risks that could affect timing or recovery.

22) Attach supporting schedules.

- Schedule A: Receipts and disbursements (opening to current date).

- Schedule B: Fee and disbursement details by professional.

- Schedule C: Claims register with admitted and disputed amounts.

- Schedule D: Asset sale summaries and key sale documents.

- Schedule E: Proposed distribution and holdback calculation.

- Schedule F: Service list with contact details for all stakeholders.

23) Draft order.

- Prepare a draft order that mirrors your requested relief.

- Keep it specific and reference the schedules where needed.

- Use language consistent with prior orders in the file.

24) Service and notice.

- Serve the report, application materials, and draft order on required parties.

- Use the method and timing set out in prior orders or the rules.

- Keep proof of service and include it in your filing if required.

25) Execution and verification.

- Sign the report in your capacity as liquidator.

- If an affidavit is required, swear or affirm before a commissioner.

- Attach the exhibits referenced in the affidavit with proper tabs.

26) File and book the hearing.

- File the report and supporting materials with the registry.

- Book the hearing date and obtain the required time estimate.

- Notify parties of the hearing details.

27) Prepare for the hearing.

- Bring a clean, tabbed copy of the report and schedules.

- Prepare a short speaking note with the relief sought and key numbers.

- Be ready to answer questions on marketing, claims, and fees.

28) After the hearing.

- Obtain the entered order and circulate it promptly.

- Carry out the steps approved, such as distributions or closings.

- Update your records and plan the next report or final steps.

Practical tips

- Use plain, neutral language. Avoid adjectives and argument.

- Keep numbers consistent across the narrative and schedules.

- Label each schedule clearly and cross‑reference it in the narrative.

- Explain variances from budgets or earlier estimates in one sentence.

- Do not assume the Court recalls prior detail. Add short reminders where needed.

- If you need to redact sensitive information, explain why and ask for leave.

Common mistakes to avoid

- Incomplete claims data. Always reconcile the claims register to your proposed distribution.

- Missing authority. Cite the paragraph of the appointment order that authorizes each key step.

- Unclear sale process. Describe how you ran the process and why the result is fair.

- Fee lumping. Break fees down by task and time period so the Court can assess them.

- Service gaps. Check the service list against the latest claims and appearances.

If you approach the form with that structure, you will give the Court what it needs. You will also reduce questions from creditors. That means faster approvals and fewer adjournments. Most important, you will show that you are acting transparently and in the best interests of the estate.

Legal Terms You Might Encounter

- Liquidator means the person responsible for winding up the company. In the Form 24 COM – Liquidation Report, you speak in that role. You confirm actions taken, money handled, and your recommendations.

- Creditor means anyone the company owes money. The report lists creditors, amounts claimed, and amounts admitted. You also explain any disputed claims and reserves.

- Secured creditor holds collateral for the debt. In the report, you show how you realized on secured assets or dealt with shortfalls or surpluses. You also note any payments to them.

- Unsecured creditor has no collateral. Your report explains the pool available for unsecured claims and the dividend rate. You also show the calculation used.

- Priority claim is a debt that ranks ahead of others. Examples include certain wages or taxes. In the report, you show these payments before general distributions and explain any holdbacks.

- Realization means converting assets to cash. You describe each sale or recovery in the report. You include sale amounts, costs, and reasons for the method used.

- Receipts and disbursements is the cash summary for the period. Your report includes a schedule of funds received and funds paid out. It should reconcile to the bank balance.

- Holdback or reserve is money you retain for specific risks. You might hold back for disputed claims, tax reassessments, or pending costs. Your report explains each reserve and the trigger to release it.

- Dividend is the distribution to creditors. In the report, you state the proposed dividend rate and the timetable. You also show who will receive payment and why.

- Remuneration is your fee as liquidator. The report outlines your fee basis and the amount claimed for the period. You include time summaries and disbursements where needed.

- Taxation of accounts is a court review of your fees. If required, you note whether fees have been reviewed or will be reviewed. You attach supporting records for the review.

- Statement of affairs is the snapshot of assets and liabilities at the start. Your report compares actual results to that snapshot. You explain variances from expected recoveries.

- Proof of claim is a creditor’s form to claim money owed. The report states the number of claims received, admitted, revised, or rejected. You explain any material rejections.

- Disclaimed contract is an agreement you have terminated. If you disclaimed a lease or supply agreement, the report says why. It also describes any resulting claims or savings.

FAQs

Do you need to attach backup documents to the Form 24 COM – Liquidation Report?

Yes. Attach schedules that support each number. Include bank statements, reconciliations, sale agreements, invoices, and receipts. Add time records for fees and a list of creditor claims and outcomes. Label each exhibit clearly and cross-reference them in the report.

Do you report the period from appointment or only the last interval?

Report from the last filed report to the current cutoff date. If this is your first report, cover the period from your appointment. State the start and end dates on page one. Reconcile opening and closing bank balances.

Do you include tax amounts like GST or payroll deductions in the report?

Yes. Show tax collected, paid, and any liabilities. Separate net proceeds from tax components in your schedules. If you expect a refund or reassessment, record a reserve and explain it.

Do you need court approval for your remuneration before paying it?

Follow the order that appointed you. Many files require approval before payment. If approval is needed, include your fee request in the report. Attach your time detail and disbursements. Ask for the specific approval you seek.

Do you have to send the report to creditors or other parties?

Yes. Serve the report on those named in the relevant orders. Include known creditors, stakeholders, and any committee. Use the service method set out in the file. Keep proof of service, such as email confirmations or affidavits.

Do you report on disputed creditor claims?

Yes. List disputed claims and the status of each. Explain the basis for the dispute and next steps. Hold a reserve until you resolve the dispute. Do not distribute amounts tied to disputed claims.

Do you need a valuation for asset sales shown in the report?

Use support that shows a reasonable sale process and value. You can include appraisals, broker opinions, or multiple bids. If you had a court-approved sale, reference that approval in the report. Attach key documents that justify the outcome.

Can you correct an error after filing the report?

Yes. File an amended report. Mark the changes and explain the reason. Serve the amended report on the same parties. If a hearing is scheduled, bring both versions and the explanation.

Checklist: Before, During, and After the Form 24 COM – Liquidation Report

Before signing

- Court file details: correct registry, file number, and style of cause.

- Appointment details: date, capacity, and any limits on your powers.

- Reporting period: start and end dates, consistent across all pages.

- Banking records: trust account statements, reconciliations, and outstanding items.

- Cash summary: receipts and disbursements schedule for the period.

- Asset support: bills of sale, auction reports, appraisals, and closing statements.

- Claims list: proofs received, admitted amounts, rejections, and disputes.

- Priority items: taxes, wages, or similar amounts, with calculations.

- Reserves plan: reasons, amounts, and release conditions.

- Fee support: time dockets, rates, disbursements, and prior approvals.

- Professional invoices: legal, accounting, storage, and other vendor bills.

- Insurance: policy status, coverage during storage or transit, and premiums.

- Tax filings: returns filed or due, remittances, and correspondence.

- Previous orders: directions about service, reporting, fees, or sales.

- Distribution model: dividend rate, payment method, and timing.

- Service list: creditors, stakeholders, and any required committees.

- Exhibits: labels, page numbers, and cross-references in the report.

- Signature block: correct name, role, and date line.

- Oath or affirmation: affidavit prepared if required by the form or court.

During signing

- Check the court file number and style of cause match the case.

- Confirm the reporting period is consistent on every page.

- Add totals that tie to the bank reconciliation.

- Tie opening balances to the last filed report.

- Cross-foot schedules and test key math.

- Confirm each exhibit is labeled and legible.

- Use consistent descriptions for each asset and claim.

- Identify negative statements, such as “no further assets realized,” where true.

- State reserves and reasons in both the summary and schedules.

- Confirm your fee disclosure matches the time records.

- Sign in the correct capacity as liquidator.

- If the form requires an affidavit, swear or affirm before a commissioner.

- Initial any handwritten edits and update the date if needed.

- Number pages and exhibits in sequence with no gaps.

After signing

- File the Form 24 COM – Liquidation Report at the correct registry.

- Pay any filing fee and obtain a filed copy for your records.

- Serve the filed report on required parties as ordered.

- Prepare an affidavit of service, with attachments as proof.

- Calendar any hearing or approval dates tied to the report.

- Track the objection period, if any, and log responses.

- Answer stakeholder questions with references to schedules.

- If approved, proceed with distributions as described.

- Release reserves only when stated conditions are met.

- Update the trust ledger after each payment.

- Keep all proofs of payment and reconciliations.

- Store the filed report and exhibits securely.

- Back up digital files and protect personal information.

- Plan the next reporting period and deadlines.

Common Mistakes to Avoid

- Leaving out a key schedule. Don’t forget the receipts and disbursements and the claims status list. Missing schedules can trigger a rejection or a request for more information. This slows distributions.

- Using the wrong reporting period. Don’t overlap or skip days. If you do, your totals will not reconcile. The court or creditors may question your math, which delays approvals.

- Paying dividends before approval. Don’t distribute funds until you have authority. Premature payment risks personal liability. You may need to claw back funds.

- Ignoring small or late claims. Don’t miss low-value creditors or late claims allowed by order. Excluding them can force a redistribution. That raises costs and damages credibility.

- Not disclosing reserves or contingencies. Don’t hide known risks. If you skip reserves for disputes or taxes, you may overpay dividends. You might have no funds for later liabilities.

- Mislabeling secured recoveries as general funds. Don’t pool collateral proceeds with general assets without clarity. You could mispay priorities. That invites objections and reversal.

What to Do After Filling Out the Form

- File the Form 24 COM – Liquidation Report at the correct court registry. Use the file number and style of cause on the form. Bring the signed original and all exhibits. Obtain the filed copy and note the filing date.

- Serve the filed report on all required parties. Follow the service method set by the court. Include known creditors, stakeholders, and any designated representatives. Keep proof of service for the record.

- Monitor timelines tied to the report. Diary any hearing dates or approval deadlines. Set a reminder for objections or responses. Record any feedback and address it promptly.

- Seek approval if needed. If your remuneration or a distribution needs approval, prepare the supporting package. Include time dockets, calculations, and proposed orders. Bring clean and blacklined versions of any changes to your plan.

- Respond to questions. Direct creditors to the right schedule for answers. Provide copies of specific pages on request. Keep a log of inquiries and your responses.

- Proceed with distributions when authorized. Pay priority claims as required. Calculate the dividend rate and issue payments to admitted unsecured creditors. Use a method that allows tracking, such as cheques or electronic payments.

- Handle unclaimed funds. Keep uncashed payments under control. Reissue payments if requested after verification. Follow any directions for holding or remitting unclaimed dividends.

- Manage reserves. Release funds when the related issue is resolved. Document the trigger event, like a claim withdrawal or a tax clearance. Update your ledger and confirm the new bank balance.

- Update your bank reconciliation. Match payments to the ledger. Identify any outstanding items. Keep the reconciliation current until the account closes.

- Prepare for the next stage. If this is an interim report, set the next reporting date. List tasks to complete before then, such as final asset sales or claim reviews. If this is a final report, plan your discharge steps and any final applications.

- Store records securely. Keep filed reports, exhibits, bank records, and proof of service. Protect personal and confidential information. Follow retention rules that apply to your role.

- If you find an error, file an amended report. Mark changes and explain them. Serve the amended version on required parties. Update any hearing materials.

- When the estate is fully administered, close the trust account. Confirm a zero balance and no outstanding cheques. File your final report and seek discharge if needed. Notify stakeholders of closure and record the final status.

Disclaimer: This guide is provided for informational purposes only and is not intended as legal advice. You should consult a legal professional.